The Australian’s James Kirby has published a fearmongering report claiming that cuts to incentives for property investors that the former government introduced three years ago have given New Zealand the mantle of the world’s worst rental market:

“After the NZ government cut tax incentives for property investors three years ago, the volume of investment funds entering the residential market halved. And as the supply of rental property evaporated, rental prices soared”, Kirby wrote.

“Treasury in Canberra is now assessing the same tax territory”…

“As Ray White group chief economist Nerida Conisbee: “The current tax incentives ensure we have enough rental housing, if you cut those incentives you only have to look at New Zealand to see what may happen – New Zealand is now the least affordable rental market in the world’’

New Zealand ring-fenced negative gearing losses in 2019 (similar to what the Australian Labor Party proposed in 2019).

In 2021, the government extended the term of the Bright Line Test for taxing capital gains on housing and fully removed the tax deductibility of mortgage interest payments on residential investment properties.

Investors were still allowed to claim the interest deduction if the property is a new build.

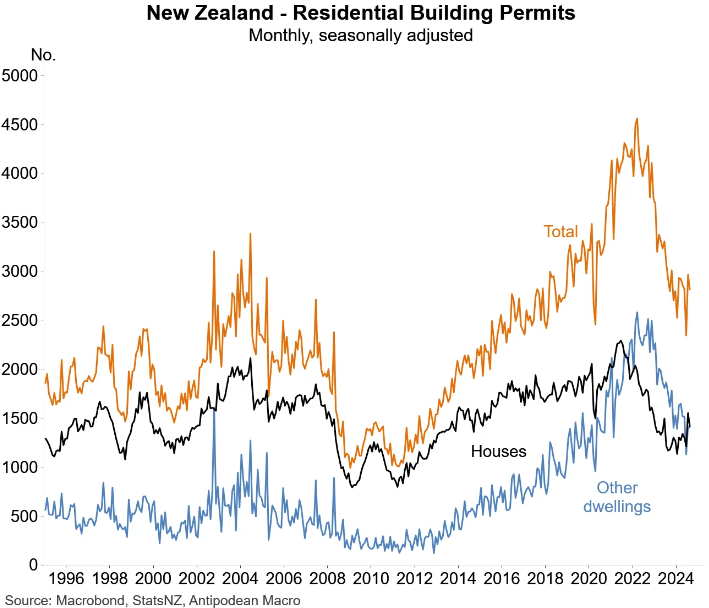

If James Kirby had actually bothered to do his own research on the matter, he would have discovered that housing construction boomed in New Zealand following the abolition of negative gearing in 2019:

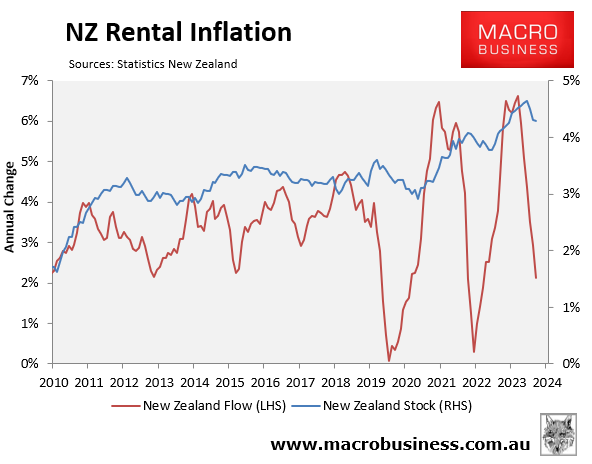

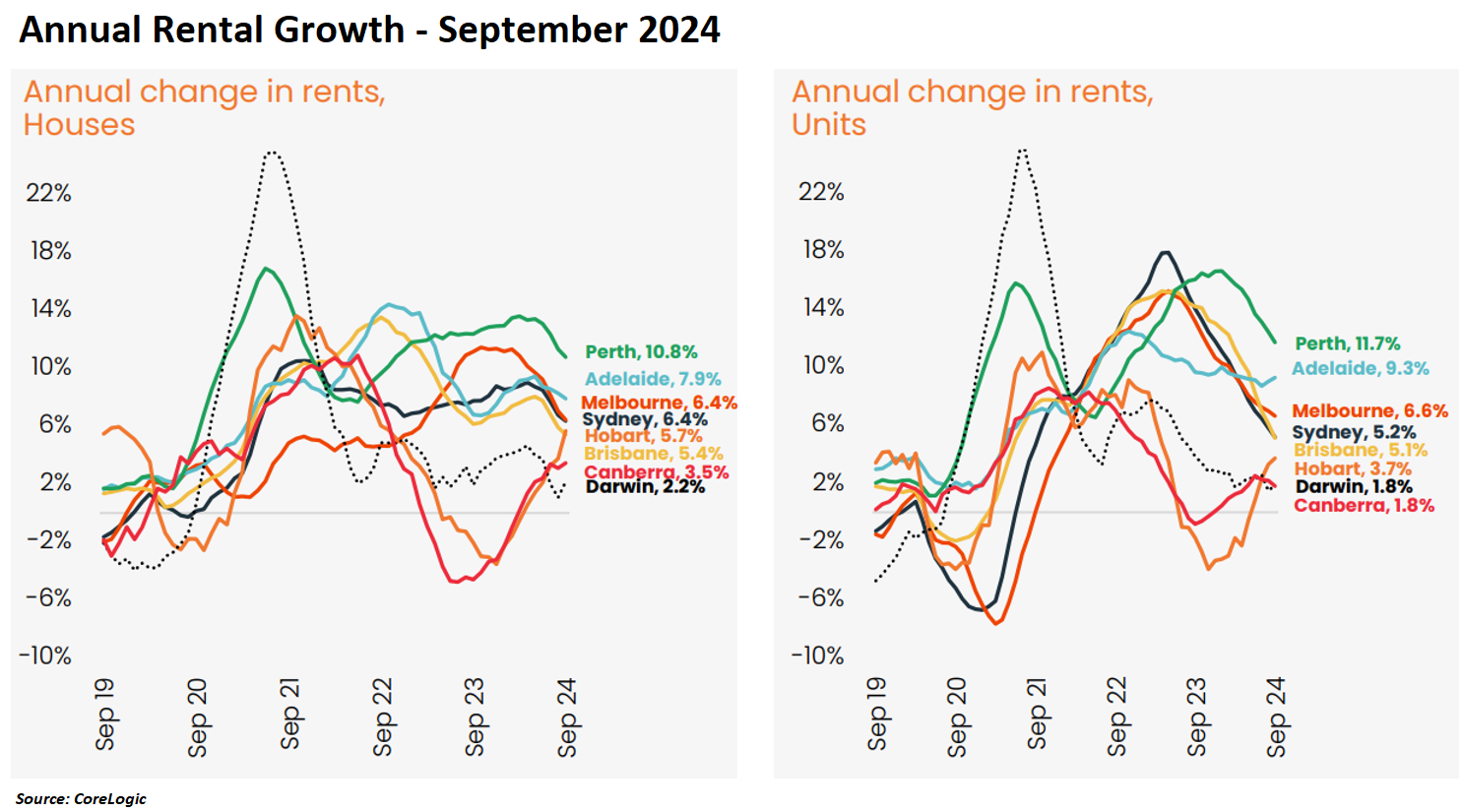

New Zealand rental inflation has also been nothing special and certainly less than Australia’s:

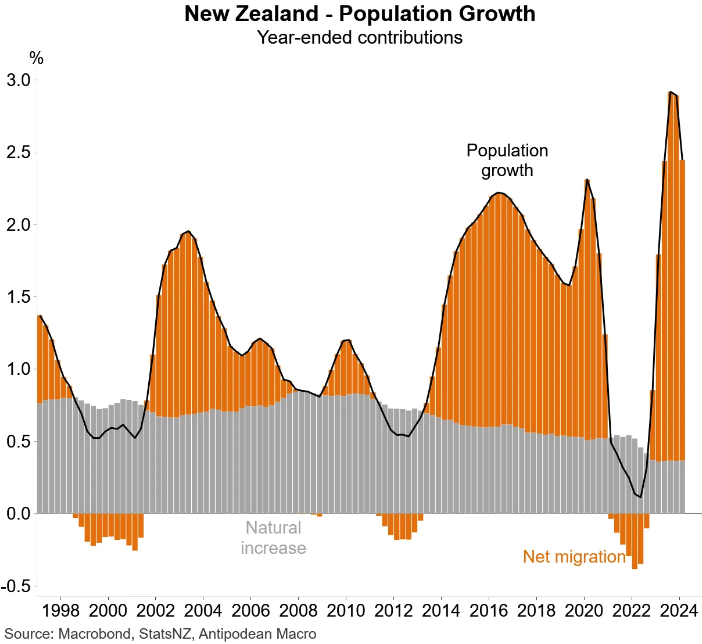

In any case, the surge in population growth (read: net overseas migration) was what caused the rise in rental inflation.

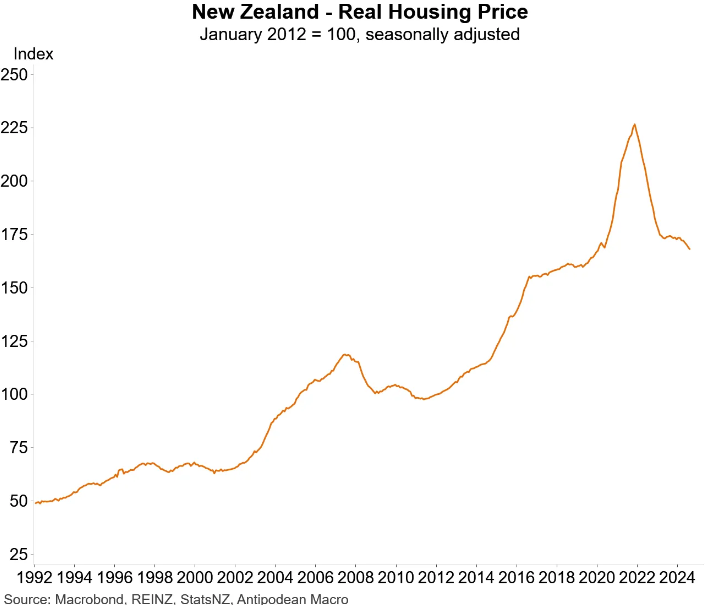

Meanwhile, the changes to property investor taxation has helped lower New Zealand house prices back to pre-pandemic levels in real terms:

Therefore, New Zealand has become more affordable to purchase for first home buyers.

James Kirby also claimed that “Victoria is a test case of what happens when investors face tax changes – a recent string of new state-based property taxes has triggered an investor exodus from the state prompting Kelly Ryan of the Real Estate Institute of Victoria to suggest “investors are leaving the Victorian market right now like nothing we have ever seen before”.

“Ironically, investors are leaving Melbourne even when the city has a vacancy rate of less than 2%”.

“Like it or not, the rental market is run by investors who depend on the current tax regime. If the terms change, then investor behaviour changes quickly, as Victoria is finding out the hard way”, Kirby said.

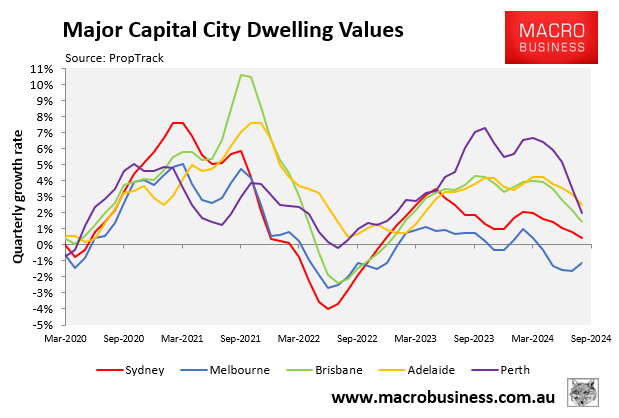

The investor tax changes in Victoria has undoubtedly lowered home prices and made housing more affordable to purchase for first home buyers:

Melbourne’s rental inflation has also tracked alongside the other capitals, despite experiencing the nation’s largest population increase:

James Kirby tried to find two smoking guns against reforming negative gearing and failed on both counts.