With the federal election due by 20 May 2025, polling suggests Australia is headed for a hung parliament.

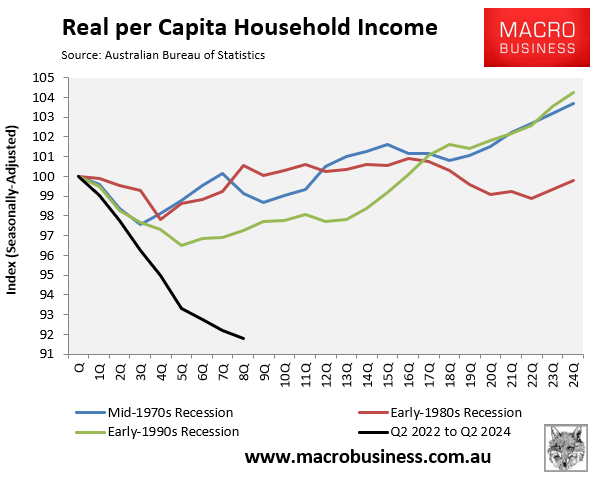

Australian households have endured their largest decline in disposable incomes on record, with mortgage holders bearing much of the brunt. The cost of living is a major concern of voters.

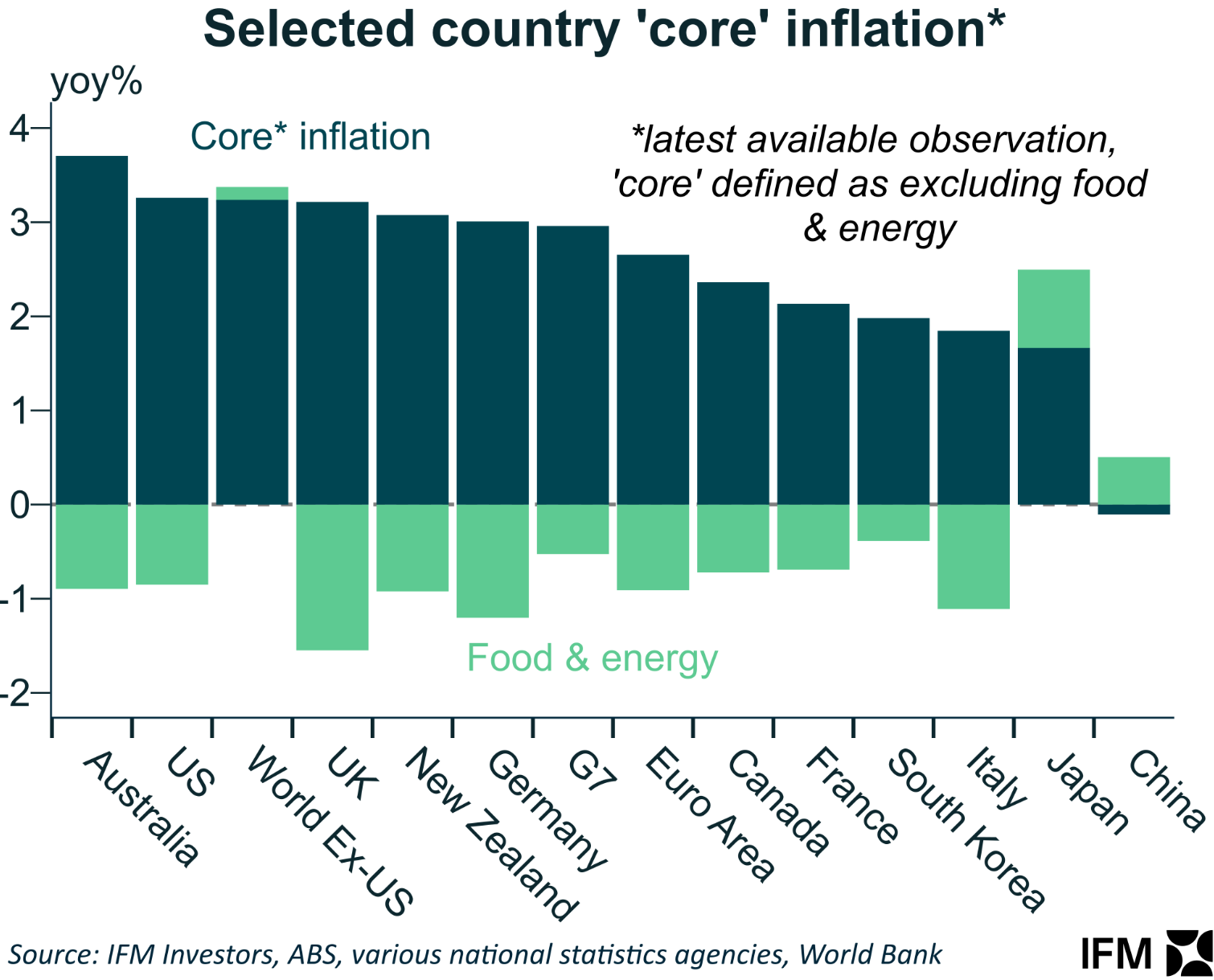

Other Anglosphere countries, including New Zealand, Canada, the United States, and the United Kingdom, have begun interest rate easing cycles, leaving Australia as a laggard in interest rates.

It would be an understatement to suggest that the Albanese government desperately needs the Reserve Bank of Australia (RBA) to cut interest rates before the election.

Wednesday’s Q3 CPI data was seized up by Treasurer Jim Chalmers, who declared that inflation was “the lowest in four years” and now back within the RBA’s target range of 2% to 3% “for the first time since 2021”.

It was a veiled swipe at the RBA as well as the government’s detractors.

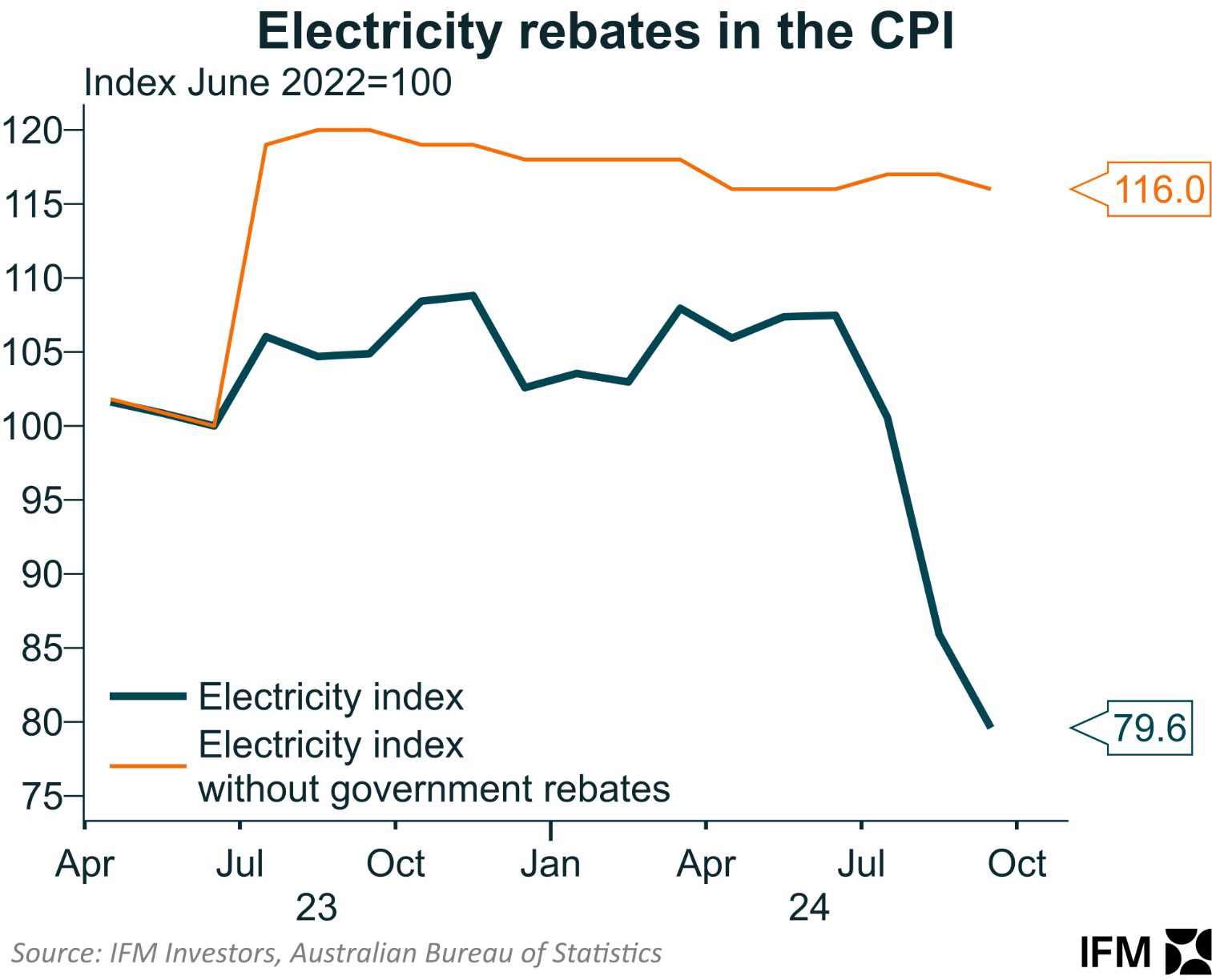

However, the decline in headline CPI inflation was driven by large price declines for electricity (-17.3% q/q) and petrol (-6.7% q/q), both of which were trimmed out.

Electricity prices subtracted 0.4ppts from the quarterly outcome and automotive fuel 0.25ppts.

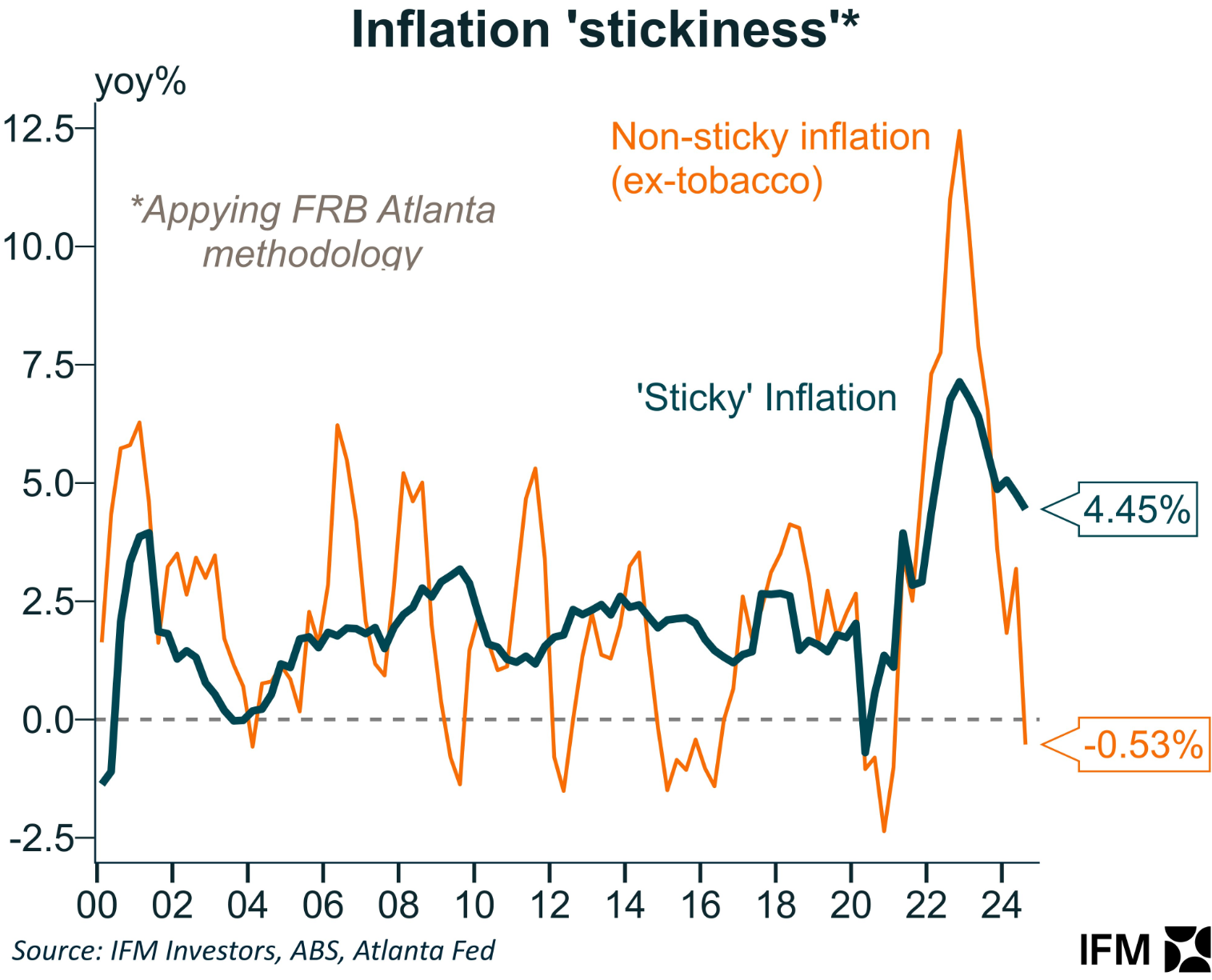

Trimmed mean remained above target at 0.8% q/q and 3.5% y/y and remains “sticky”, as illustrated by Alex Joiner at IFM Investors.

Australia’s core inflation is also running above other advanced nations.

The RBA has repeatedly stated that it will ignore the headline CPI result because of the impact of subsidies and focus on core inflation instead.

As a result, interest rates are likely to remain on hold until next year.

Alex Joiner, chief economist at IFM Investors, explained that rate cuts could even be pushed beyond February, bringing the election into focus:

“With inflation matching the RBA’s expectations, it is unlikely to alter its near-term policy approach. Given the strength of the labour market, we don’t foresee any possibility of a rate cut this year”.

“While February easing is currently the consensus, further disinflationary progress and/or weakening activity data and labour market indicators would likely be needed to shift the RBA from its neutral stance within this relatively short timeframe”.

“This suggests to us that the risks to a February easing might be pushed out to April or May, bringing the Federal election into the RBA’s considerations”.

This sets this up for frosty relations and a potential war of words between the government and the RBA.

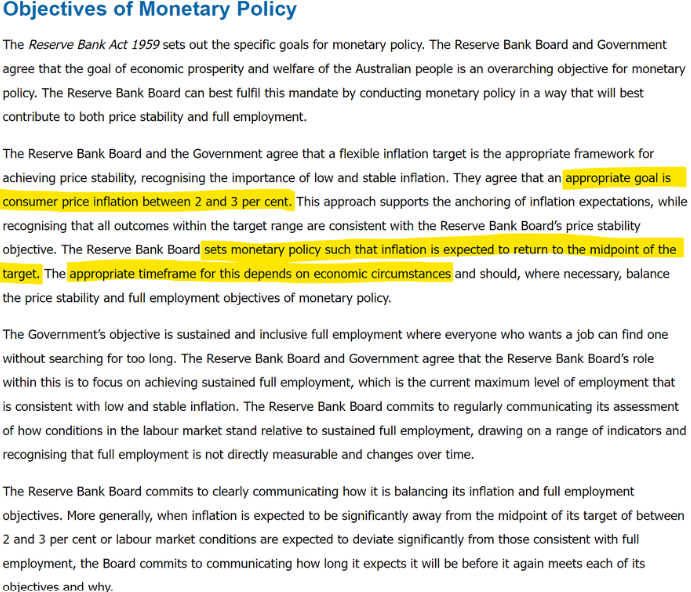

Treasurer Jim Chalmers can point to the fact that headline CPI is now within target and that the “objectives of monetary policy” in the Reserve Bank Act refer to headline inflation being within the target range of 2% to 3%, not trimmed mean inflation:

The RBA can point to the fact that core inflation remains sticky and well above target.

Thus, it will make for interesting watching in the months ahead and potentially tense scenes between the RBA and government. Pass the popcorn.