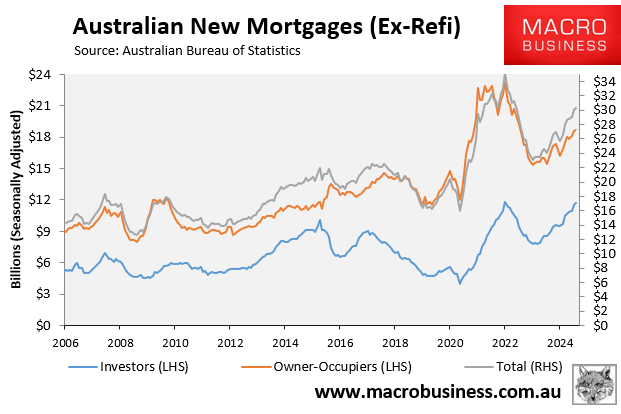

On Friday, the Australian Bureau of Statistics (ABS) released housing finance data for August, which reported that investor demand continues to rise.

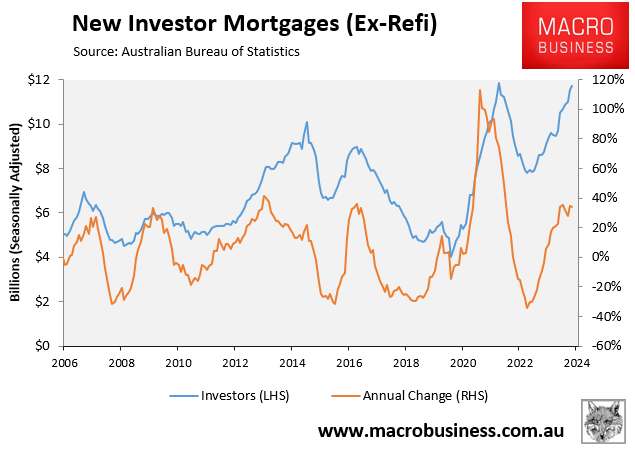

The volume of investor mortgages originated has almost risen back to the pre-monetary tightening peak after growing by 34% year-on-year:

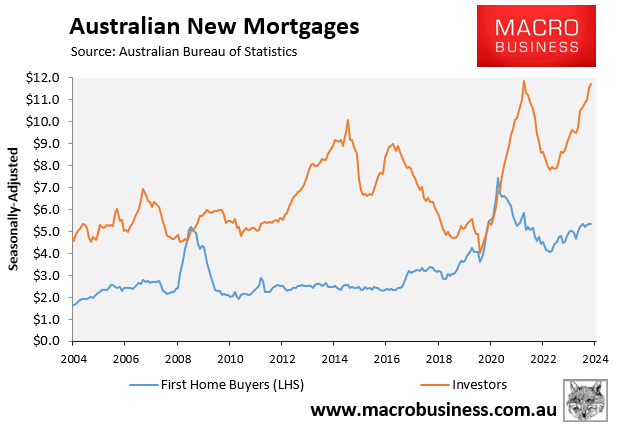

At the same time, the growth in first-home buyer mortgages has stalled in a relative sense and is tracking well below the pre-monetary tightening peak:

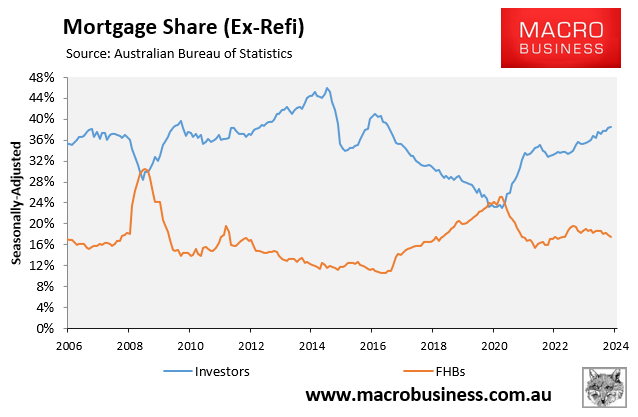

The following chart, which tracks the share of mortgages, suggests that investors are crowding out first home buyers:

As you can see, the share of mortgages going to investors and first-home buyers is negatively correlated.

When investor mortgage commitments rise, it is typically associated with a commensurate decline in first-home buyer commitments.

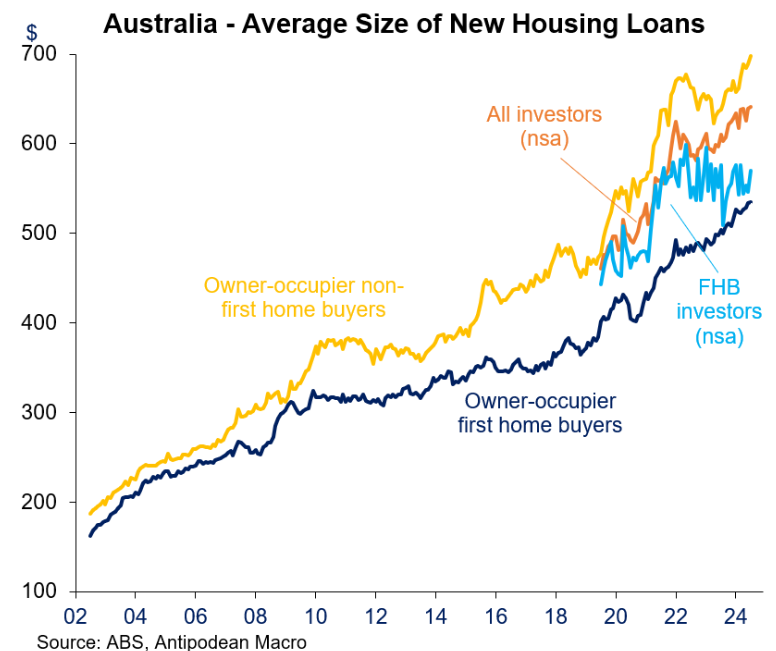

The average loan size of investors is significantly larger than that of first-home buyers, as illustrated below:

Therefore, first home buyers are typically on the losing end of bidding wars.

The above data highlights why curbing investor tax breaks would increase the share of homes purchased by first-home buyers and, therefore, the nation’s homeownership rate.

That said, the best way to help first home buyers from an affordability perspective is to cut immigration significantly.

Excessive immigration is especially pernicious to first home buyers for two reasons:

- It drives up the cost of renting, making it harder for first home buyers to save a housing deposit.

- It drives up house prices, pushing home ownership further out of reach.

Sadly, our political leaders do not genuinely want more affordable housing because it would require lower prices.

They will never reduce immigration to reasonable, sustainable levels below 120,000 so that housing supply can keep up with demand; although the Coalition has at least promised cuts.

Nor will our politicians undertake broad-based tax reforms to shift economic activity away from housing speculation.

Instead, they pretend to care by providing false solutions and hope to would-be first-home buyers while systematically driving higher housing costs through demand-side stimulatory policies.