All eyes remain on the broadening Middle East conflict as oil prices spiked again while the USD remains firm given Friday night’s strong non-farm payroll print. Risk markets are still in a flux with Wall Street restarting the trading week with some losses while the USD kept Euro well below the 1.10 level as the Australian dollar also dropped below the mid 67 cent level.

10 year Treasury yields moved higher, lifting nearly 5 points to break the 4% level while oil prices spiked and held on to their returns at the end of the session as Brent crude pushed well above the $81USD per barrel level. Gold again tried to find some upside but is seeing a lot resistance at the $2660USD per ounce level, falling back to the $2640 level overnight.

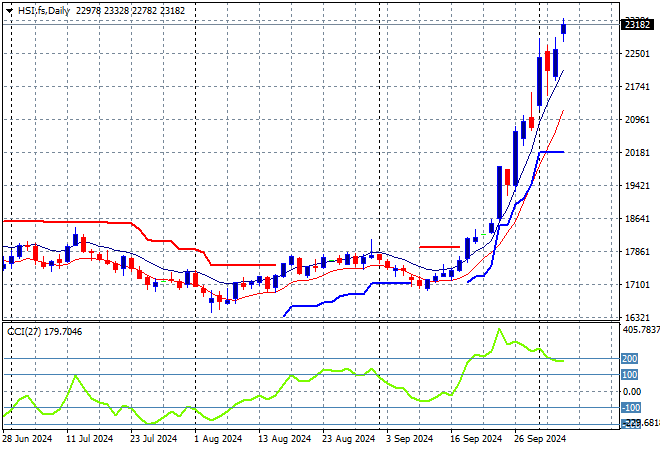

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets remain closed but will reopen today as the Hang Seng Index lifted again, closing some 1.6% higher at 23002 points.

The Hang Seng Index daily chart shows how short term resistance was finally being pushed away with a huge breakout above the 19000 point level that then set up for a run at the 20000 level in the response to PBOC stimulus but I am still wary of a sharp retracement on profit taking here on the return of mainland markets:

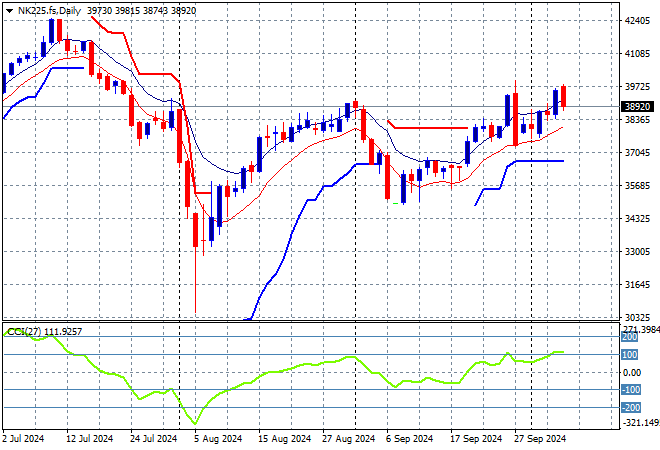

Japanese stock markets rebounded further with the Nikkei 225 closing nearly 1.8% higher at 39332 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards as positive momentum is building but futures are indicating a possible pullback today:

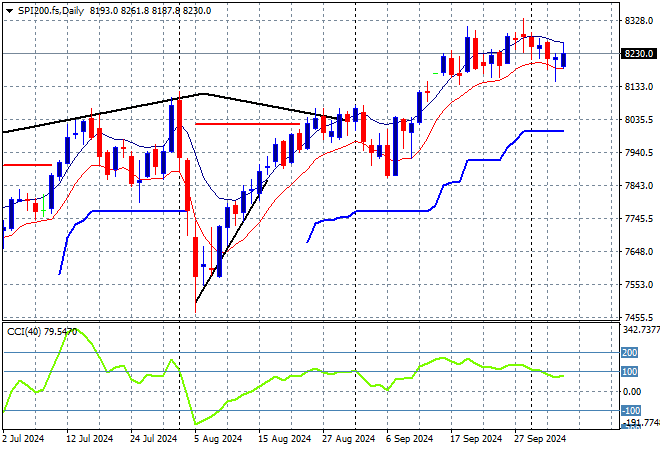

Australian stocks were able to make headway with the ASX200 up nearly 0.7% to cross back above the 8200 point level, closing at 8205 points.

SPI futures are flat due to the lack of upside movement on Wall Street overnight with the lower Australian dollar possibly help cushioning here. Short term momentum and the daily chart pattern was potentially signalling a top but price action still shows a clear breakout to new highs with momentum somewhat overbought, but some buying exhaustion might be setting in:

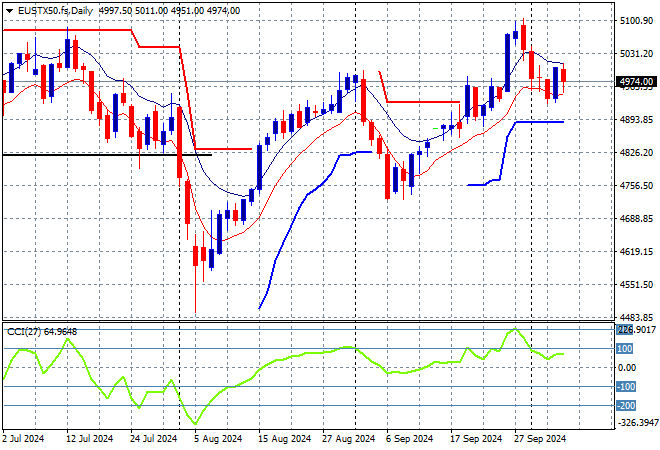

European markets had a better start to the trading week with some mild gains across the continent as the Eurostoxx 50 Index closed 0.3% higher to 4969 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is not quite overbought here:

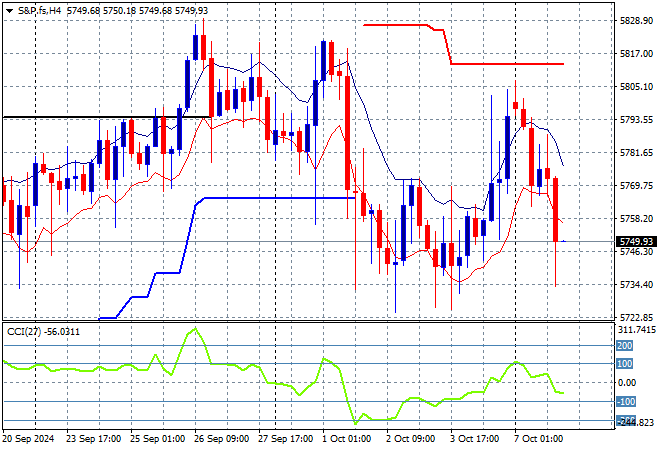

Wall Street however staggered around after absorbing the full impact of the NFP print on Friday night with falls across the board as the NASDAQ lost more than 1% while the S&P500 also nearly closed 1% lower at 5695 points.

The four hourly chart illustrates the series of breakouts since the early September lows as Fed signalling is doing its thing. Price action had a small breakout on Friday night’s NFP print but the sequential hurricanes and Middle East tensions are taking a toll here:

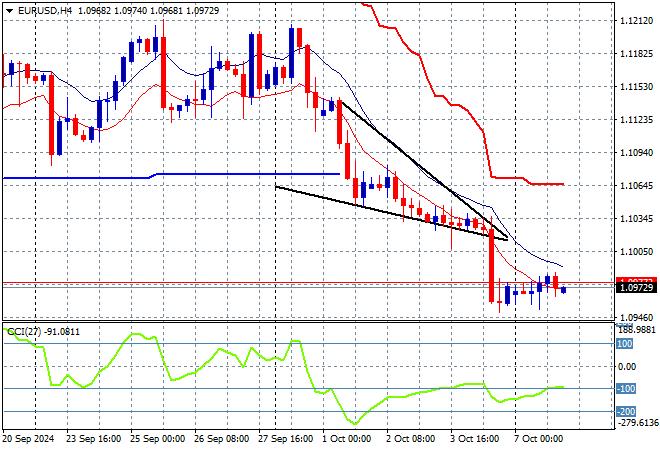

Currency markets are remaining in the thrall of USD strength again amid the geopolitical strife with King Dollar keeping Euro squashed below the 1.10 handle after its breakdown on Friday nigth from the NFP print.

The union currency had been structurally supportive before the Fed meeting and US jobs report but a double plunge indicated more weakness in the short term as momentum collapsed into the oversold zone with a breakdown of short term ATR support as well. Overhead resistance has now moved to the 1.11 level in the short term with any breaks above the 1.10 level likely temporary:

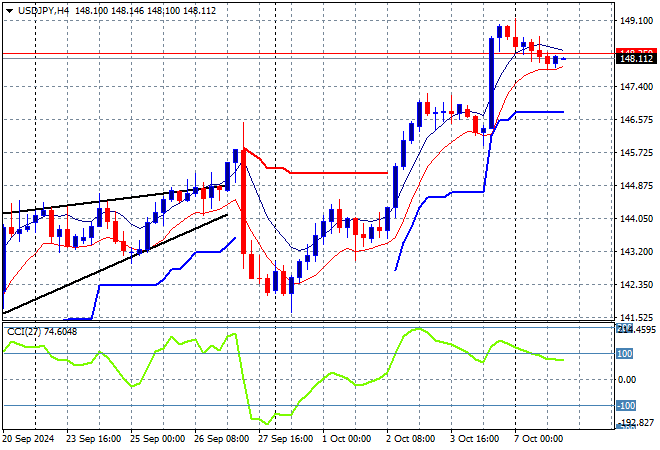

Rate hike speculation sent the USDJPY pair higher last week and the stronger USD has kept it elevated over the weekend gap as its stays above the 148 level overnight.

Momentum had gotten very oversold following the break of the bearish rising wedge pattern and I thought this could be a dead cat bounce with another return to the 140 level but that was nullified with this reversal potentially having more legs in the coming sessions:

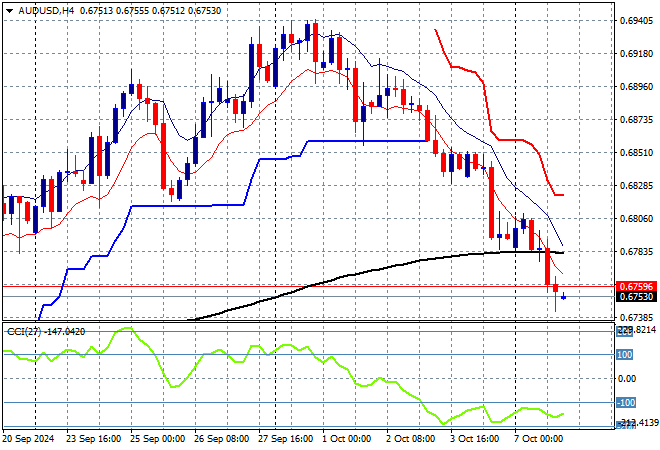

The Australian dollar really wanted to hold above the 69 level following the recent hawkish RBA meeting and in the wake of more rate cut signalling from the Fed but it can’t beat the run to safety in USD, haven broken below short term support at the 68 cent level before Friday’s NFP print. Overnight it cracked lower still to the mid 67 cent zone.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. The potential for more upside has dissipated here as ATR support is broken:

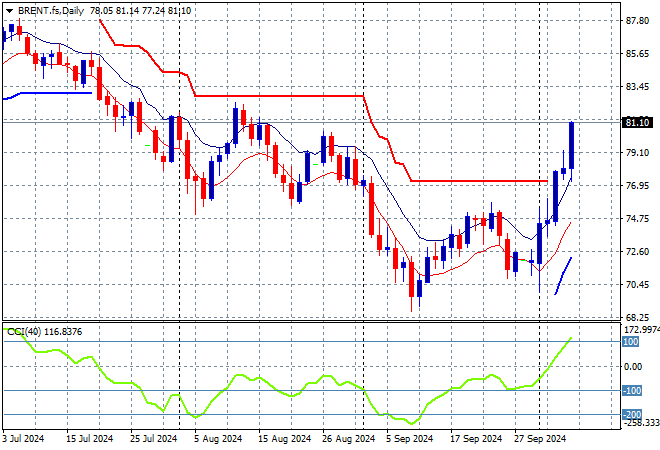

Oil markets are breaking out in volatility as the Middle East wars spread, with Brent crude spiking up through the $81USD per barrel level in a strong buying session in a more convincing move.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken but short term momentum was only slowly getting out of negative territory, but this is a clear move higher as the Iranian oilfields are likely to be targeted next:

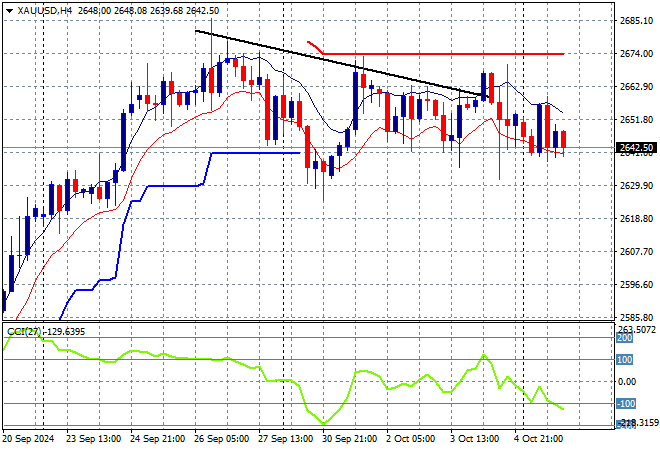

Gold had almost returned to its former high at the $2660USD per ounce level after bouncing off short term support last week but couldn’t make a new session high as resistance kept the shiny metal contained. This happened again overnight with a pushback to short term support at the $2640 level.

Price action was starting to show signs of upside exhaustion here as momentum slows down in the short and medium term timeframes. I continue to watch for any break of short term support at the $2600USD level going into this week’s NFP print as a prelude to a wider retracement on profit taking:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!