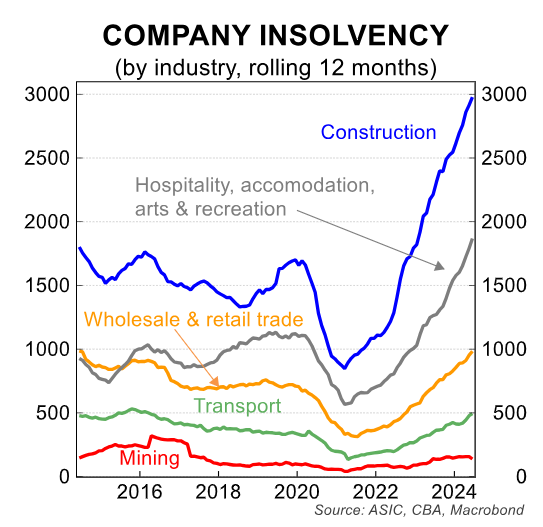

According to insolvency data from the Australian Securities and Investments Commission (ASIC), over 1,900 hospitality businesses failed last financial year as food and energy expenses rose and discretionary consumer spending fell sharply.

Restaurant and Catering Australia (RCA) CEO Suresh Manickam warned that the hospitality industry was going through one of its most difficult periods in history.

“Higher interest rates, cost of living pressures on the up, more expensive produce and the cost of energy are all having an impact”, Manickam said.

“People have less money in their pockets and a reduced ability to pay and go out, and there lies the problem the sector is facing”.

RCA projected that one in eleven hospitality businesses would collapse over the coming year.

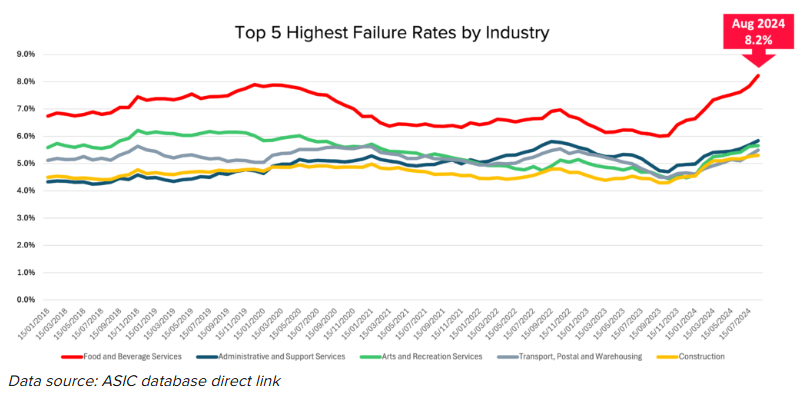

Data compiled by CreditorWatch showed that the food and beverage services industry is experiencing the highest failure rate in the nation, driven by low levels of consumer spending, high inflation and interest rate increases.

“The Food and Beverage sector, in particular, is facing a ‘perfect storm’ of continued rising costs as demand declines”, CreditorWatch noted. “At the same time, the ATO is actively chasing tax debts, many of which sit with businesses in this sector”.

“And in almost all instances, businesses in the Food and Beverage sector pay rent on retail space that is typically located in high foot traffic retail precincts”.

“It is very difficult for restaurants and cafes to move premises to get a better rent deal, therefore rents and the associated increases are an added burden on this industry”, explained CreditorWatch.

CreditorWatch CEO, Patrick Coghlan, also warned that businesses desperately need interest rate relief to boost consumer demand.

“One of the biggest contributing factors to this increase in our business failure rate is the lack of consumer demand”, he said.

“This is reflected in the ABS household spending and Westpac Consumer Sentiment numbers”.

“Consumers won’t be inclined to open their wallets in any significant way until they get a reduction in their mortgage payments”.

“A couple of rate cuts would also mean that credit becomes more affordable for businesses, and they are able to get back on the growth track as well”, Coghlan said.

Australia had too many hospitality establishments, like restaurants and cafes, prior to the pandemic. And given the high cost of living, many will be forced to close.

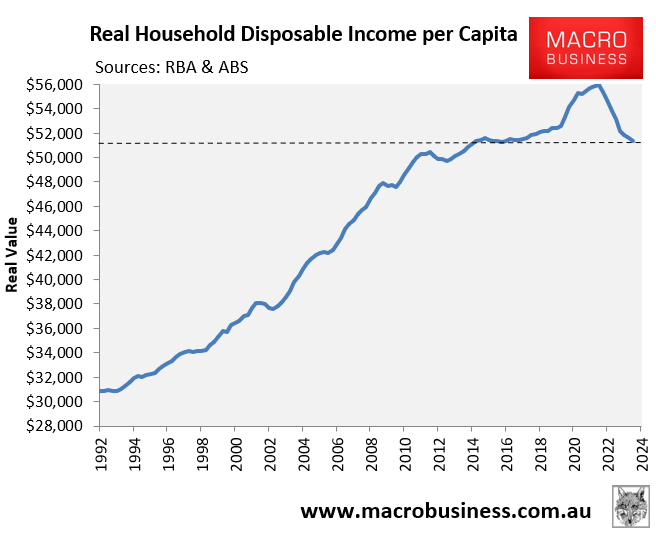

After all, how many Australians can afford to pay $5 for a lukewarm coffee and $20 for avocado on toast, given the significant decline in real household disposable incomes over the last two years?

Australia functioned fine 20 years ago when there was a fraction of the number of cafes and restaurants. It will do so again.

Moreover, the Australian economy would benefit from the closure of marginal, low productivity hospitality businesses. The capital and labour could be deployed better elsewhere in the economy.