Several of Australia’s major banks have pushed for an easing of credit standards to assist first home buyers.

ANZ has called for looser credit, claiming that the current rules are precluding lower-income borrowers from gaining a home loan.

ANZ also recently canvassed 50-year mortgage terms, which would lower monthly loan repayments and entice more buyers into the market.

Similarly, NAB executive Andy Kerr told a parliamentary inquiry last week that prospective first homebuyers would have more purchasing power if rules restricting access to mortgages were more flexible.

Kerr argued that first homebuyers were no more risky than other borrowers.

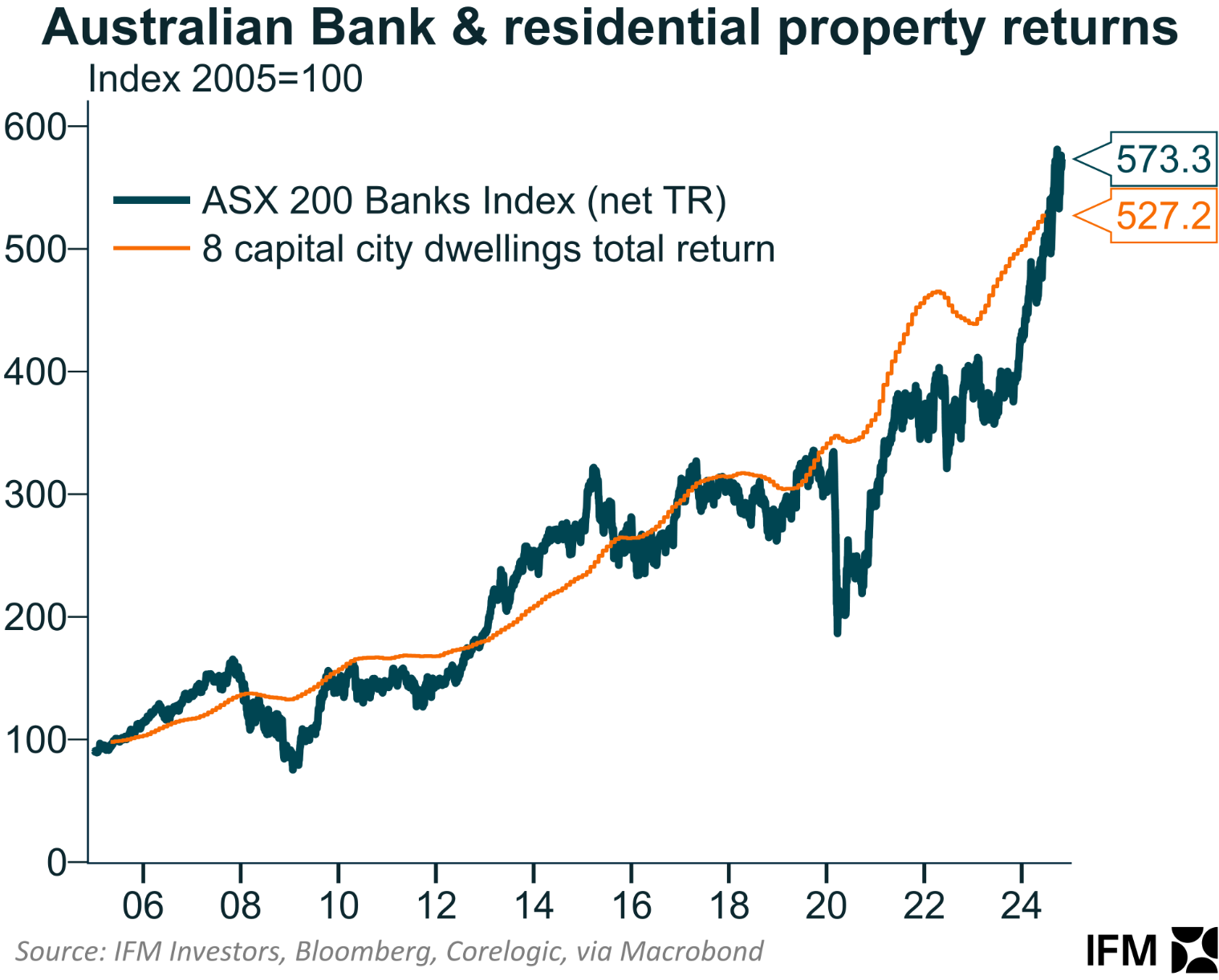

The following chart from Alex Joiner, chief economist at IFM Investors, explains why Australia’s banks typically support looser rules around the provision of credit.

As you can see, the market value of Australia’s banks has risen alongside residential property returns.

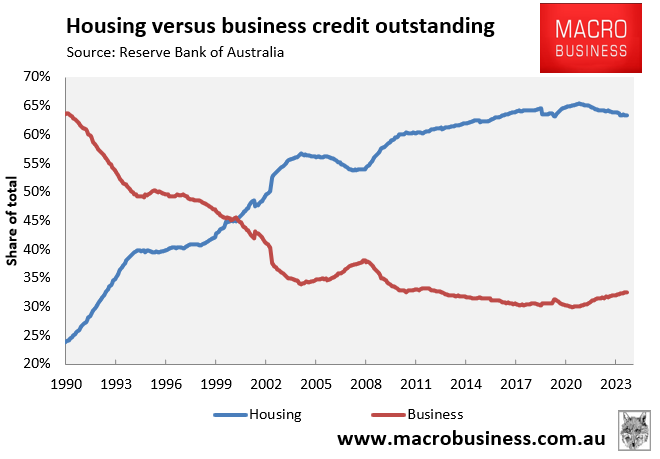

The fact that our banks have shifted their lending towards housing over the past 30 years supports this outcome.

In 1990, nearly two-thirds of lending was to businesses, whereas only around one-quarter of lending was for housing.

The last 30-plus years have seen the roles reverse, with around two-thirds of lending now going to housing and only around one-third going to businesses.

Personal loans are not shown on the chart above.

As explained by Alex Joiner on Twitter (X):

“The banks get it all in the end yet they always are pushing the boundaries to lend more, lower credit standards, lower the mortgage buffer, extend loan terms, etc”.

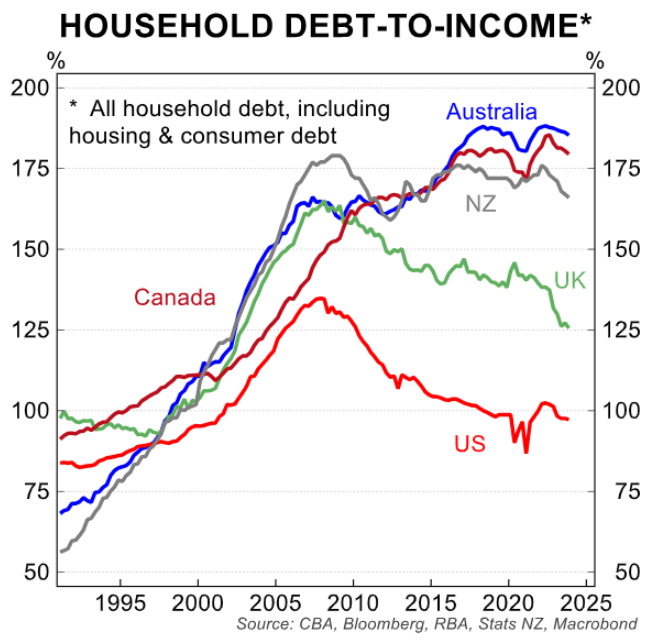

“This comes despite the Australian household sector being one of the most indebted in the world”.

“No policymaker will ever curtail this so over the long run, bank stocks really are safe as houses”.

I will add that Australia’s banks are too big to fail. Pretty much everyone in Australia now has a stake in the banks because a huge chunk of the nation’s superannuation savings are invested there.

Like it or not, most Australians have a vested interest in keeping the housing bubble afloat. And our politicians know it, which is why they continually implement policies aimed at pumping demand.