Last week, the Australian Bureau of Statistics (ABS) released a stronger-than-expected employment report, with 64,000 jobs created in September (51,600 full-time), a 0.1% decline in the nation’s unemployment rate, and record participation and employment-to-population rates.

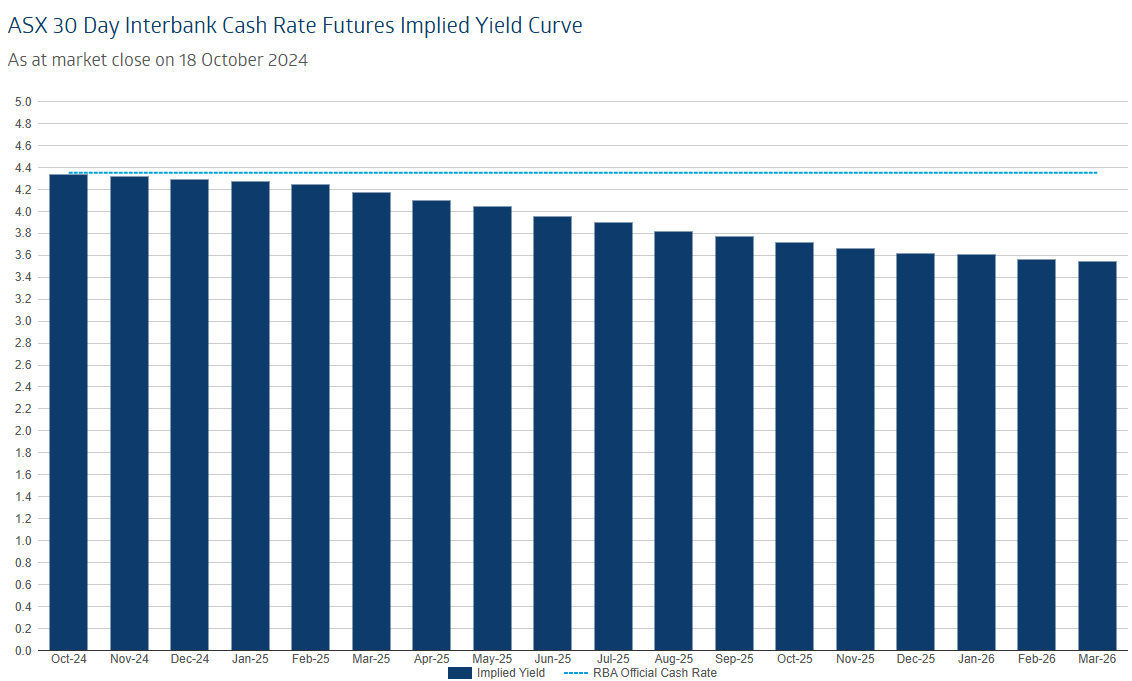

The strong result prompted interest rate traders to push back their expected timing of the first Reserve Bank of Australia (RBA) cut to April from February:

RBA Deputy Governor Andrew Hauser addressed the CBA 2024 Global Markets Conference in Sydney on Monday, expressing a slight surprise at the strength of the Labour market.

Hauser noted Australia’s labour market participation rate is exceptionally high and emphasised that while the RBA is data-dependent, it is not data-obsessed.

He also said that the RBA will consider next week’s Q3 CPI release, alongside other data, to form a view on the future direction of monetary policy.

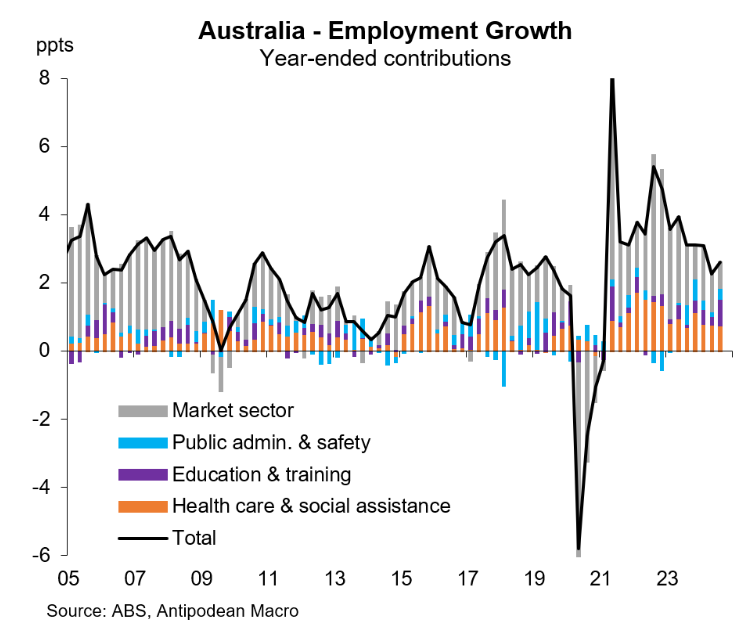

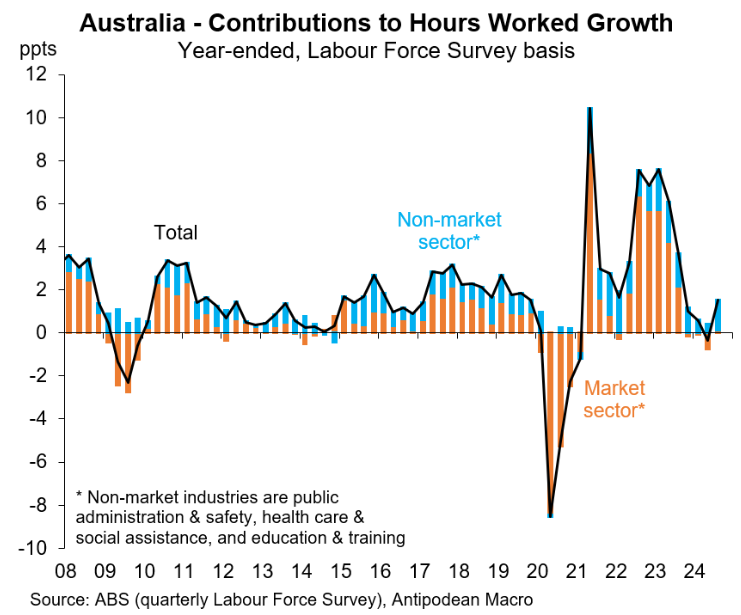

As Justin Fabo at Antipodean Macro reported on Friday, around 70% of Australia’s job growth over the past year has come from the non-market (government-aligned) sector, whose funding is largely determined by government:

Moreover, all of Australia’s 1.5% annual job growth in the year to September came from the non-market (government-aligned) sector:

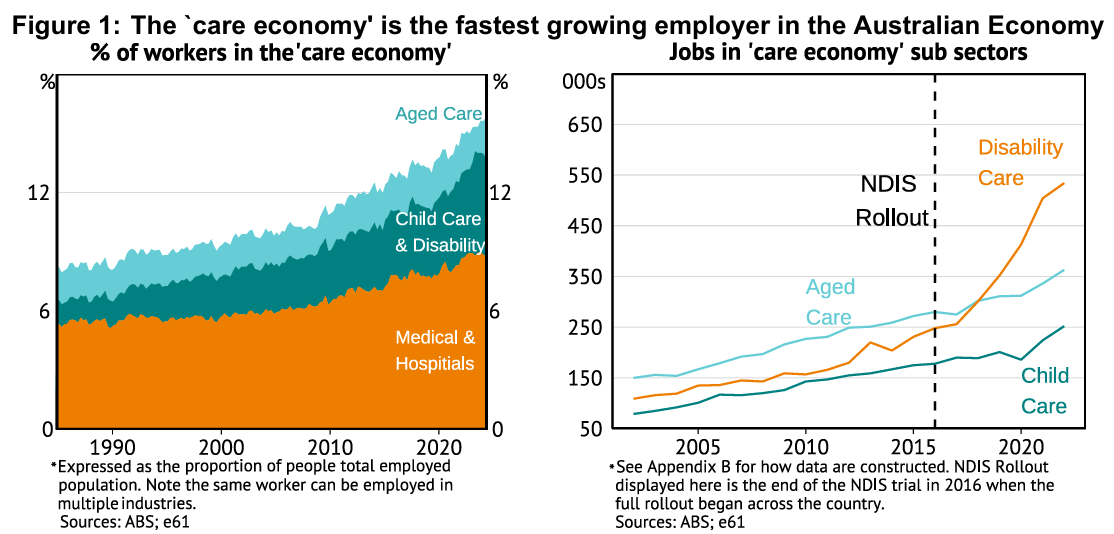

Most of these non-market jobs have come via the NDIS, which has expanded in cost by around 20% annually in recent years:

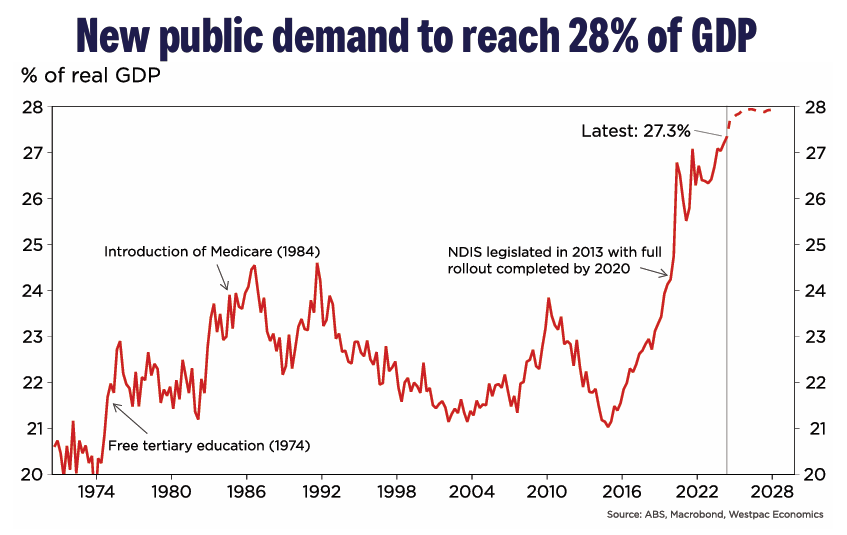

In Q2 2024, public demand hit a record high of 27.3% of GDP. Westpac also projected that government spending will continue to increase as a share of the economy:

Thus, unprecedented government spending is preventing the economy from entering a technical recession and is driving the nation’s job growth.

The downside for the Albanese government is that the strong growth in government-aligned jobs will likely delay the RBA from cutting interest rates, which the government desperately needs before May’s federal election.