CBA senior economist Stephen Wu has released a preview of next week’s Q3 CPI inflation release from the Reserve Bank of Australia (RBA).

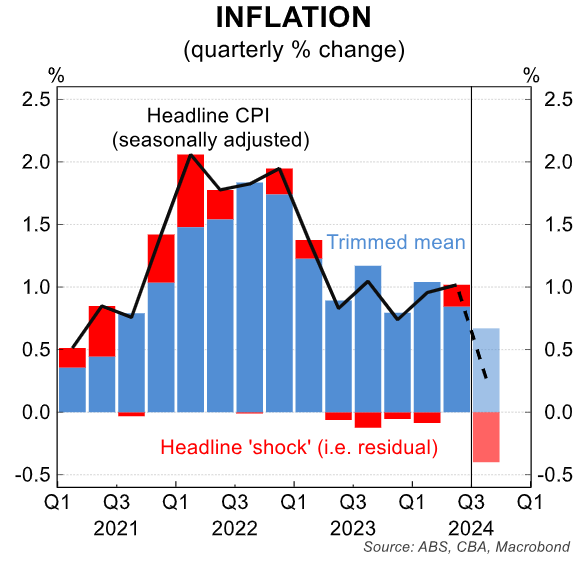

CBA expects that headline CPI rose by 0.3% over Q3 to be 2.9% higher year-on-year, driven by lower electricity prices (-16%) via rebates and fuel declines (-6%).

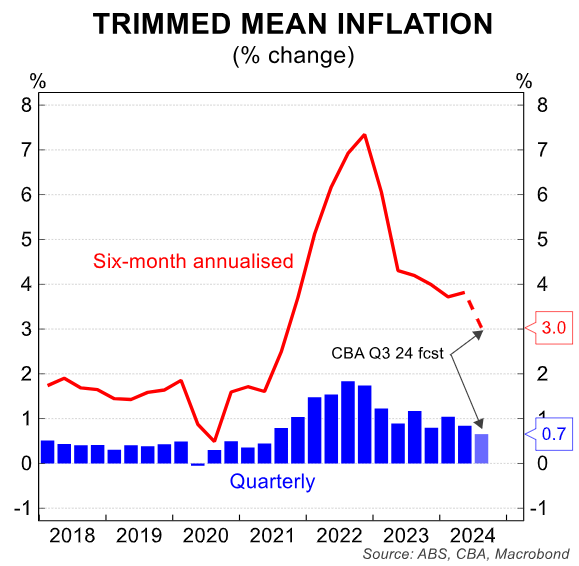

More importantly, CBA forecasts a 0.7% increase in trimmed mean CPI in Q3 (3.4% year-on-year), which would be a touch softer than the RBA’s implied forecasts from August.

CBA projects that annual trimmed mean CPI will return to the top of the RBA’s inflation band (3.0%) in six-month annualised terms – i.e., putting more weight on recent outcomes than those a year ago.

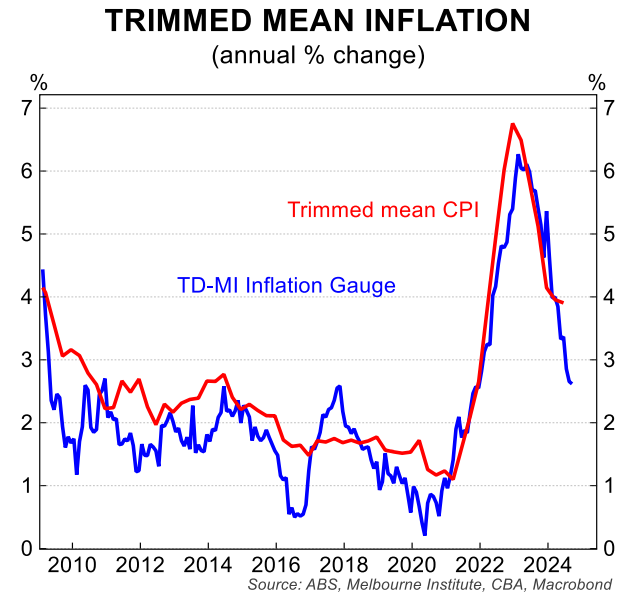

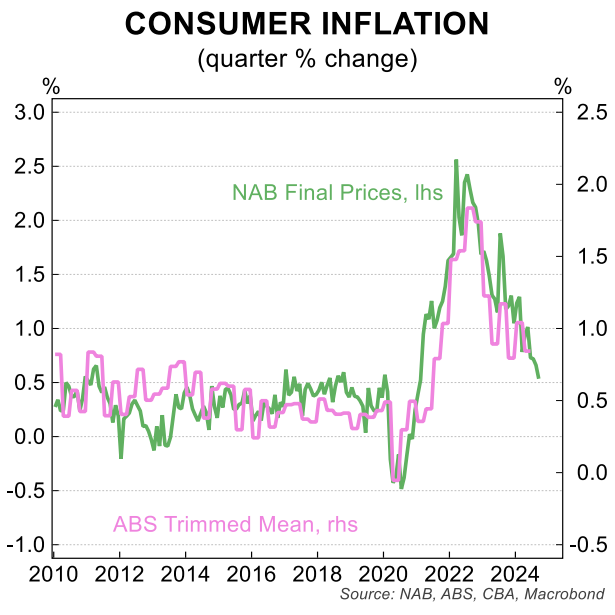

Stephen Wu notes that “the various ‘soft’ survey data on prices stepped down too”, which “provided a good steer for a softer trimmed mean CPI outcome in the June quarter”.

These include the softening read from the Melbourne Institute Inflation Gauge:

The NAB business survey’s final prices measure has also softened materially:

“These surveyed price data give us greater confidence that the desired disinflationary process has been gathering momentum recently”, Wu notes.

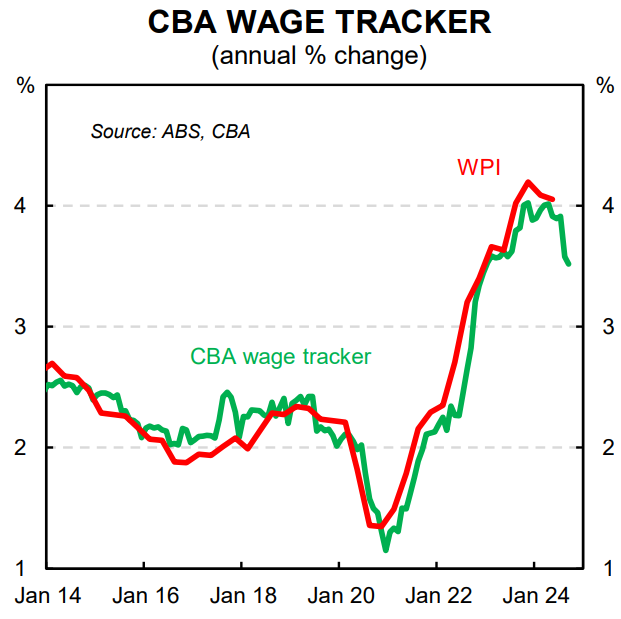

“Wages growth has also been easing over the September quarter too. Our CBA wages tracker with data to September has continued to tick down and we are confident of a big step down in the annual change in the Wage Price Index when the Q3 24 data is released”.

CBA is still hanging onto its non-consensus call that the RBA will commence its monetary easing cycle before Christmas, however this will be contingent on trimmed mean inflation falling to 0.7% or below in Q3.

“Our call for a rate cut by year-end is contingent on a trimmed mean CPI inflation outcome that is not higher than 0.7%/qtr”, Wu noted.

“While our rate view is also premised on a weak Q3 24 household consumption outturn, we think a weaker-than-expected inflation outcome is the primary signal the RBA will need to see before they will be willing to join other central banks and start normalising interest rates”.

My view is that last week’s stronger-than-expected labour force release has greatly reduced the chances of a rate cut this year.

The RBA would need to see next week’s trimmed mean inflation come in way below expectations before considering a rate cut.