The Victorian government has released its Rental Report for the June quarter of 2024, which shows that the number of properties available to rent has declined amid an exodus of property investors.

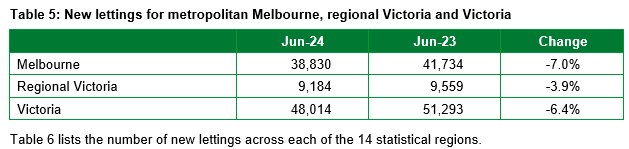

As illustrated in the following table, new lettings fell by 6.4% across Victoria and by 7.0% across Melbourne in the 2023-24 financial year:

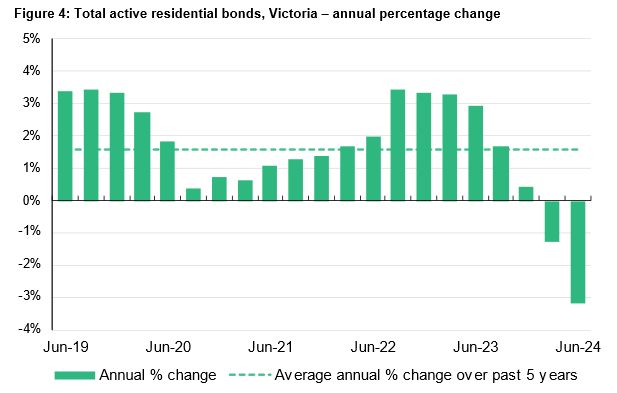

Meanwhile, total active rental bonds held by the Residential Tenancies Bond Authority (RTBA), which is indicative of the total stock of rental housing, fell by 3.2% in 2023-24:

“On average, the number of active bonds has increased by 1.6% annually over the past 5 years, and 2.9% annually over the past 10 years”, the report notes.

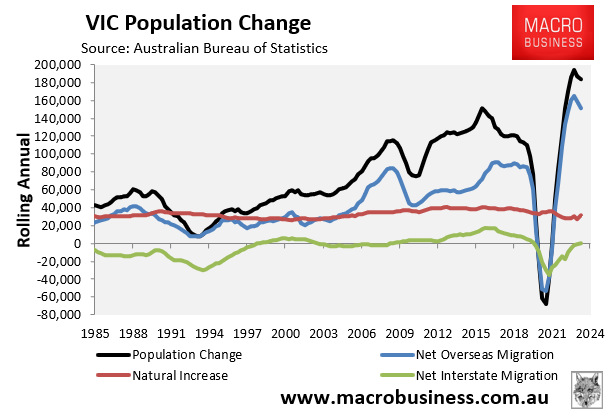

The report also shows that Victoria’s rental market remains tight amid the record rebound in net overseas migration following the pandemic:

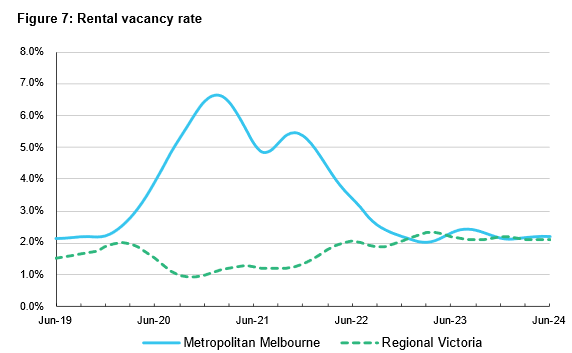

“The trend vacancy rate for metropolitan Melbourne remained stable over the quarter at 2.2%, falling slightly from 2.3% in June 2023”, the report notes.

“The trend vacancy rate reached its lowest point (1.0%) in early 2008 and its highest point (6.6%) in January and February 2021”.

Melbourne median rents also surged following the record rebound in immigration after plunging during the pandemic:

The Metropolitan Rent Index (MRI) increased by 0.8% over the June quarter 2024 and by 10.9% year-on-year.

As expected, the property lobby used the data to argue against policy changes that dissuade investors.

Property Investment Professionals of Australia (PIPA) Victoria board director Cate Bakos claimed legislative changes around minimum rental standards and increased land taxes were driving investors from the state.

She said real estate agents were also reporting a higher percentage of sellers being investors, declaring Victoria to be the “least accommodating state or territory for property investors”.

Property Investors Council of Australia chair Ben Kingsley also said that the fall in rental bonds in Victoria “should be an alarm signal for the government that the investors are basically voting with their feet and their wallets, and they are tapping out”.

“The bleeding obvious thing is the governments severely overreached on the reform agenda”.

“The unintended consequences have been that effectively the investors are moving on”, he said.

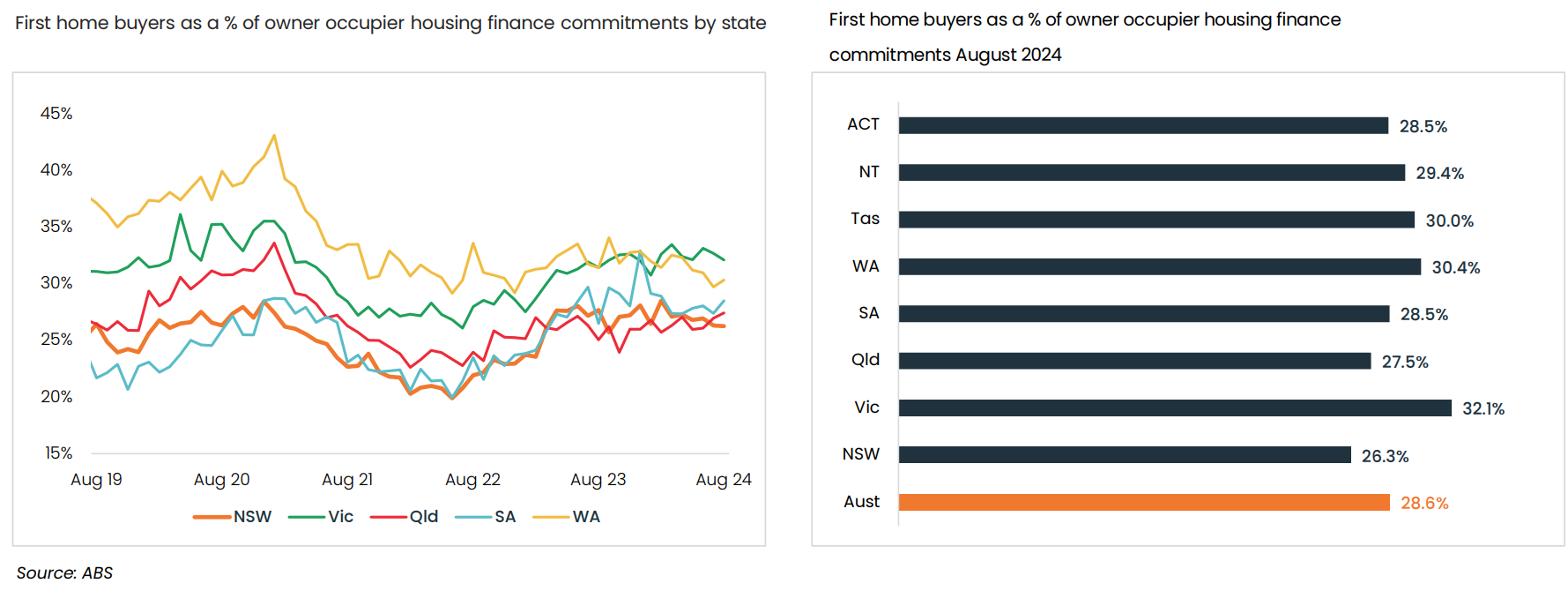

However, PIPA did at least acknowledge that first home buyers in Victoria are benefiting, snapping up 65% of the properties investors sold.

The data is clear that first home buyers in Victoria have benefited from the Victorian government’s property tax reforms.

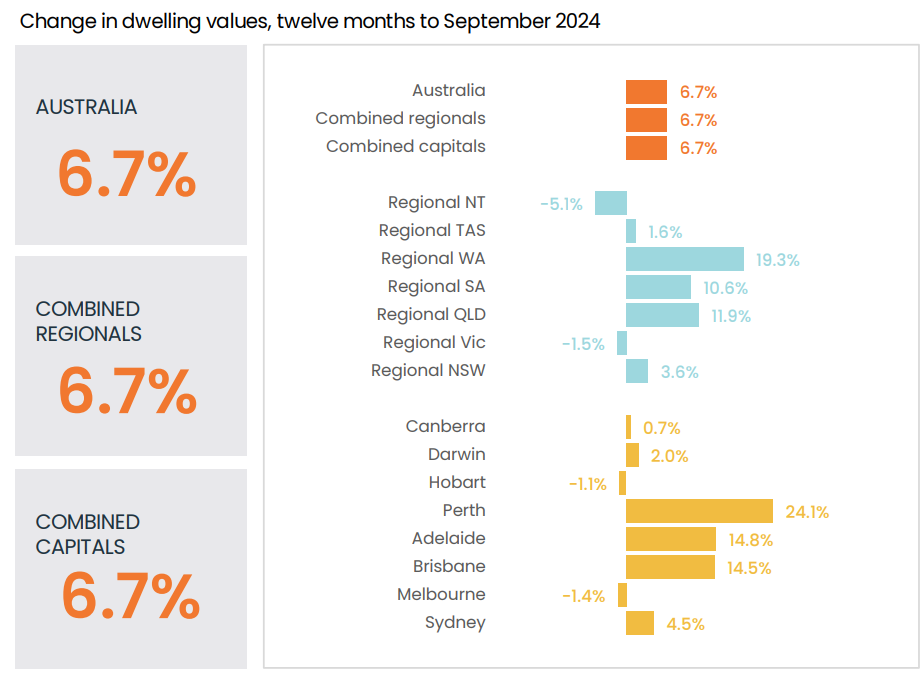

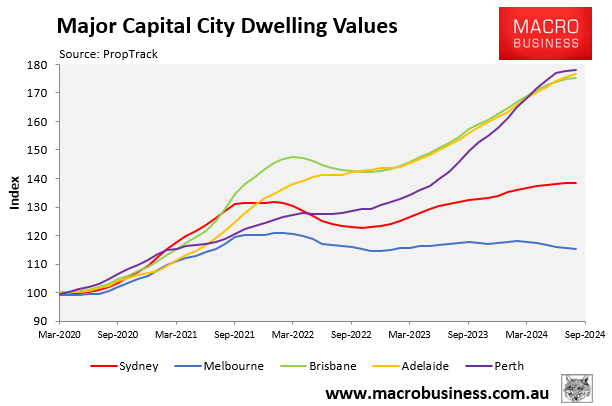

Dwelling values in Melbourne and Victoria have lagged well behind the other major jurisdictions:

Source: CoreLogic

According to PropTrack, Melbourne home values have only risen by 15% since the beginning of the pandemic in March 2020, well below Sydney (38%), Brisbane (75%), Perth (78%) and Adelaide (77%).

The share of mortgages going to first-home buyers is significantly higher in Victoria (32.1%) compared to the rest of the nation (national average = 28.6%).

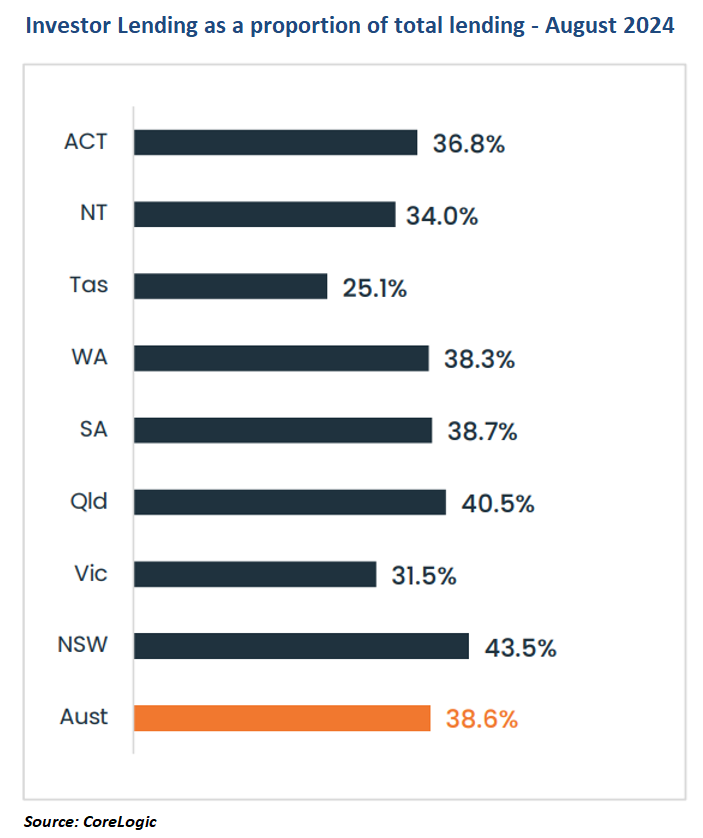

Source: CoreLogic

At the same time, the share of mortgages taken up by investors is far lower in Victoria (31.5%) than the other major jurisdictions (national average = 38.6%).

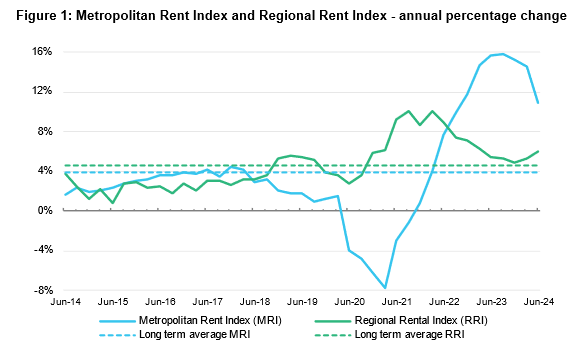

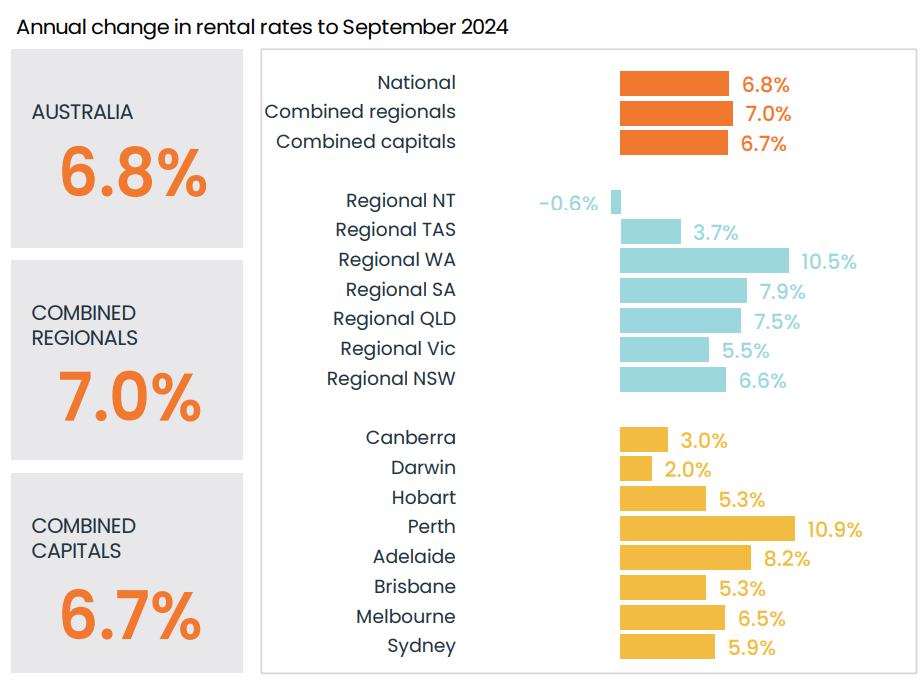

There is also no proof that the ‘exodus’ of investors from Victoria is raising rents vis-à-vis the rest of the nation.

Victoria’s rental growth has actually lagged behind the national average:

Source: CoreLogic

Curbing property tax concessions like negative gearing and the capital gains tax discount is likely to have a similar impact to what is being experienced in Victoria.

Such reforms would be likely to place moderate downward pressure on prices, lift the proportion of first-home buyers in the market, and increase the overall home ownership rate.