Westpac with the note.

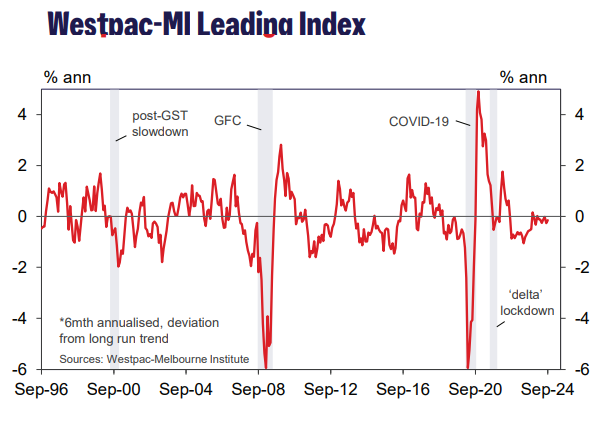

The Leading Index growth rate has been slightly negative for the best part of a year now. That in itself is fairly rare – this is one of the longest periods of ‘middling’ reads in the history of the measure with the more typical pattern one of more pronounced swings between strong and weak. Individual components of the Index have also shown little impetus either way, with the moves that have come through also tending to be offset by other components.

At least some of this lack of direction reflects the monetary policy backdrop, with the RBA cash rate having been unchanged at restrictive levels since November last year. Notably, the last time the Leading Index growth rate hovered around current levels for an extended period was during the sustained hold at the end of the RBA’s last tightening cycle in 2011.