Asian stock markets are somewhat mixed after a similarly lacklustre performance on Wall Street and in European stocks overnight as currency traders position for tonight’s ECB meeting. Locally the latest unemployment print surprised to the upside with both Australian stocks and the dollar rebounding higher although the latter is falling back going into the London open.

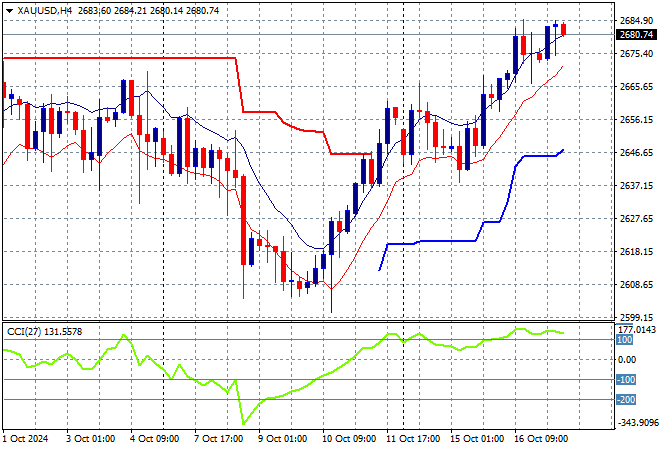

Oil futures are still pulling back as Brent crude falls to the $74USD per barrel level while gold is making a stronger comeback after bouncing off the $2600USD per ounce level as it pushes above its previous highs:

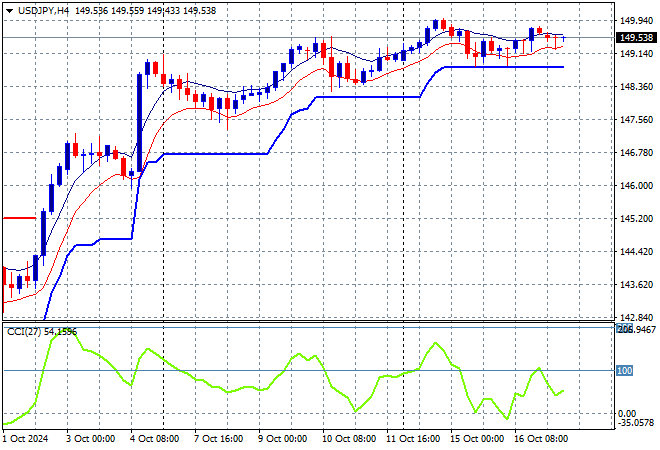

Mainland Chinese share markets are falling into the close with the Shanghai Composite down more than 0.6% while the Hang Seng Index is off by more than 0.5% to 20182 points. Meanwhile Japanese stock markets are having another bad day with the Nikkei 225 closing more than 0.7% lower at 38911 points while trading in the USDPY pair muted as it stays just above the 149 handle:

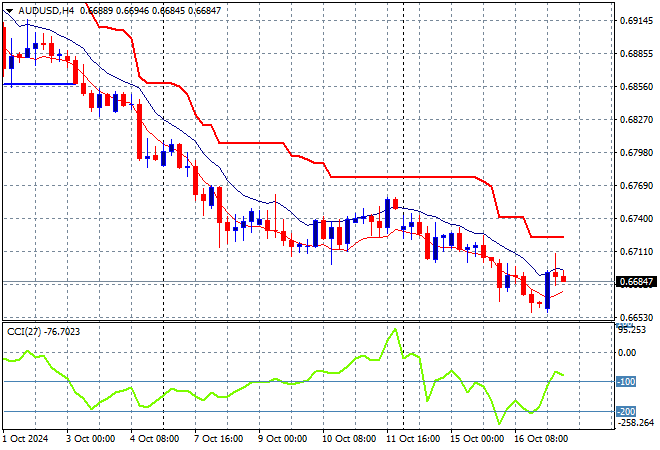

Australian stocks were the standout with the ASX200 launching nearly 0.9% higher to 8355 points while the Australian dollar has bounced up towards the 67 cent level on the jobs print but has since retraced this afternoon as it looks like continuing its downward trajectory:

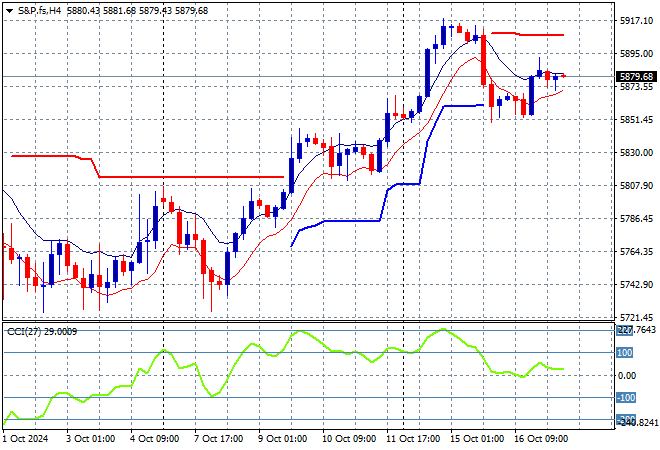

S&P and Eurostoxx futures are flat going into the London session with the S&P500 four hourly chart showing momentum still at neutral settings from the recent retracement but still slightly positive:

The economic calendar will focus mainly on the upcoming ECB Meeting.