A red sea across Asian stock markets which have all failed to advance in the wake of the latest BOJ meeting and North Korean sabre rattling, while US stock futures are down despite some solid after hours earnings from tech stocks. Yen strengthened slightly, giving a headwind to Japanese equities while the USD remains tentatively strong against most of the other undollars as the Australian dollar holds above the mid 65 handle.

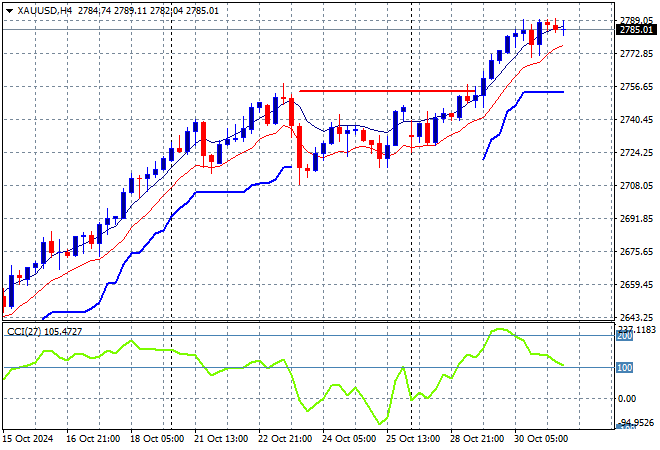

Oil futures are holding after their little spike overnight with Brent crude holding at the $72USD per barrel level while gold is relatively steady as it sits just below its recent record high at the $2790USD per ounce level:

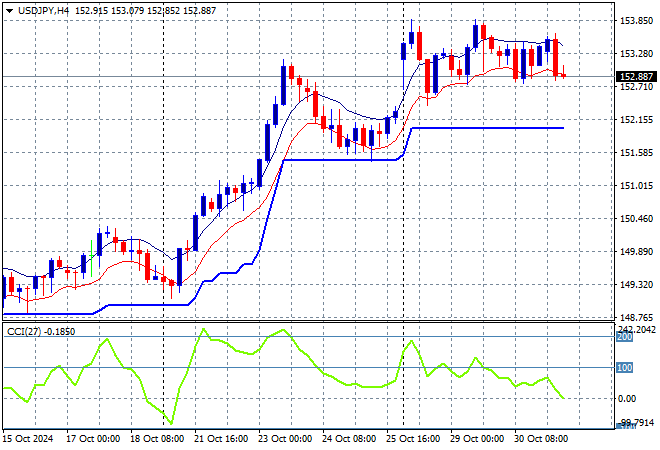

Mainland Chinese share markets are up modestly going into the close with the Shanghai Composite gaining more than 0.2% but still unable to get back above the 3300 point level while the Hang Seng Index is dead flat at 20374 points. Meanwhile Japanese stock markets are back tracking in the wake of the BOJ meeting with the Nikkei 225 down 0.7% to 39000 points as the USDPY pair came back slightly to just below the 153 handle:

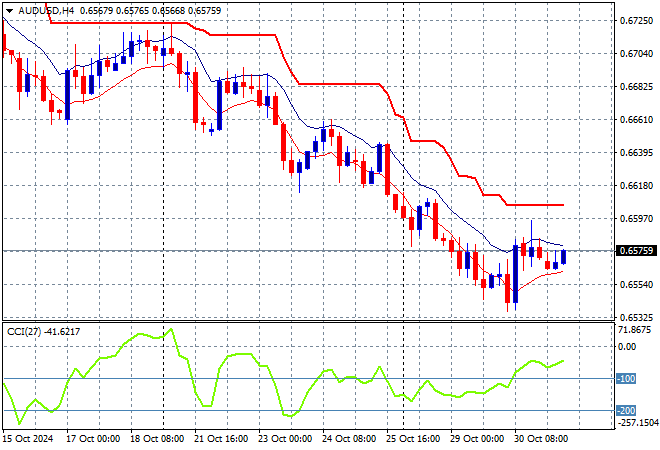

Australian stocks were basically unchanged despite a big list of releases as the ASX200 closed 0.2% lower at 8160 points while the Australian dollar has firmed only slightly on the latest retail sales and building approvals data, holding above the mid 65cent level, as momentum tries to normalise after a long run down all month:

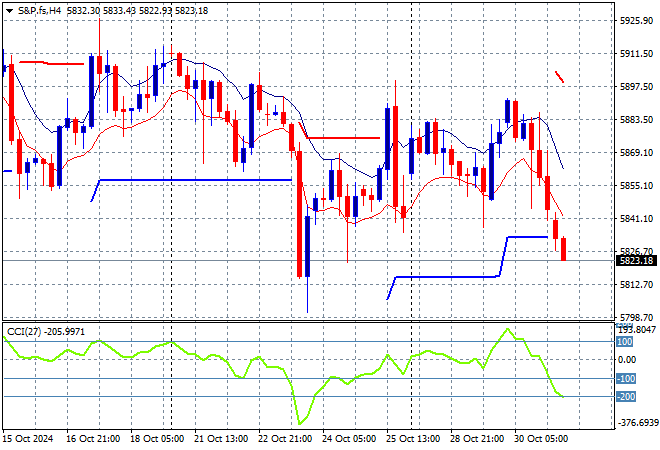

S&P and Eurostoxx futures are down 0.5% going into the London session with the S&P500 four hourly chart showing momentum just in positive settings with price action not yet pushing above the 5900 point zone with authority:

The economic calendar ramps up again tonight with end of month features including Euro inflation and a slew of US income numbers.