Australian policymakers have created an even worse way to grow the economy than through high immigration and housing speculation.

The National Disability Insurance Scheme (NDIS) has become a literal financial ‘black hole’ that is driving the nation’s jobs and growth.

As The AFR’s Michael Read noted on Monday, the NDIS “was originally forecast by the Productivity Commission to cost $22 billion” but has already ballooned to $49 billion and could top $100 billion within a decade, exceeding the cost of the aged pension.

This “once-in-a-generation rise in government spending” now “rivals the mining boom in terms of scale”, according to Read.

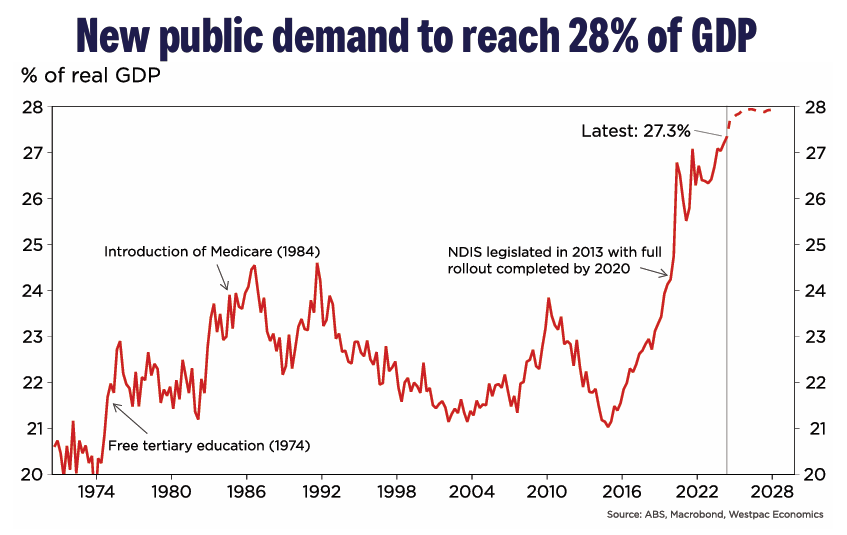

The NDIS has helped to drive public spending as a share of GDP to record highs, with further growth projected:

The NDIS has also spurred an unprecedented rise in government funded jobs, which have accounted for around three-quarters of job growth this year.

“The increase can be largely explained by a boom in healthcare employment courtesy of the NDIS”, noted Read.

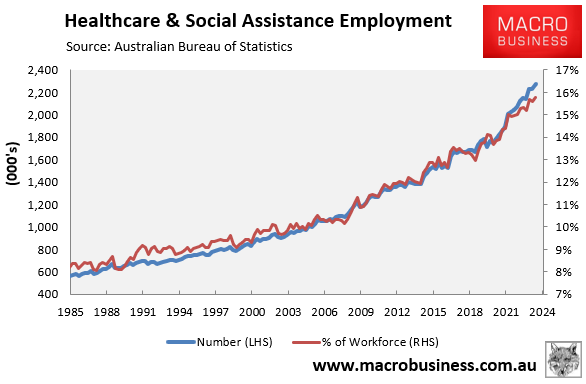

Indeed, the healthcare and social assistance industry now comprises nearly 16% Australia’s jobs, up from 12% a decade ago:

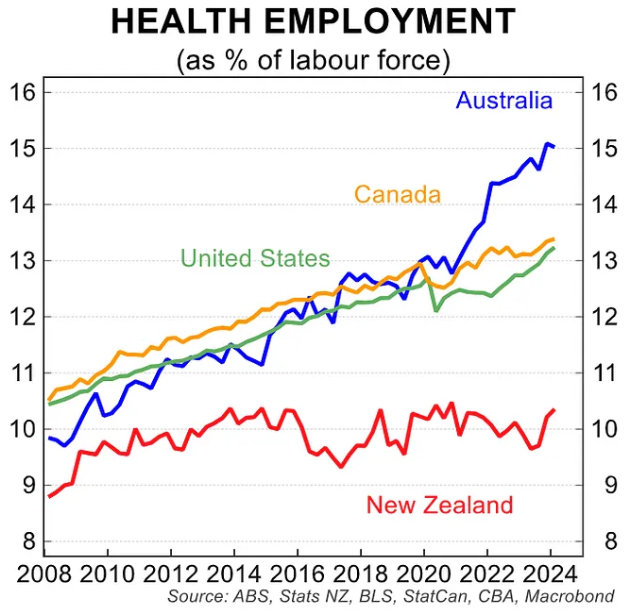

Australia’s increase in healthcare and social assistance jobs dwarfs other Anglosphere nations:

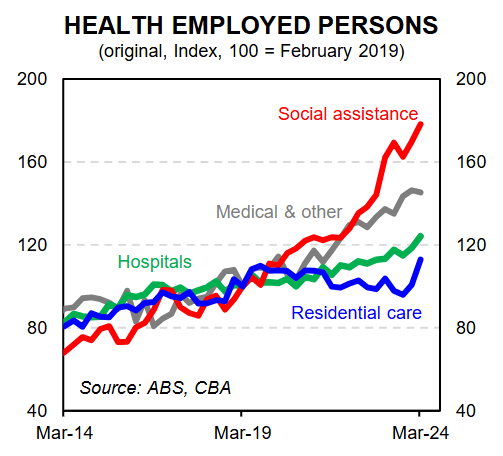

Australia’s increase has been driven overwhelmingly by social assistance roles, driven by the NDIS:

CBA economist Harry Ottley estimates that over the past five years, employment in the healthcare and social assistance surged by 36%, versus only 8% growth across all other industries.

“The increasing NDIS-aligned workforce likely goes most of the way to explaining the exceptional growth in this specific sub-industry”, explained Ottley.

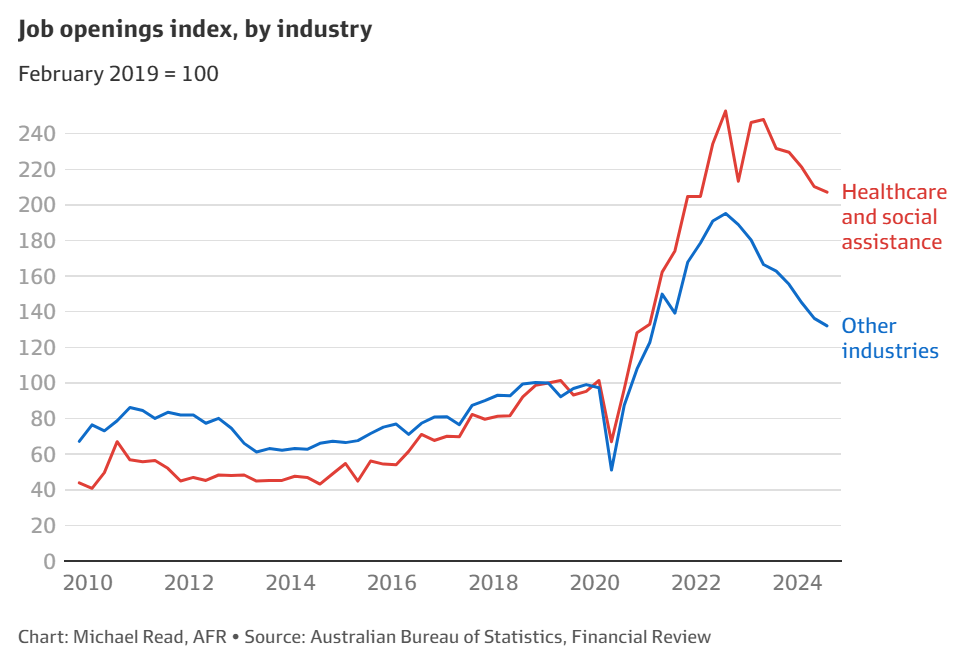

Michael Read notes that NDIS-related employment is not slowing down, with the number of job openings in healthcare and social assistance still more than double 2019 levels:

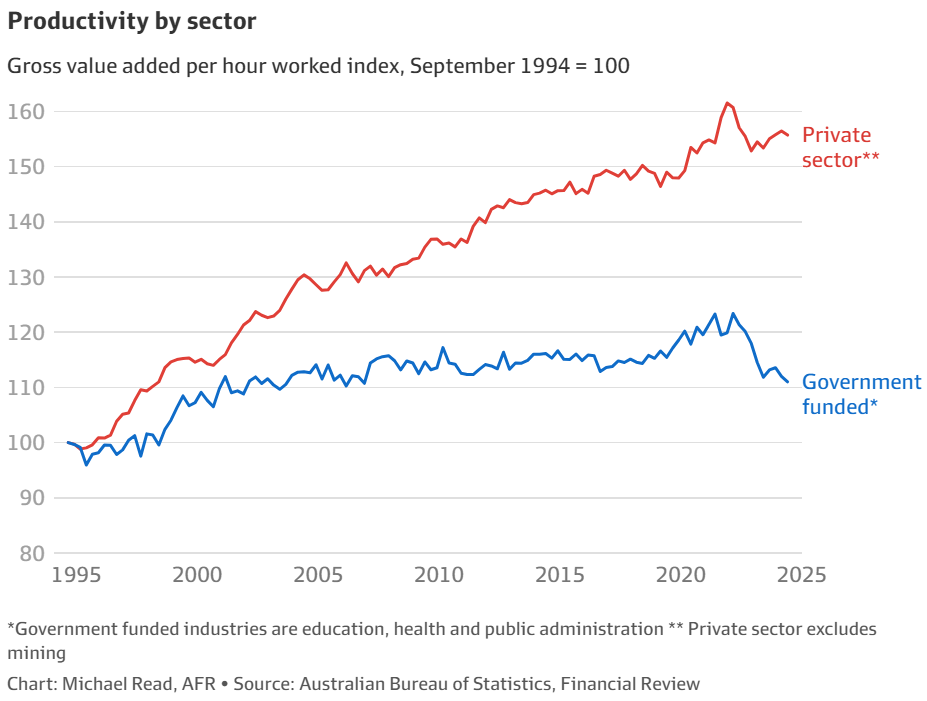

Meanwhile, the explosion in NDIS-related jobs spells doom for Australia’s productivity growth, with “labour productivity across government-funded industries to fall to an 18-year low in June”, according to Read:

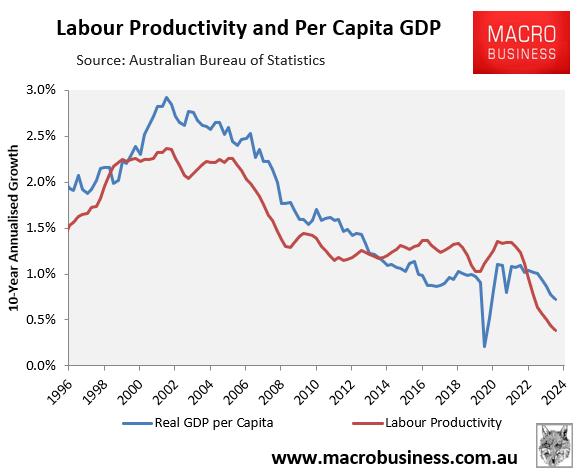

Given that productivity growth is the key determinant of per capita GDP growth, as illustrated below:

The surge in non-market jobs points to economic stagnation for Australia.

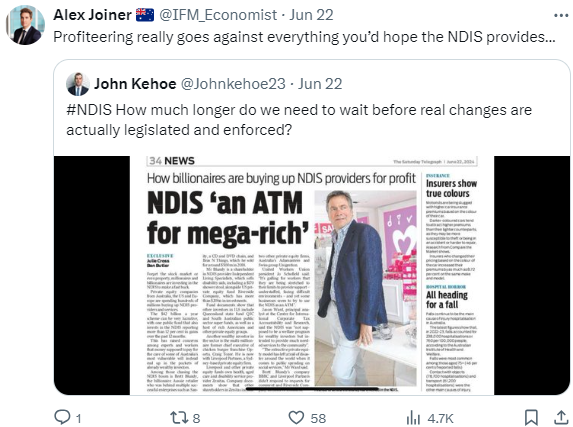

While everyone can agree that the disabled should be looked after, Australians should be concerned by the proliferation of private equity firms, billionaires, and organised criminals abusing the NDIS.

As noted by Michael Read, “for $90,000, you can buy an “established” NDIS business in Sydney that has no participants and was only set up last December, but claims to be registered to provide everything from personal training to disability housing”.

“This is a unique opportunity to acquire a well-positioned NDIS business with a wide range of service offerings”, the Facebook marketplace ad says.

Even worse, The Australian reported last month that there are currently around 170,000 NDIS providers, 150,000 of whom are operating without oversight. How has this been allowed to occur?

With a honeypot worth tens-of-billions of dollars annually, the NDIS was always going to attract large numbers of unscrupulous players seeking a quick buck.

In this regard, the NDIS was designed to fail from the beginning.

Every time the federal government has created a privatised market with a large pot of money on offer, there has been significant rorting, misuse, and waste.

We observed widespread exploitation of the private vocational education and training (VET) system, the pink batts scheme, and child care subsidies. The NDIS is just the latest example.

Put simply, the NDIS’s increasing costs and economic impacts cannot be ignored.

As more resources are directed towards the NDIS, the economy will become less dynamic and income-generating.

Strict regulation and oversight are desperately needed.