Asian stock markets are all in the red after the retracement on Wall Street overnight although Chinese are relatively flat as they continue to absorb the PBOC stance on stimulus. Currency markets are still under the thrall of King Dollar with the Australian dollar still getting dragged down despite some dovish talk from the Fed overnight as it slips below the 67 cent level.

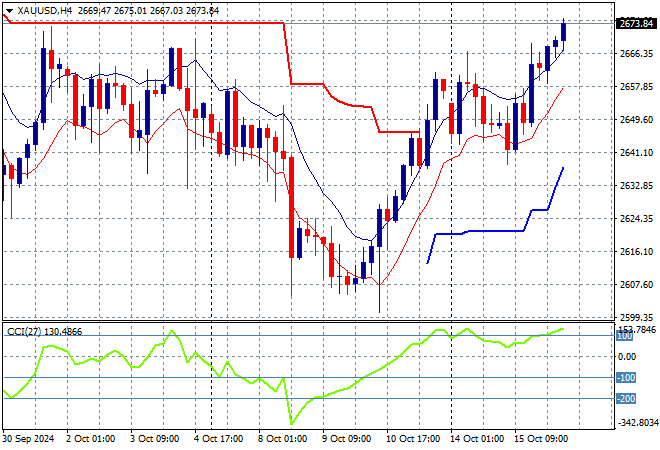

Oil futures are still pulling back as Brent crude falls to the $74USD per barrel level while gold is making a stronger comeback after bouncing off the $2600USD per ounce level as it pushes above its previous highs:

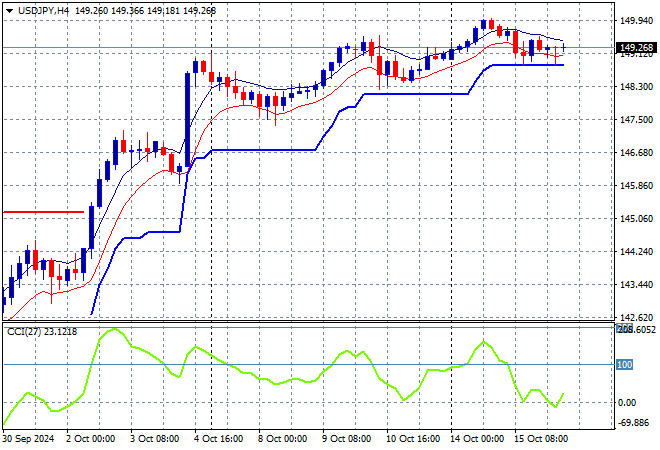

Mainland Chinese share markets are reducing in volatiltiy with the Shanghai Composite flat going into the close while the Hang Seng Index is also barely changed to remain at the 20320 point level. Meanwhile Japanese stock markets are having a bad day with the Nikkei 225 closing more than 1.8% lower at 39180 points while trading in the USDPY pair muted as it stays just above the 149 handle:

Australian stocks are doing as best they can with the risk off mood with the ASX200 down just 0.4% to 8284 points while the Australian dollar has moved below the 67 cent level this afternoon as it continues its downward trajectory:

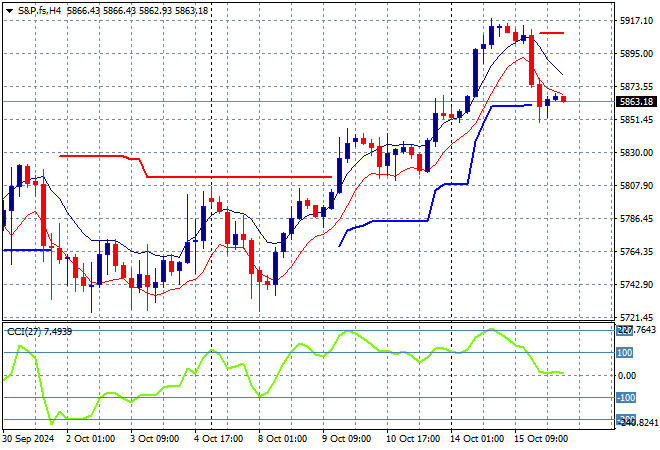

S&P and Eurostoxx futures are flat going into the London session with the S&P500 four hourly chart showing momentum coming back to neutral settings from the overnight retracement but still slightly positive:

The economic calendar will focus mainly on the latest UK inflation print tonight.