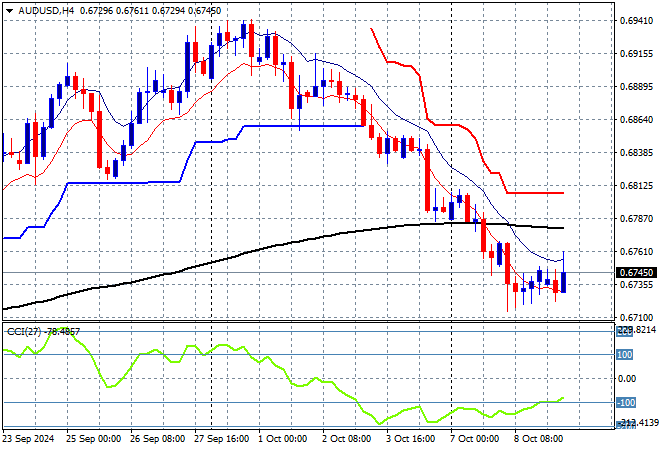

Most currencies were little changed across Asia today although Kiwi dropped sharply on the 50bps cut by the RBNZ while the USD remains calm in anticipation of the release of the latest Fed minutes tonight. Mainland Chinese markets took back all of their previous comeback gains as they continue to pivot on what the PBOC will finally deliver in terms of stimulus while local stocks were dead flat. The Australian dollar was steady just above the 67 cent level after a small false breakout on the Kiwi cut.

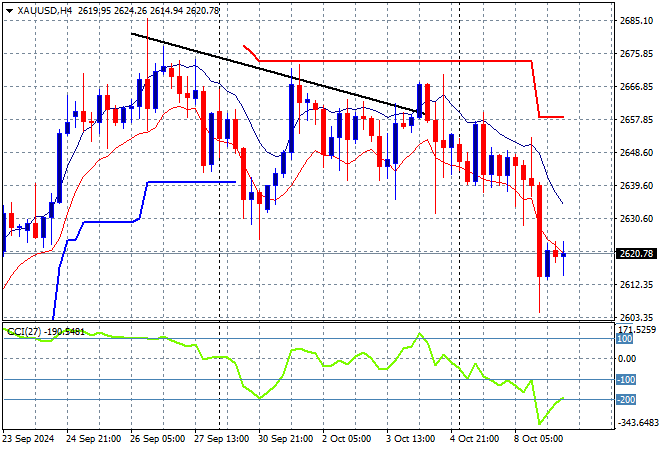

Oil futures remain volatile in the wake of more action in the Middle East as Brent crude tries to steady around the $80USD per barrel level while gold is trying to comeback after its sharp retracement overnight, stalled at the $2620USD per ounce level:

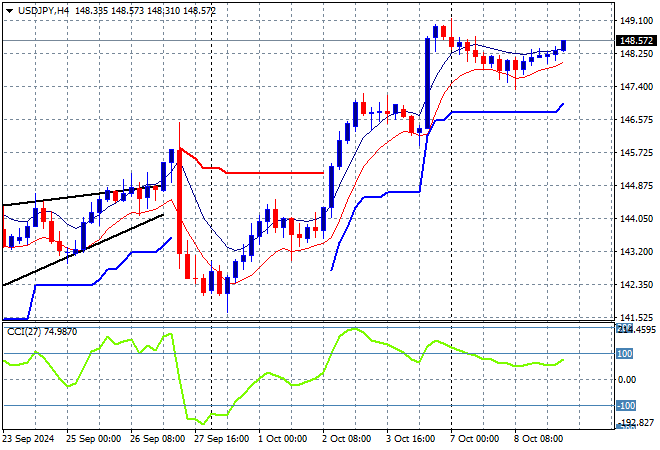

Mainland Chinese share markets are losing their recent gains with the Shanghai Composite falling more than 4% to 3336 points while the Hang Seng Index is relatively steady at 20973 points. Meanwhile Japanese stock markets are getting back on track with the Nikkei 225 closing 1% higher at 39340 points as the USDPY pair slowly gets back on trend to clear the mid 148 level:

Australian stocks were basically unchanged as hesitation continues to mount with the ASX200 up just 0.1% to close at 8187 points while the Australian dollar remains under pressure where it sits just below the mid level this afternoon:

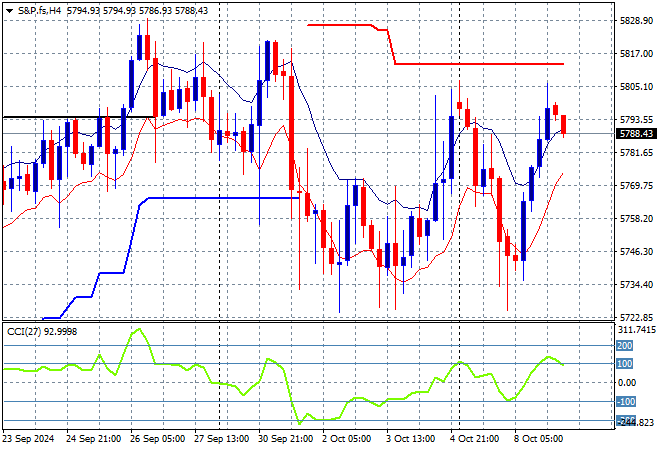

S&P and Eurostoxx futures are down slightly going into the London session with the S&P500 four hourly chart showing momentum flat lining and price action still in a swinging mood:

The economic calendar includes the previous Fed minutes with all eyes remaining on events unfolding in the Middle East.