Very, very early days but some data from Goldman.

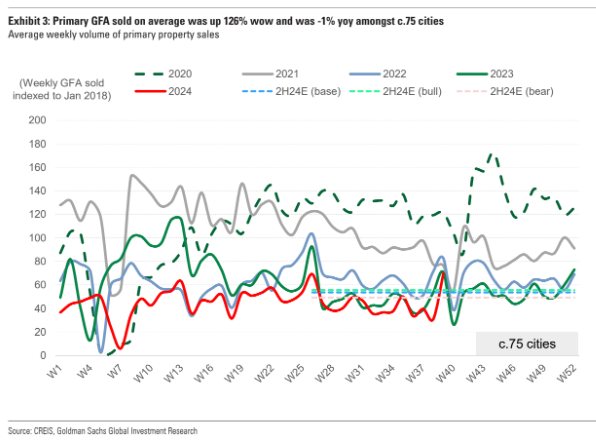

New homes sales volume on average was +126% wow, and down 1% yoy with tier-3 and Northern outperforming.

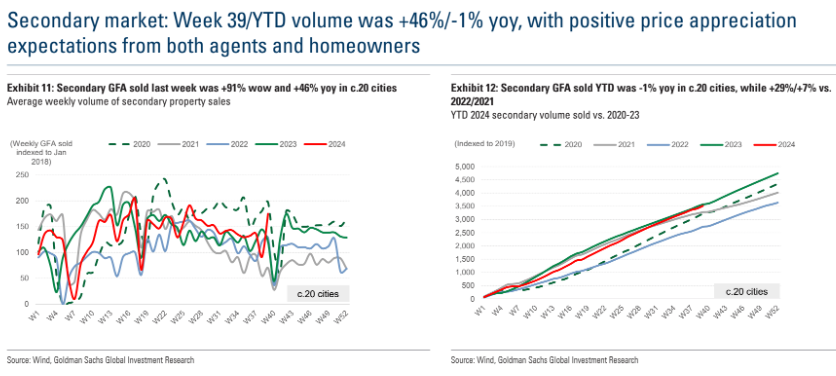

Secondary transactions on average were +91% wow, and up 46% yoy with positive price appreciation expectations from both agents and homeowners.

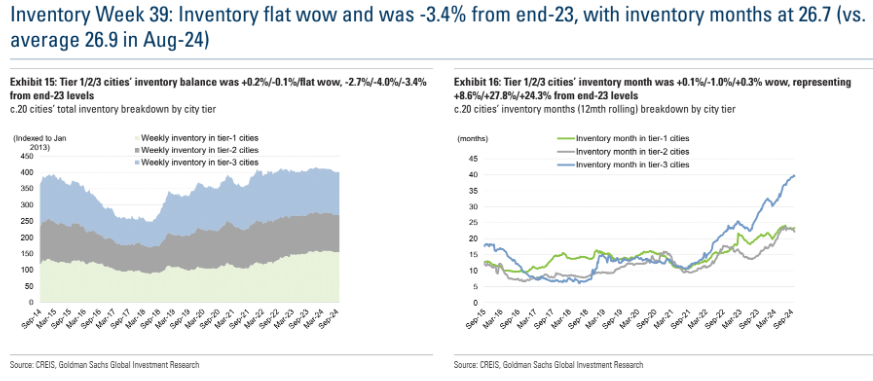

Inventory balance was flat wow and was down 3.4% from end-23, with inventory months at 26.7 (vs. average 26.9 inAug-24).

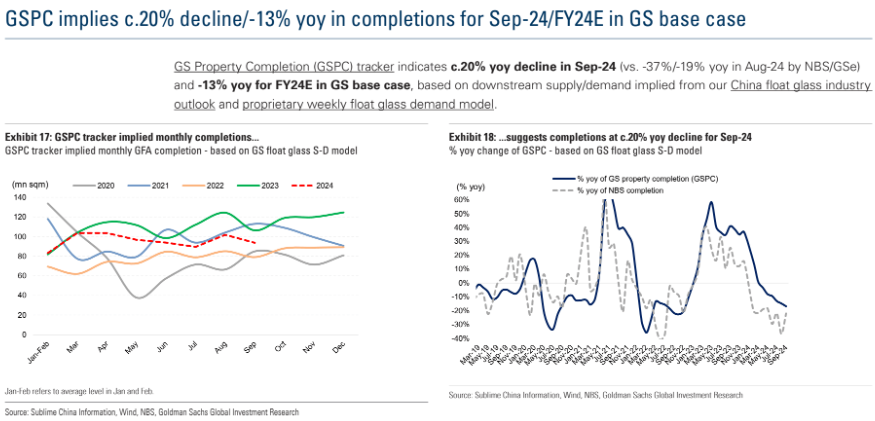

Completions: GSPC tracker indicates c.20% yoy decline in Sep-24 (vs. -37%/-19% yoy in Aug-24 by NBS/GSe) and -13%yoy in FY24E in the GS base case.

No clear evidence in new home sales. The surge is seasonal into Golden Week.

But there is evidence of green shoots in the secondary market with a big surge beyond recent yoy comparisons, notwithstanding timing issues.

I do expect a pop in property. As we saw in May

The question is, will is last and will it translate to greater building volumes.

My answers are: skeptical on the first and doubtful on the second.

Remember, it is completions not starts that have greatest correlation with bulk commodity prices these days and there is a cliff ahead catching down to lagged sales: