New data highlights the two-tier nature of Australia’s construction sector at present, with the number of cranes deployed on residential building sites falling to a two-year low of 493 in the September quarter, compared with 535 six months earlier.

In contrast, the data from quantity surveying firm RLB shows that the number of cranes on non-residential construction sites, including infrastructure projects, rose to a record 370 in the quarter.

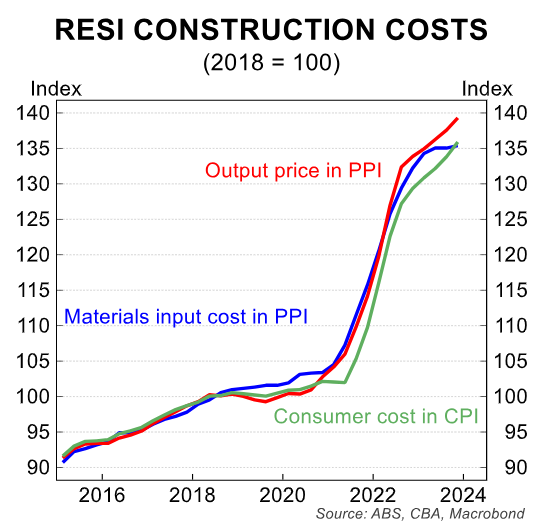

Domenic Schiafone, the head of Oceania research for quantity surveying firm RLB, stated that the infrastructure boom was inflating costs and exacerbating labour shortages, crowding-out housing developments.

“When you have [residential] projects that could get off the ground the pricing has not been feasible”, he said.

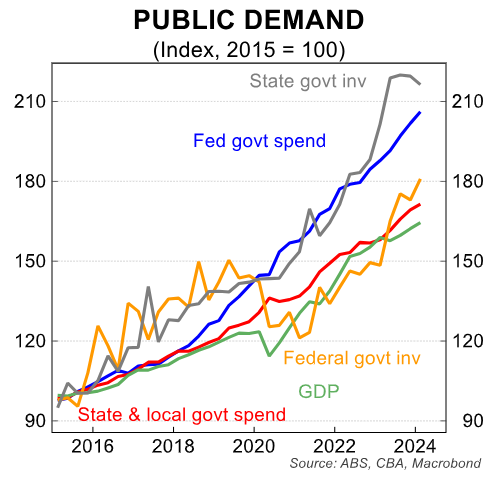

The following CBA chart illustrates the significant increase in state government investment spending, which is a result of “big build” infrastructure projects:

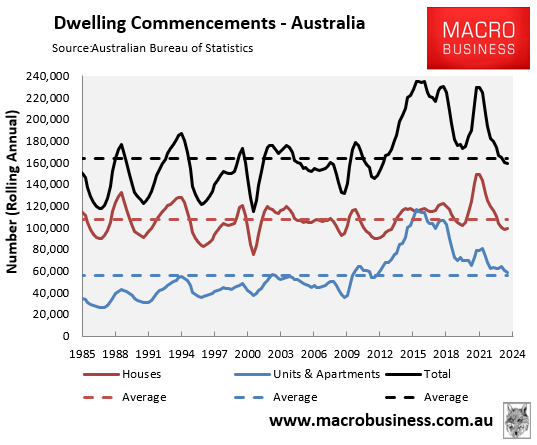

In contrast, dwelling commencements across Australia have collapsed to a 12-year low, with only 158,750 dwellings commenced in the year to June 2024, 81,250 (34%) below Labor’s annual housing target of 240,000 dwellings a year.

“If building continues at this pace, we’ll be in for less than 800,000 new home starts over the next five years”, warned Master Builders Australia chief economist Shane Garrett.

With builders competing for labour and materials against government big build infrastructure projects, along with structurally higher costs, there is simply no way that Labor’s 1.2 million housing target can be met.

Immigration must be cut hard. Otherwise, Australia’s housing shortage will continue to worsen.

Australia simply cannot build enough housing and infrastructure to keep pace with historically high levels of immigration.