Investment bank Barrenjoey has called on financial regulators to consider a scheme it argues would give first-home buyers access to cheaper loans and allow them to borrow up to 3% more.

In a supplementary submission to the Senate Economics inquiry examining financial regulations and homeownership, Barrenjoey has urged the Australian Prudential Regulatory Authority (APRA) to lower the risk weights it applies to loans provided to younger borrowers.

Barrenjoey bank analyst Jon Mott claims that the reduction in risk weights would result in a 0.29% reduction in mortgage rates for first-home buyers, saving them $37,300 on average on a $600,000 loan over 30 years.

In turn, first-home buyers would be able to borrow 1% to 3% more, increasing their capacity to pay.

To counterbalance the proposal, Barrenjoey recommends increasing average risk weights to around 110% for other borrowers.

“These changes would not lead to a movement in the average risk weights of the entire mortgage book, which would stay at around 25%”, Mott said. As such, they would be neutral overall for the market.

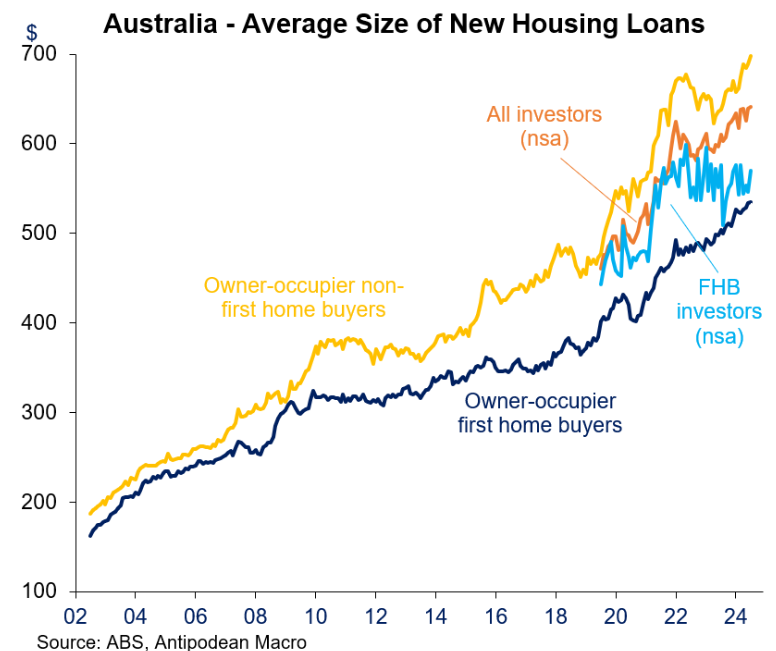

The following chart shows that the average mortgage size for first-home buyers is below other types of borrowers (i.e. upgraders and investors).

Barrenjoey’s proposal would, therefore, slightly tilt the balance in favour of first-home buyers by increasing their loan capacity while slightly reducing the loan capacity of other borrowers.

That said, the proposal is modest at best and there are far better ways to help first home buyers by making housing structurally more affordable.

First, immigration should be lowered significantly.

Excessive levels of immigration are especially harmful to first home buyers for two reasons:

- It drives up the cost of renting, making it harder for first home buyers to save a housing deposit.

- It drives up house prices, pushing home ownership further out of reach.

Net overseas migration is projected to remain at historically high levels permanently, which means that first home buyers will remain locked out of the housing market.

Second, Australia should undertake broad-based tax reform to shift economic activity away from housing speculation.

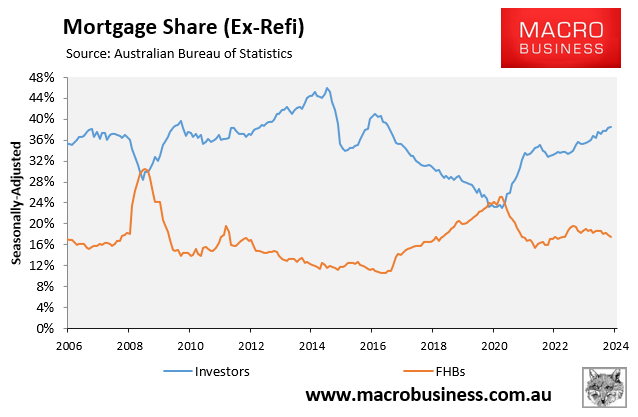

As illustrated in the next chart, investors are clearly crowding-out first-home buyers:

Therefore, part of the solution must involve curbing property tax concessions (e.g., negative gearing and the capital gains tax discount), preferably as part of a broader tax reform package that also lowers income taxes.

Less demand from property investors would necessarily put some downward pressure on home prices as well as increase the share of first home buyers and the homeownership rate.