The National Disability Insurance Scheme (NDIS) has been growing in cost by 20% and now costs nearly $50 billion a year.

Recent projections from the Parliamentary Budget Office (PBO) suggested that the cost of the NDIS could blow-out to around $100 billion per year within a decade, exceeding the the aged pension.

One of the most shocking statistics surrounding the NDIS was uncovered by The Australian last month, which reported that of around 170,000 NDIS providers, 154,000 operate without regulatory oversight.

The Australian reported that outgoing NDIS minister Bill Shorten “will start forcing the 150,000 NDIS providers operating without oversight to become registered”.

“Shorten will begin the process of mandatory registration from next month for all of the 170,000 providers operating within the $40 billion-a-year disability scheme”.

“Only about 16,000 providers in the NDIS are currently registered, leaving the NDIS Commission with limited oversight of the practices of the other 154,000, who have no mandatory reporting obligations”, the report noted.

Over the weekend, Reg Vitnell, the director of support provider Australian Carers, described the NDIS as “the Wild West” amid revelations that providers are touting free interstate getaways and charging companies up to $3000 for lucrative referrals of disabled clients.

“They sell them off like it’s a cattle sale”, Vitnell said. “This is the Wild West”.

The SMH also reported last week that the NDIS spent millions of dollars sending participants on African safaris, international cruises, and other overseas holidays.

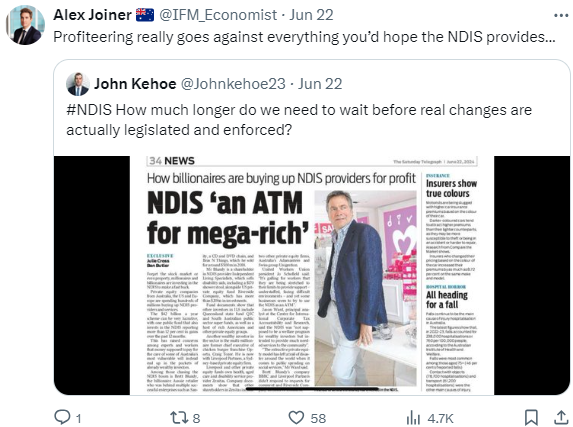

There has also been a proliferation of private equity firms, billionaires, and organised criminals profiting from the NDIS.

As noted by Michael Read recently, “for $90,000, you can buy an “established” NDIS business in Sydney that has no participants and was only set up last December, but claims to be registered to provide everything from personal training to disability housing”.

“This is a unique opportunity to acquire a well-positioned NDIS business with a wide range of service offerings”, the Facebook marketplace ad read.

With a honeypot worth tens of billions of dollars each year, the NDIS was bound to draw significant numbers of unscrupulous players seeking a quick buck.

In this aspect, the NDIS was designed to fail from the start.

Every time the federal government has established a privatised market with a huge pot of money on offer, we have witnessed significant rorting and waste.

We saw extensive rorting of the private vocational education and training (VET) system, the pink batts program, and child care subsidies. The NDIS is simply the latest and greatest example.

Stricter regulation and oversight of the NDIS are clearly needed.