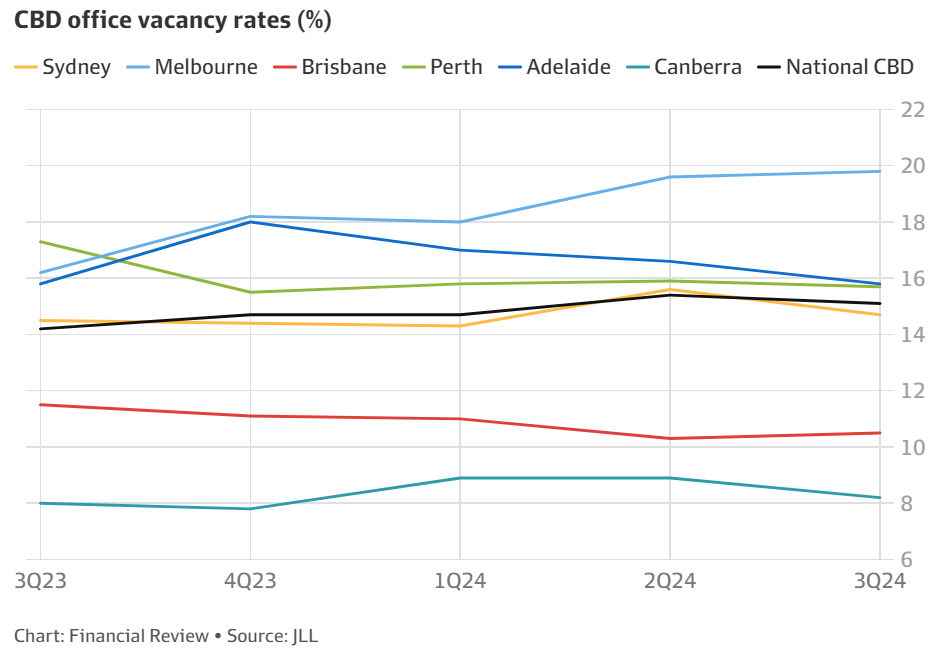

JLL has reported that the Melbourne CBD office vacancy rate rose from 19.6% in the June quarter to 19.8% in September.

By contrast, Sydney’s CBD office vacancy rate contracted from 15.6% to 14.7%, with Brisbane and Canberra also recording falls in vacancy rates. The national CBD vacancy rate improved by 30 basis points to 15.1% quarter-on-quarter.

“Melbourne’s still a basket case. From Queen Street and William Street out towards the west, vacancy rates are very high and that’s not going to change any time soon”, Steve Urwin, director of tenant advocacy firm Kernel Property, said.

“There is so little demand from tenants seeking 2000 square metres and above, so we’re not seeing where future demand is going to come from”.

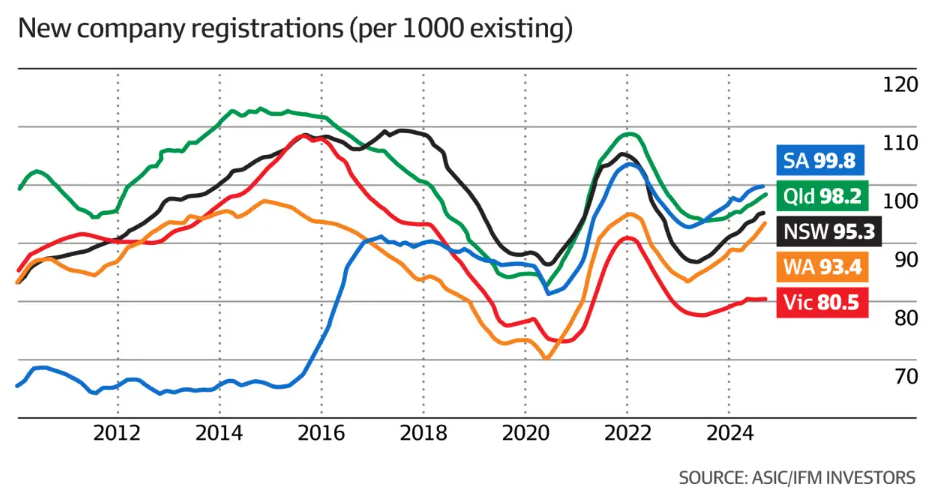

This follows data from the Australian Securities & Investment Commission (ASIC) showing that Victoria recorded the lowest number of businesses registered per 1,000 existing firms in 2023-24:

Victoria recorded only 80.5 new business registrations per 1,000, well below 99.8 in South Australia, 98.2 in Queensland, 95.3 in New South Wales, and 93.4 in Western Australia.

A detailed investigation published in the Weekend Australian shows that Victoria’s economic situation is dire.

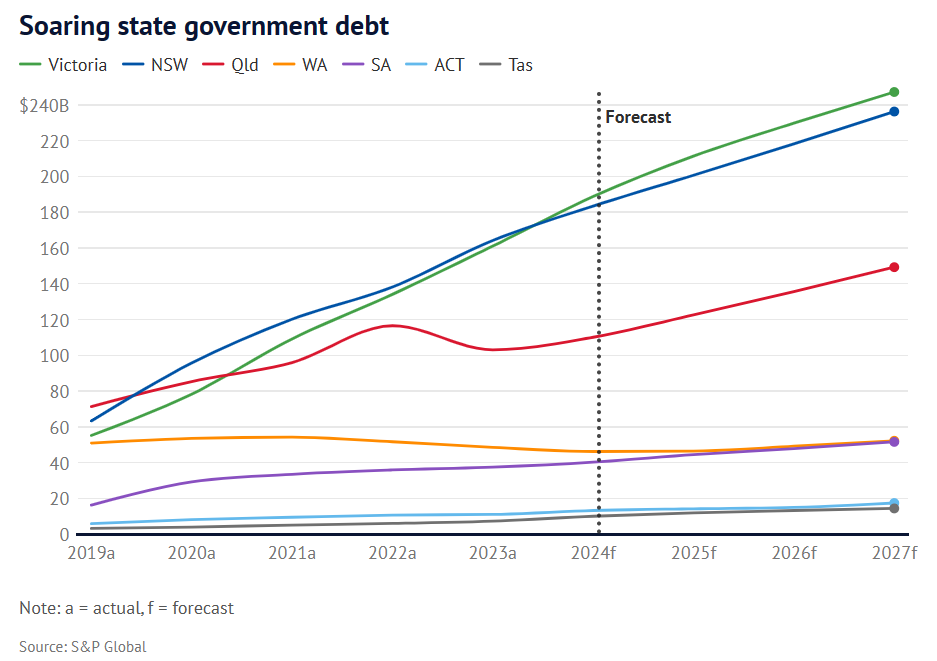

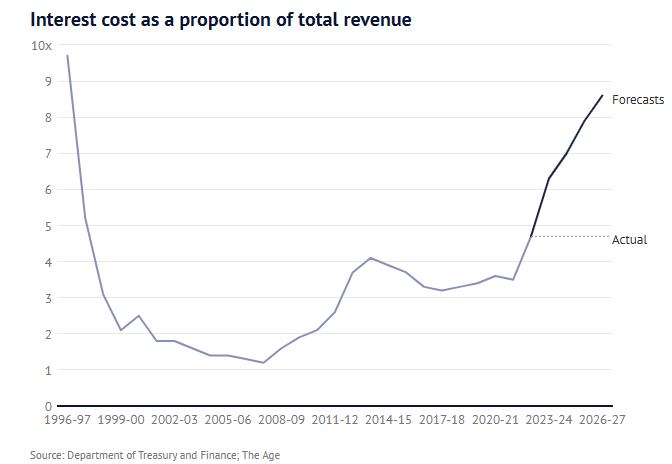

Government spending has more than doubled in the decade since Daniel Andrews took power, with state government debt growing by 319%.

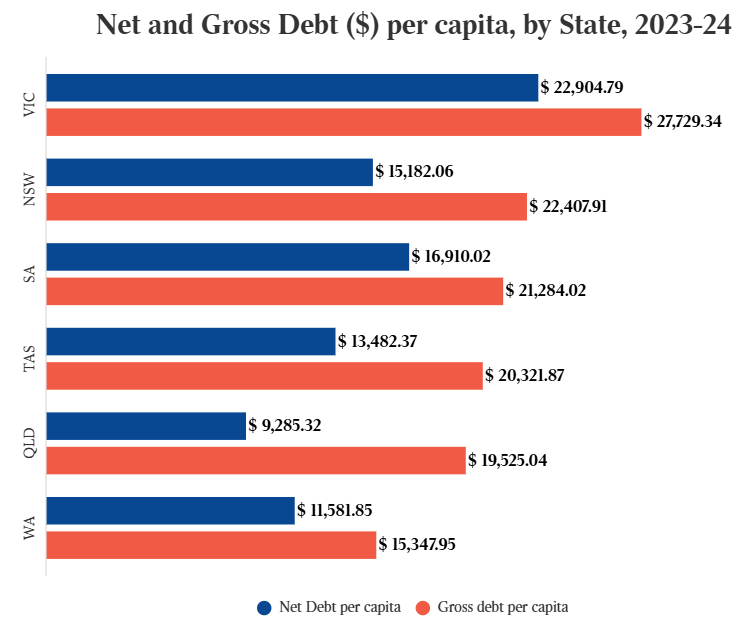

As a result, per capita public debt in Victoria now stands at $28,000 per person, 40% higher than other major states.

Source: The Australian

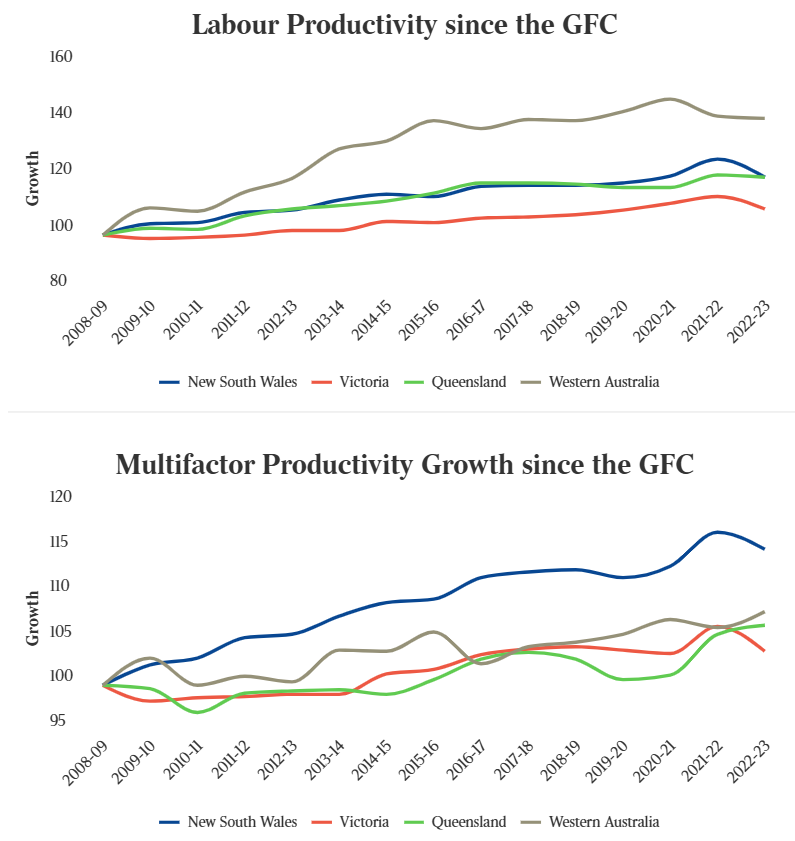

Productivity in Victoria is also poor, rising at less than one-third the rate in NSW. Private capital investment is also lagging, limiting the private sector’s long-term capacity to expand.

Source: The Australian

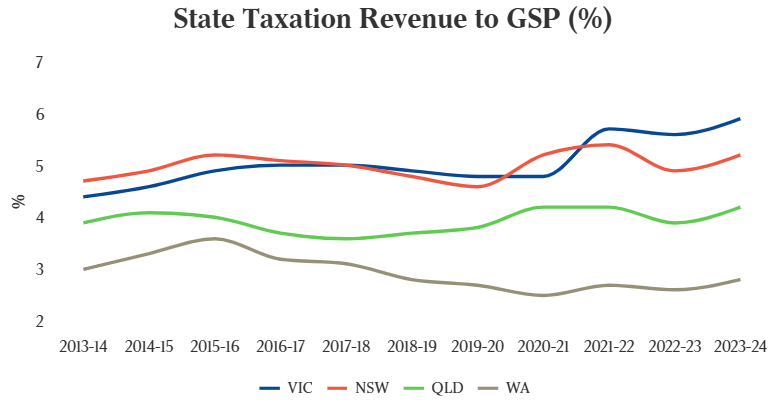

These factors have constrained household income growth and the state’s ability to raise taxes.

Put simply, Victoria has been forced to fund higher repayments on its debt out of lower incomes, resulting in higher average tax rates.

Source: The Australian

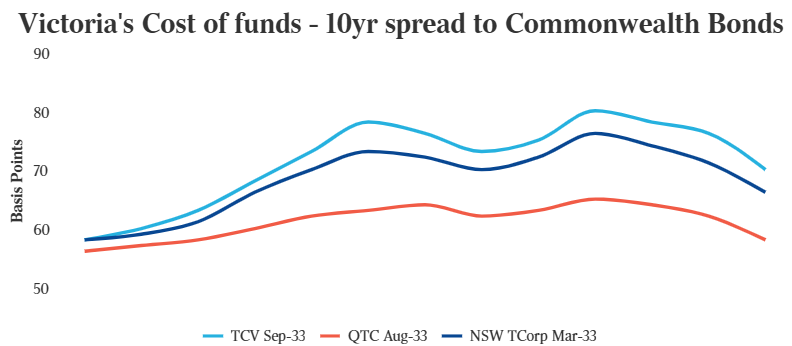

Interest rates on Victoria’s public debt have been pushed to almost one percentage point above the 10-year commonwealth bond rate.

Source: The Australian

As a result, debt servicing costs have increased by over $1 billion each year.

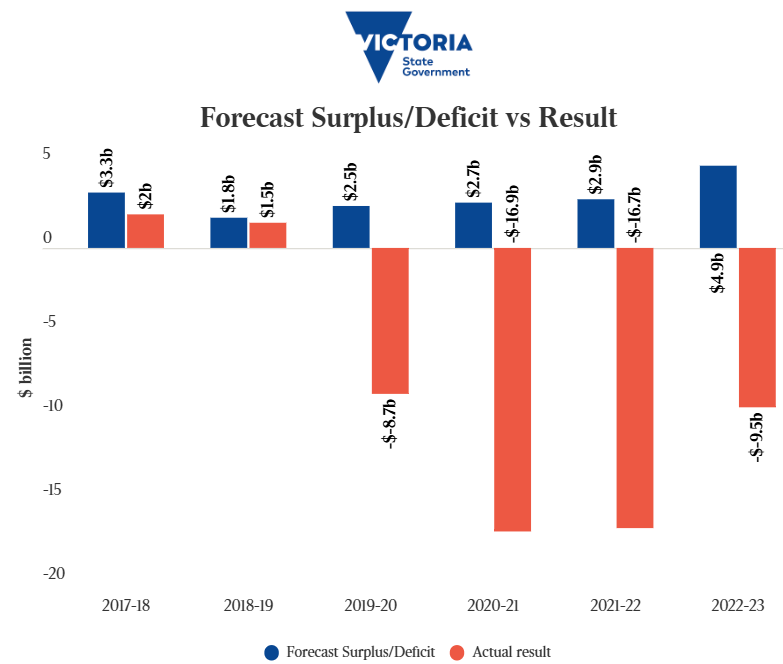

The Victorian Treasury’s budget forecasts have also proven wrong by $5 billion a year since 2014-15, with promised surpluses being lower and deficits higher.

Source: The Australian

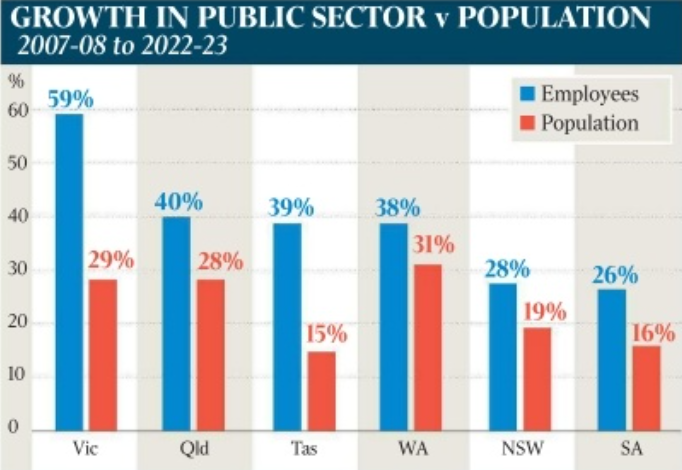

I will add that Victoria’s public sector workforce ballooned by 59% over the 15 years to 2022-23, easily exceeding the state’s population growth of 29%.

Source: The Australian

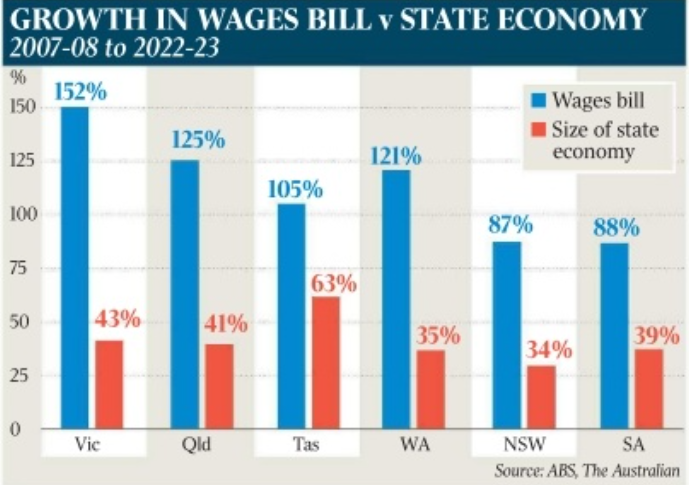

Victoria’s public servant wage bill expanded by 152% over the same 15-year period, easily outpacing the rest of Australia:

Source: The Australian

As of May 2024, the average full-time weekly earnings of a Victorian public servant were $2,130, about $48 more than in New South Wales ($2,082).

The average total earnings of a Victorian public servant ($1,767) also exceeded those of New South Wales ($1,757).

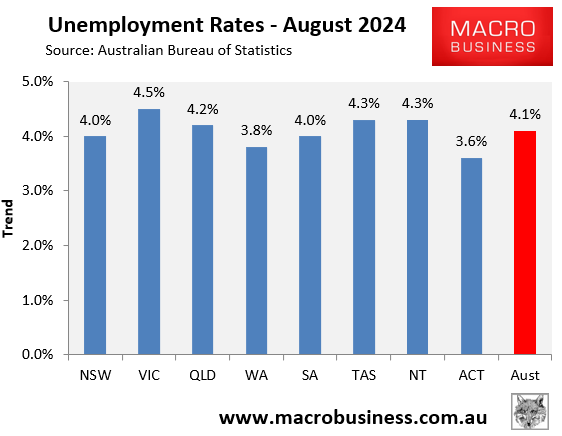

Yet, despite the lavish spending on bureaucrats, Victoria’s unemployment rate is the highest in the nation:

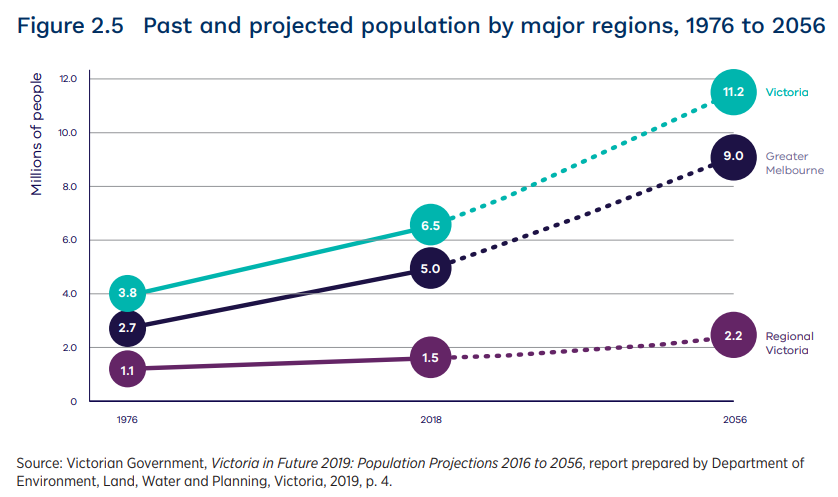

Victoria is the epitome of a Ponzi economy. It is wholly reliant on extreme immigration-driven population growth and government spending.

However, individual living standards are collapsing under the endless population crush, falling productivity, and ballooning state debt.