The Albanese government is reportedly preparing to reintroduce its stalled Help to Buy shared equity housing bill into parliament next week in a bid to increase pressure on the Greens.

The Help to Buy scheme would help first home buyers with limited savings to enter the property market. The government would own up to 40% of a property, with the money repaid when the homeowner sold.

“We do need a circuit breaker here”, Housing Minister Clare O’Neil told the ABC on Wednesday.

“The Prime Minister has left that really open and it’s a serious proposition because we’re serious about addressing the housing crisis”.

“We have stepped into the housing problem in a way that we haven’t seen the Commonwealth government do for many decades”, O’Neil said.

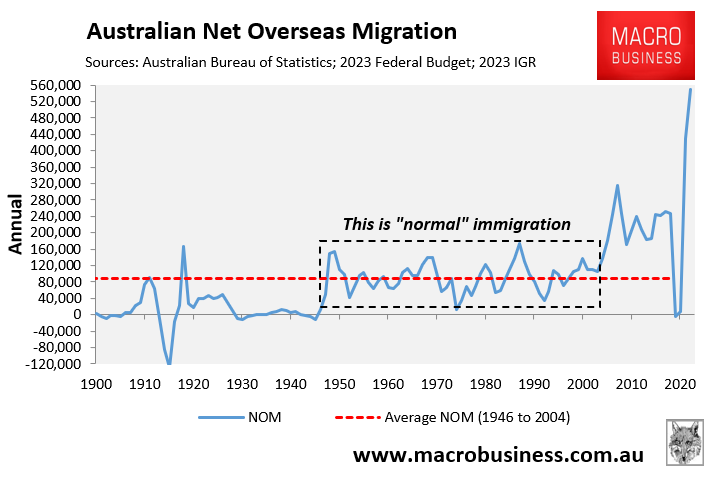

Actually, Clare O’Neil, Labor has made the housing crisis worse by running the largest and most absurd immigration program in Australia’s history.

Help to Buy is another phoney demand-side “affordability” measure that would ultimately raise housing demand and put upward pressure on house prices. It is, therefore, self-defeating from an affordability perspective.

Indeed, AMP chief economist Shane Oliver previously described shared equity schemes as a “band-aid solution” at best and counterproductive at worst:

“To the extent that it brings forward demand, there’s a risk this worsens the problem and benefits those already in the property market through higher prices”, Oliver said.

Ultimately, first home buyers are locked out of the housing market because prices are too high relative to incomes.

The number one solution is to slash immigration, which is especially pernicious to first home buyers for two reasons:

- Excessive immigration drives up the cost of renting, making it harder for first home buyers to save a housing deposit.

- Excessive immigration drives up house prices, pushing home ownership further out of reach.

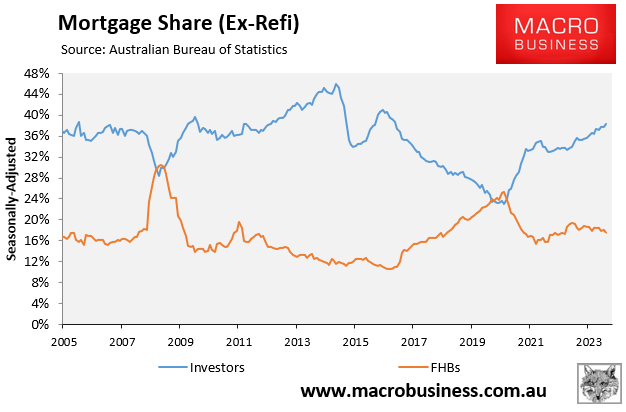

The federal government should also curb investment property concessions, preferably as part of a broader reform of the tax system that shifts the burden away from workers via income taxes to other forms of taxation (e.g., resources, consumption and wealth).

The Australian Bureau of Statistics housing finance data clearly shows that investors are outbidding and crowding-out first home buyers, as illustrated in the following chart:

Therefore, curbing demand from investors via offering less generous tax breaks would boost first home buyer demand and the nation’s home ownership rate.

Sadly, the Albanese government has no interest in “solving” the housing crisis.

Like the Coalition, Labor pretends to care by providing fake solutions while systematically driving the cost of housing higher through stimulatory demand-side policies.