Stephen Wu, senior economist at CBA, has published research showing how Australians are overwhelmingly using the extra disposable income from the Stage 3 tax cuts to pay down debts.

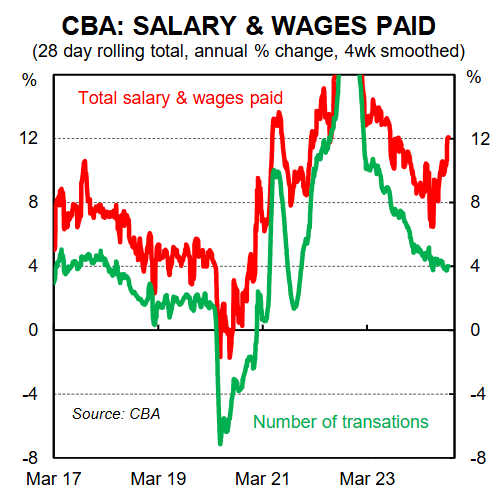

Wu notes that the growth in total salaries and wages paid into CBA bank accounts has picked up since the tax cuts took effect in July.

At the same time, the growth in the number of income transactions has trended lower, suggesting softer job growth.

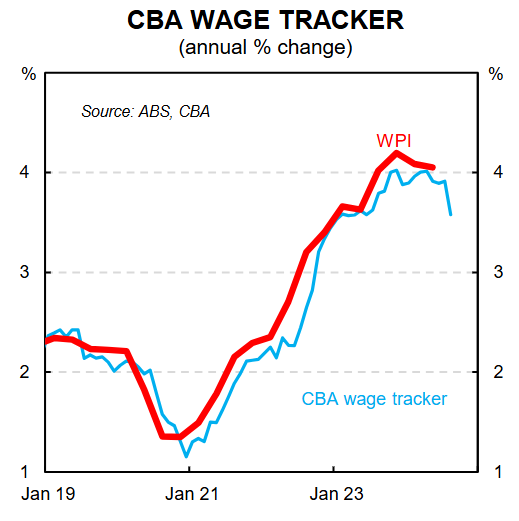

The increase in total salary and wages has come despite before-tax wage growth easing sharply in August, according to the CBA wage tracker, which closely tracks the ABS Wage Price Index:

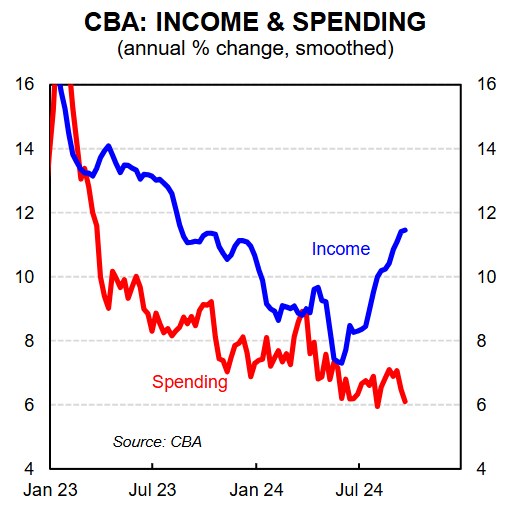

Wu notes that “aggregate income growth has been stronger than aggregate spending growth since the beginning of last year, though both had slowed”.

However, the recent tax cut induced rise in disposable income has been not been matched by an increase in spending:

The widening gap between income and spending, therefore, means that household savings have increased in the wake of the tax cuts.

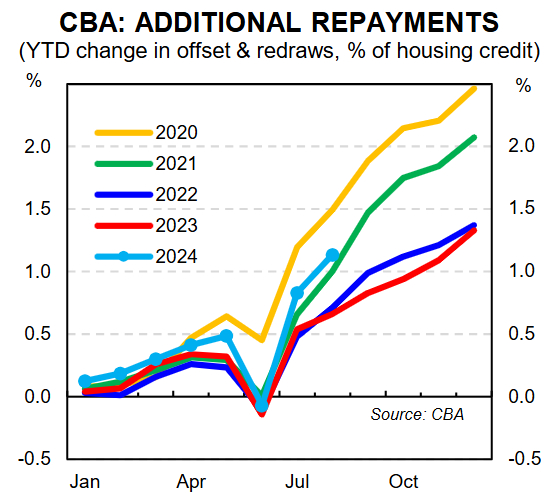

CBA account data shows that households have chosen to make extra debt repayments, with flows into offset and redraw accounts rising sharply for CBA customers in the year to August:

This result would please the Reserve Bank of Australia for two reasons.

First, it means that the Stage 3 tax cuts have not added materially to aggregate demand or inflation, thereby negating the need for further monetary tightening.

Second, the reduction of debt and increased household financial buffers increase the resilience of the financial system, lessening the likelihood of a future financial crisis.

In aggregate, Australian households have used the tax cuts responsibly, using the extra disposable income to pay down debt instead of spending it.