Most stock markets were unchanged in Asia today due to the meek response on Wall Street to the latest US CPI print which came in slightly hotter than expected. Currencies are equally unchanged although the Australian dollar is trying to lift off its recent low at the 67 cent level.

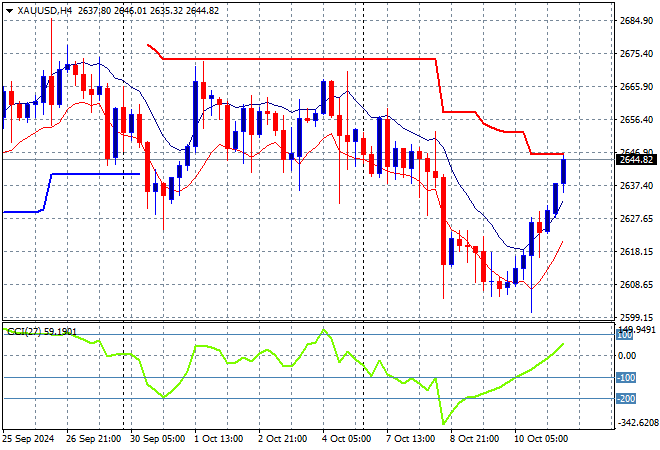

Oil futures have not yet reduced in volatility as Brent crude tries to steady under the $80USD per barrel level while gold is making a better fist of its comeback after bouncing off the $2600USD per ounce level as it heads back to the start of week position at the $2640 zone:

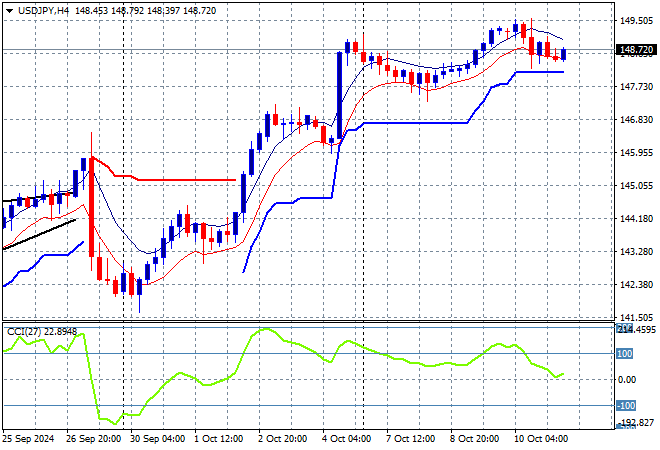

Mainland Chinese share markets are however remaining quite volatile with the Shanghai Composite losing nearly 1.6% to remain below the 3300 point barrier while the Hang Seng Index is closed for a holiday. Meanwhile Japanese stock markets are up slightly with the Nikkei 225 about to close 0.5% higher at 39597 points as the USDPY pair slowly gets back on trend to remain just below the 149 level:

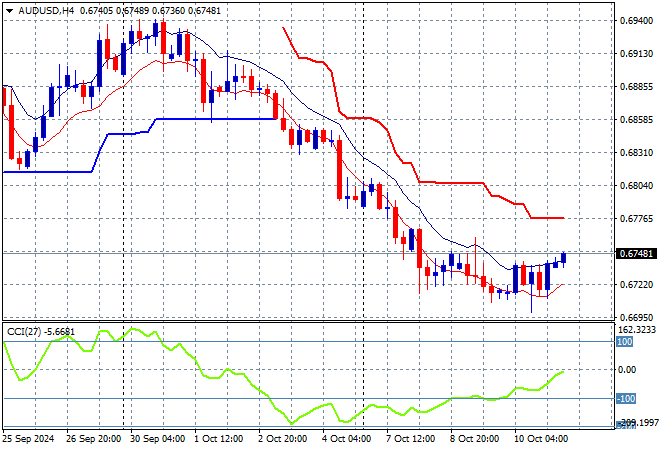

Australian stocks are going nowhere fast with the ASX200 unchanged at 8223 points while the Australian dollar is trying to get out from being under pressure all week as it lifts meekly to the mid 67 cent level this afternoon:

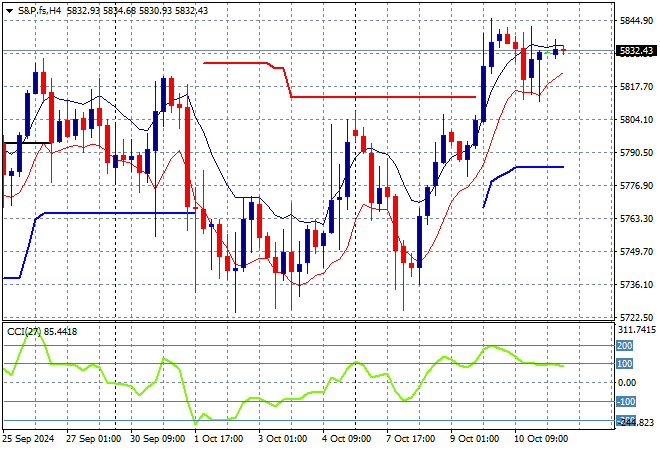

S&P and Eurostoxx futures are steady going into the London session with the S&P500 four hourly chart showing momentum still pulling back after last night’s stall:

The economic calendar includes the latest German CPI print, followed by the US PPI release later tonight.