Asian stock markets are still putting in very mixed sessions, as Wall Street fell back overnight while the economic calendar finally heats up tonight although all ears and algos will likely be on more ECB and Fed speeches than anything else. The USD remains strong against all the undollars as the Australian dollar fails to get back above the 67 cent level after almost cracking the 66 handle overnight.

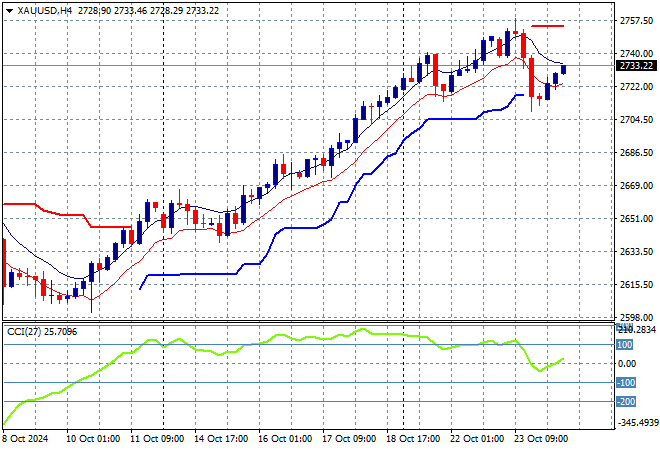

Oil futures are stabilising as Brent crude holds just below the $76USD per barrel level overnight while gold has recovered half of its overnight losses, currently back at the $2730USD per ounce level after getting overextended:

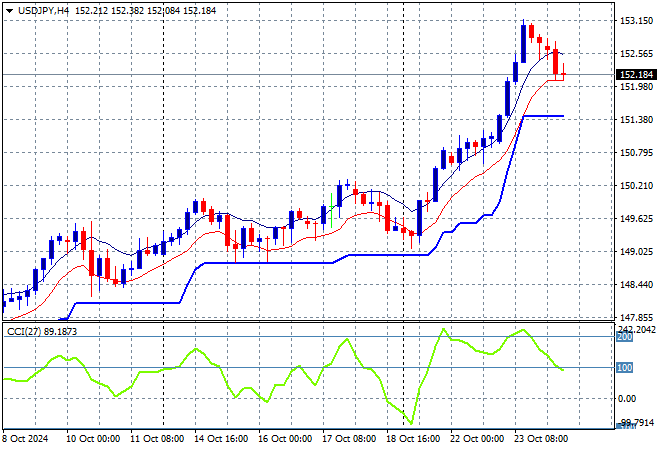

Mainland Chinese share markets are down sharply going into the close with the Shanghai Composite losing more than 0.8% to remain well below the 3300 point level while the Hang Seng Index is off by more than 1% to 20502 points. Meanwhile Japanese stock markets are having scratch sessions with the Nikkei 225 basically unchanged at 38143 points while the USDPY pair is retracing back down to the 152 handle after getting well overextended:

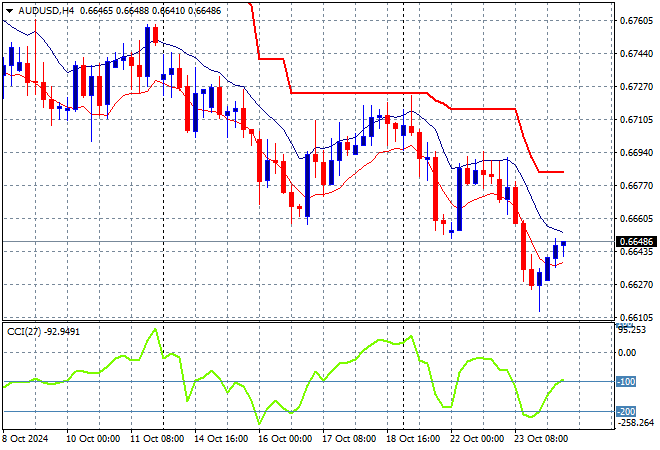

Australian stocks finished on a flat note yet again as the ASX200 closed 0.1% lower at 8206 points while the Australian dollar has tried to bounce back after almost pushing through the 66 cent level overnight but still looks very weak here:

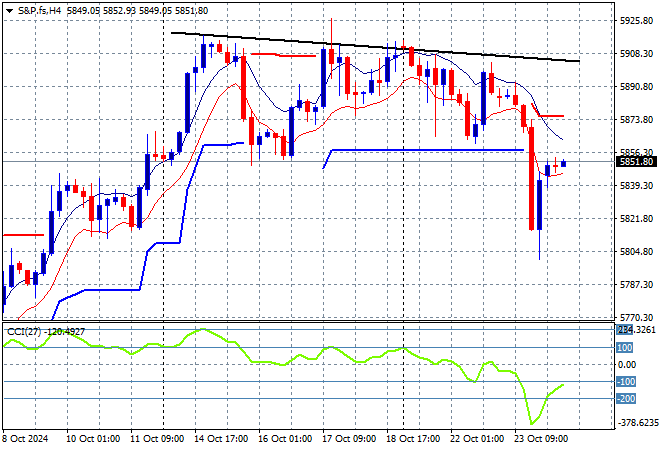

S&P and Eurostoxx futures are up slightly going into the London session with the S&P500 four hourly chart showing momentum still in positive settings with price action not yet pushing above the 5900 point zone with authority:

The economic calendar finally ramps up tonight with some Fed speeches plus Euro wide manufacturing and services PMI prints.