Asian stock markets are again very mixed with a poor lead from Wall Street overnight not helping, neither is the impact of the latest PBOC rate cut with very little for risk markets to go on. Futures are indicating a flat or lower start for European stocks which are likely to be muted again without much on the calendar. The USD remains strong against all the undollars but gold as the Australian dollar jumps back above the 67 cent level.

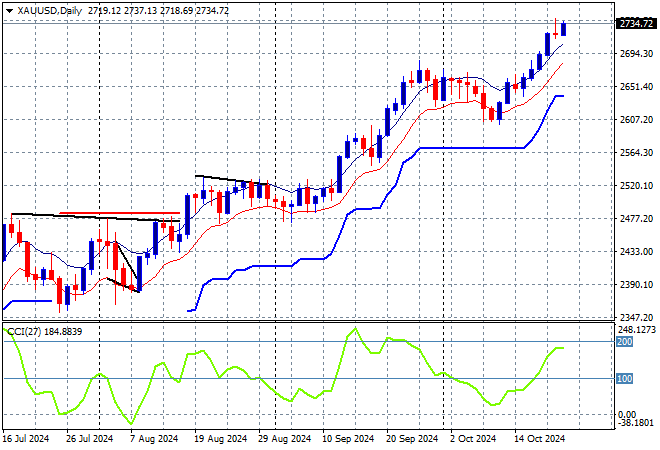

Oil futures are still pulling back as Brent crude falls to the $74USD per barrel level while gold is making another record high extending above the $2700USD per ounce level as the daily chart shows the current trajectory:

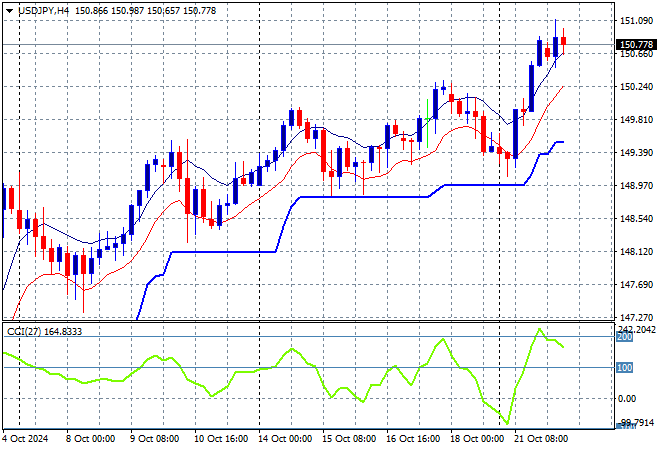

Mainland Chinese share markets are building going into the close with the Shanghai Composite up 0.4% while the Hang Seng Index is flat at 20457 points. Meanwhile Japanese stock markets are pulling back on BOJ concerns with the Nikkei 225 down more than 1.4% to 38411 points while the USDPY pair is firming above the 150 handle:

Australian stocks were the worst performers in the region this time as the ASX200 lost nearly 1.6% to close at 8205 points while the Australian dollar has tried to lift back above the 67 cent level following the weekend gap and the recent PBOC rate cut:

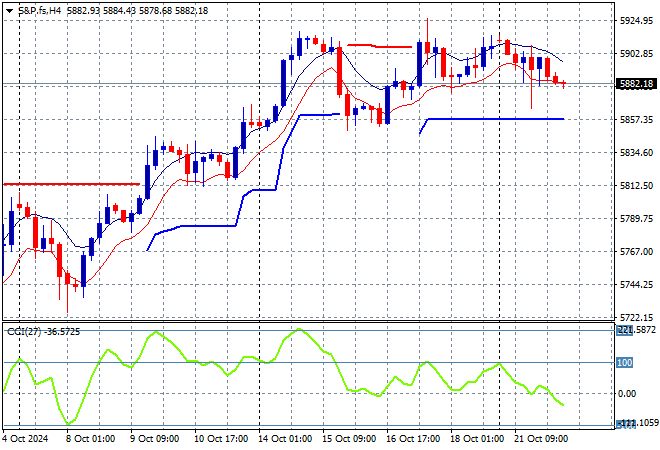

S&P and Eurostoxx futures are flat going into the London session with the S&P500 four hourly chart showing momentum still in positive settings with price action not yet pushing above the 5900 point zone with authority:

The economic calendar is sparse of main releases tonight but there’s a slew of central bank speakers to watch out for.