A very mixed start to the trading week with most Asian stock markets failing to advance while a much weaker Yen is supporting Japanese equities as the majority party lost their majority on the weekend. Oil prices are down as Middle East worries dissipate slightly while the USD remains strong against all the undollars as the Australian dollar falls below the 66 handle.

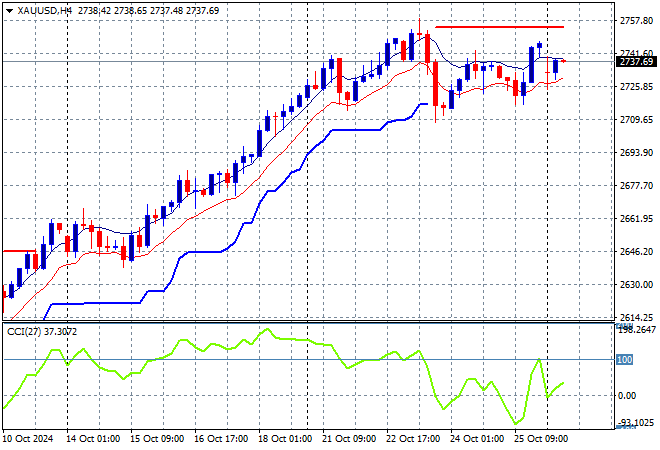

Oil futures have gapped down significantly over the weekend with Brent crude blasting through to the $72USD per barrel level while gold is relatively steady as it sits just below its recent record high at the $2750USD per ounce level:

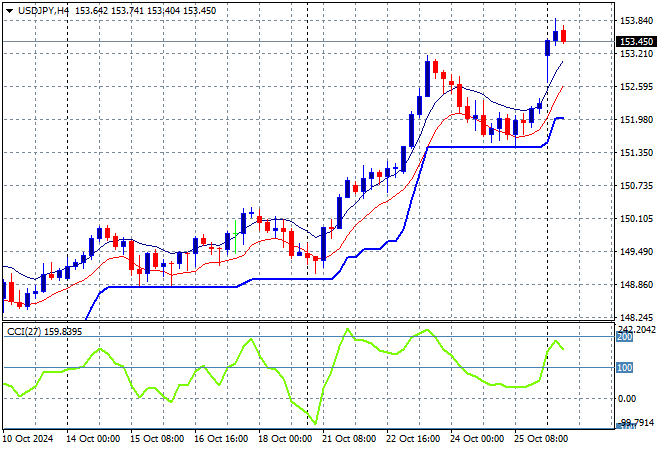

Mainland Chinese share markets are up modestly going into the close with the Shanghai Composite gaining more than 0.2% to finally get back above the 3300 point level while the Hang Seng Index is up by just 0.1% to 20617 points. Meanwhile Japanese stock markets are having the best time however with the Nikkei 225 up more than 1.8% to 38605 points as the USDPY pair was relaunched back through the 153 handle after its pause last week:

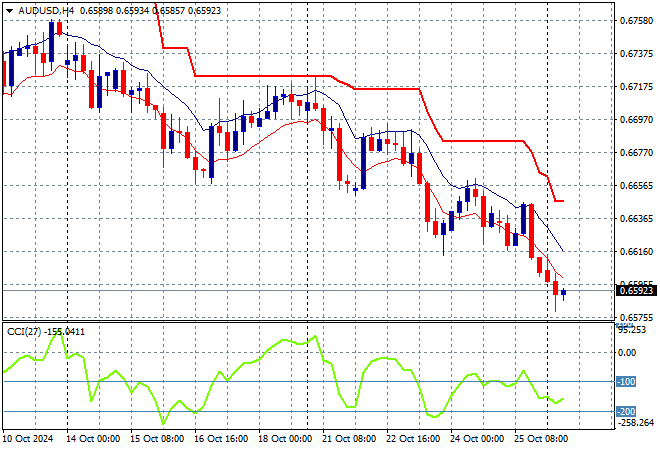

Australian stocks started on a flat note yet again as the ASX200 closed 0.1% higher at 8222 points while the Australian dollar has fallen back below the 66 cent level, continuing its Friday night selloff and looking very weak here:

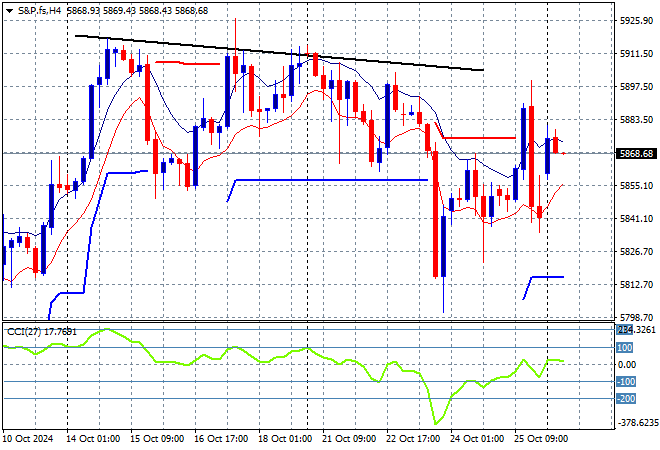

S&P and Eurostoxx futures are down slightly going into the London session with the S&P500 four hourly chart showing momentum just in positive settings with price action not yet pushing above the 5900 point zone with authority:

The economic calendar is relatively quiet again although trading hours have changed for daylight savings in the UK.