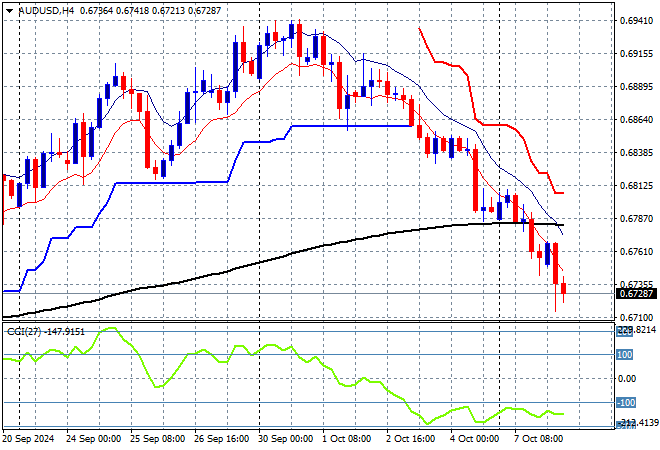

A tumultous return for mainland Chinese markets as the comeback after the week long holiday, expecting more than what the PBOC could deliver today with stocks in Hong Kong slammed lower as a result. Tensions in the Middle East are inflamed and that’s what other risk markets are pivoting on with stock futures across the globe all in the red. The USD has remained strong for its safe haven as the Australian dollar deflates back down to the 67 cent level.

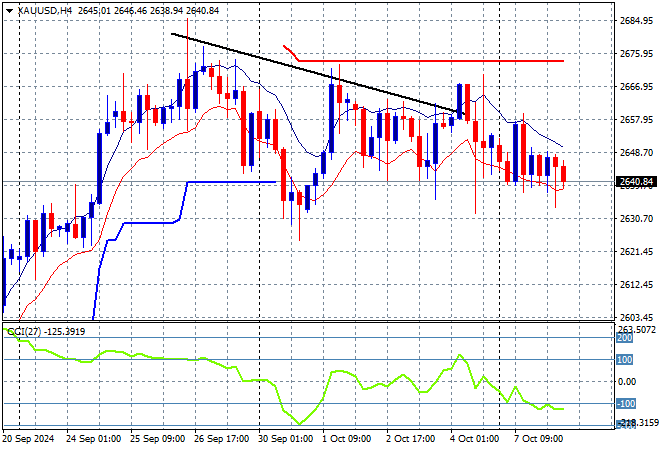

Oil futures are building in volatility in the wake of more action in the Middle East as Brent crude drops sharply below the $80USD per barrel level while gold is failing to comeback after its small retracement at the start of the week, now stalling below the $2640USD per ounce level:

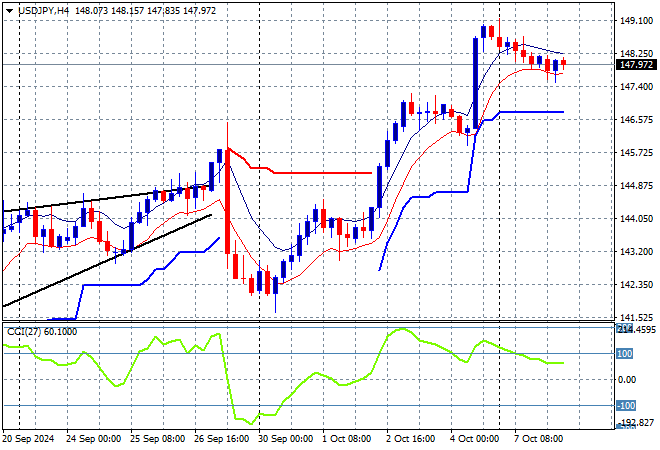

Mainland Chinese share markets reopened with the Shanghai Composite lifting more than 4% to 3482 points while the Hang Seng Index had a massive slump, falling more than 7% to 21347 points, taking back most of its recent gains. Meanwhile Japanese stock markets are also faltering but not at the same magnitude with the Nikkei 225 closing 1% lower at 38935 points as the USDPY pair remains relatively steady just below the 148 level:

Australian stocks fell back across the board as hesitation mounts with the ASX200 falling more than 0.3% to close at 8176 points while the Australian dollar remains under pressure where it almost fell below the 67 level this afternoon:

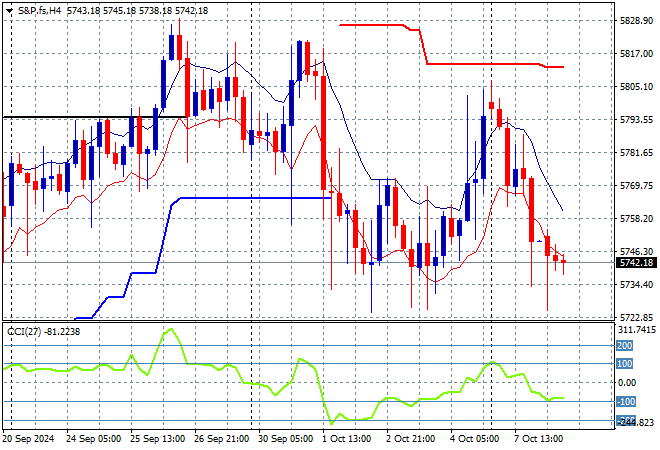

S&P and Eurostoxx futures are down slightly going into the London session with the S&P500 four hourly chart showing momentum flat lining and price action in a waning mood:

The economic calendar is relatively quiet tonight with all eyes remaining on events unfolding in the Middle East.