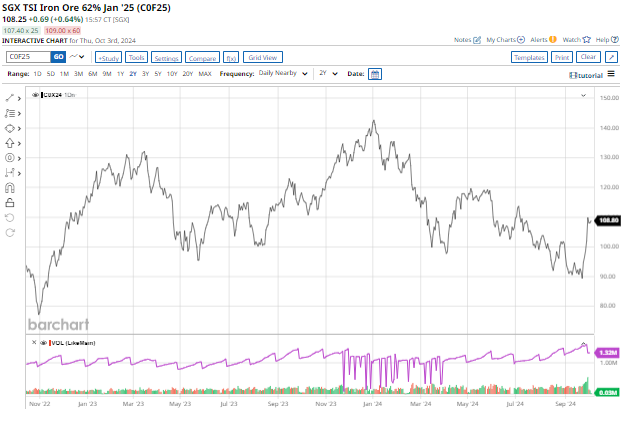

With Chinese markets closed, SGX is wandering sideways:

There is almost no scenario in which iron ore will be driven higher by fundamentals.

There’s too much. The supply chain is chock-o-block. There’s more coming. And Chinese demand will struggle to hold even with stimulus give the baked-in reduction in Chinese property completions ahead.

This is purely an animal spirits rally that comes with unfortunate side effect of guaranteeing maximum further supply.

Indian supply is the highest cost marginal producer and will surge at these levels.

That iron ore has flown further than other base metals is a function of how short markets were, not that the stimulus presents a better outlook:

Based on previous short-squeezes, there is another leg to go before we reverse just as spectacularly to the highest cost marginal producer at $80.