Last week, I posted research from the world’s largest commercial real estate group, CBRE, which projects that Australia’s rental crisis will continue as population demand overruns supply.

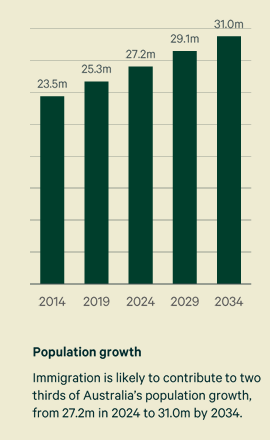

CBRE projects that Australia’s population will balloon by 3.6 million to 31 million by 2034 (from 27.4 million currently).

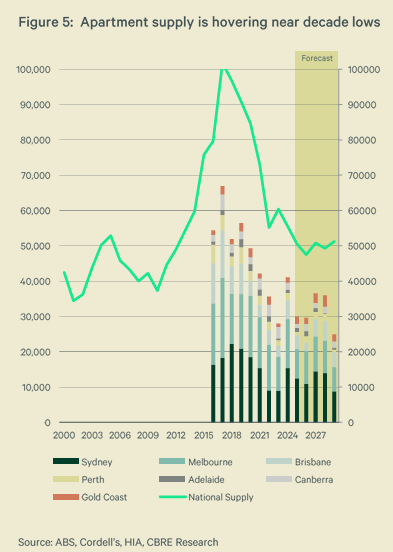

CBRE also projects apartment supply to hover around decade lows of about 50,000 units per year between 2024 and 2029:

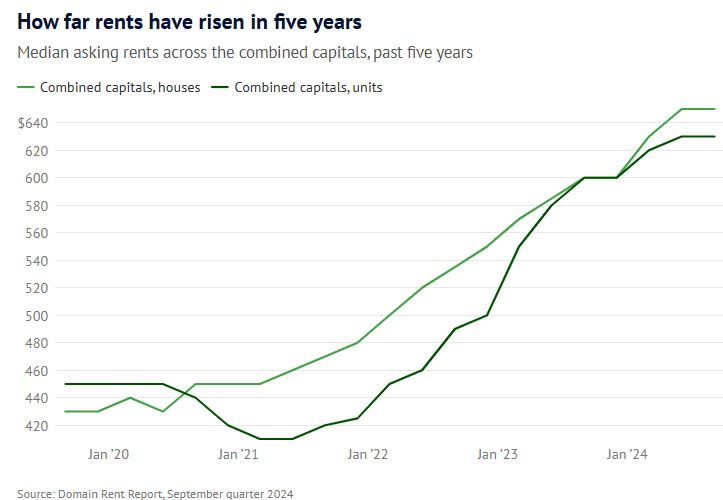

As a result, Australia’s capital city vacancy rate is projected to fall further to 1.2% by 2029, from 1.9% in 2024. And this will drive median Australian rents up by another 25% between 2024 and 2029, well above projected CPI inflation.

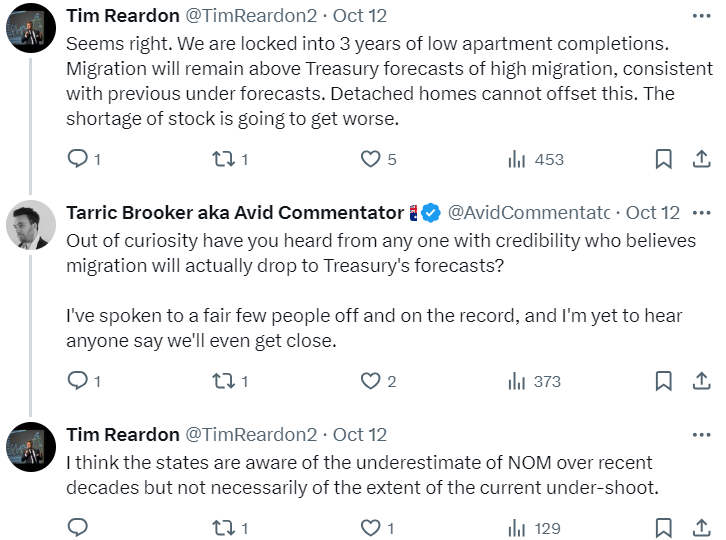

Independent Economist Tarric Brooker posted my report on Twitter (X) and received the following reply from the chief economist at the Housing Industry Association (HIA), Tim Reardon:

Reardon agrees with CBRE’s assessment, noting that “we are locked into 3 years of low apartment completions” and that “migration will remain above Treasury forecasts of high migration, consistent with previous under forecasts”.

As a result, Reardon believes that “the shortage of stock is going to get worse”.

The 2023 Intergenerational Report projected that net overseas migration would remain at the permanently high level of 235,000 a year for the next four decades:

This permanently high net overseas migration is projected to increase Australia’s population by more than 13 million, or roughly 50%, in only 39 years, equivalent to adding another Sydney, Melbourne, and Brisbane to the current population.

Clearly, the only genuine solution to Australia’s housing shortage is to dramatically reduce net overseas migration to a level below the nation’s capacity to build housing and infrastructure.

Australia’s rental crisis will not end unless the federal government eases demand by slashing immigration.