Japanese stocks continued their rebound on more dovish talk around rate cuts from the BOJ while mainland Chinese stocks remain closed for the week as Hong Kong reopened with a relatively slight fall. The USD remained somewhat strong from its safe haven surge as the Australian dollar tries but fails to get back above the 69 cent level.

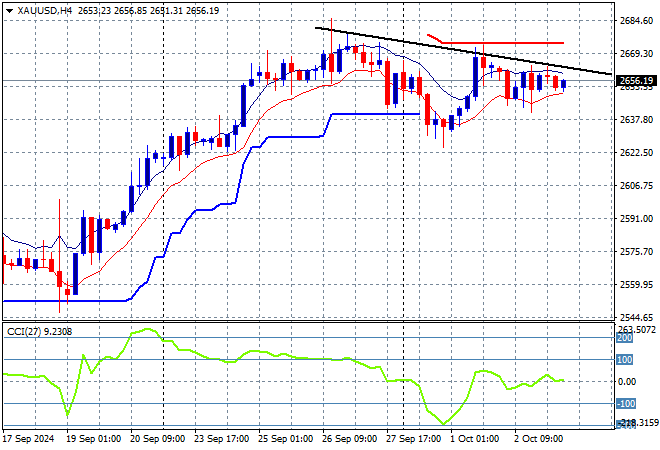

Oil futures are lifting in the wake of more action in the Middle East as Brent crude lifts towards the $75USD per barrel level while gold is trying to comeback after its small retracement at the start of the week, now hovering just below the $2660USD per ounce level but resistance is weighing on the shiny metal:

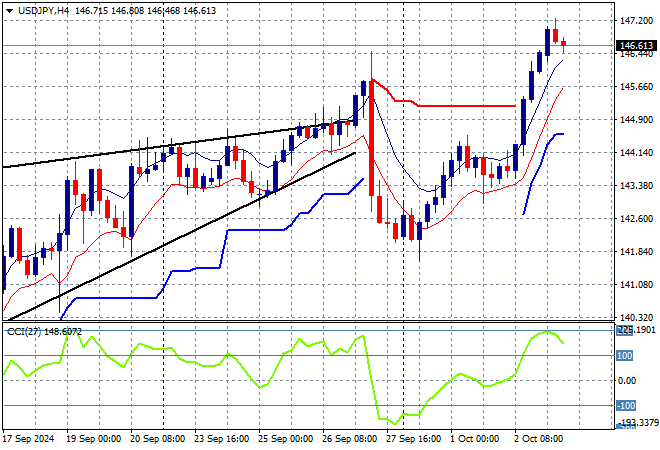

Mainland Chinese share markets remain closed for the week but the Hang Seng Index reopened with a slight pullback, closing some 0.8% lower at 22254 points with Japanese stock markets further rebounding on the rate comments with the Nikkei 225 closing nearly 2% higher at 38552 points. Meanwhile the USDPY pair has paused its overextended rebound to steady somewhat at the 146 level:

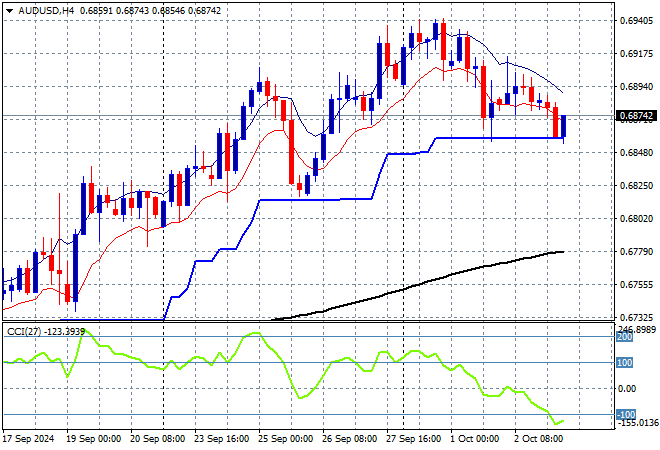

Australian stocks were again unable to make headway with the ASX200 up just a handful of points to cross back above the 8200 point level while the Australian dollar has slid further back into the high 68 level this afternoon:

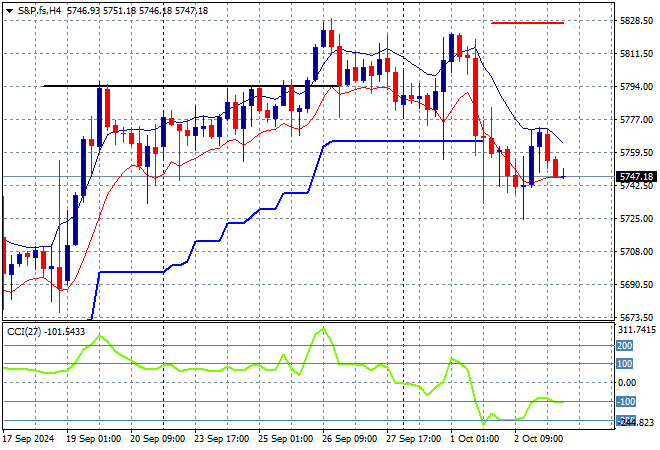

S&P and Eurostoxx futures are down slightly going into the London session with the S&P500 four hourly chart showing momentum still looking good although price action wants to breakout above the recent highs:

The economic calendar continues tonight with the latest weekly initial jobless claims from the US, a good prelude to tomorrow night’s non-farm payrolls print that everyone is waiting for….