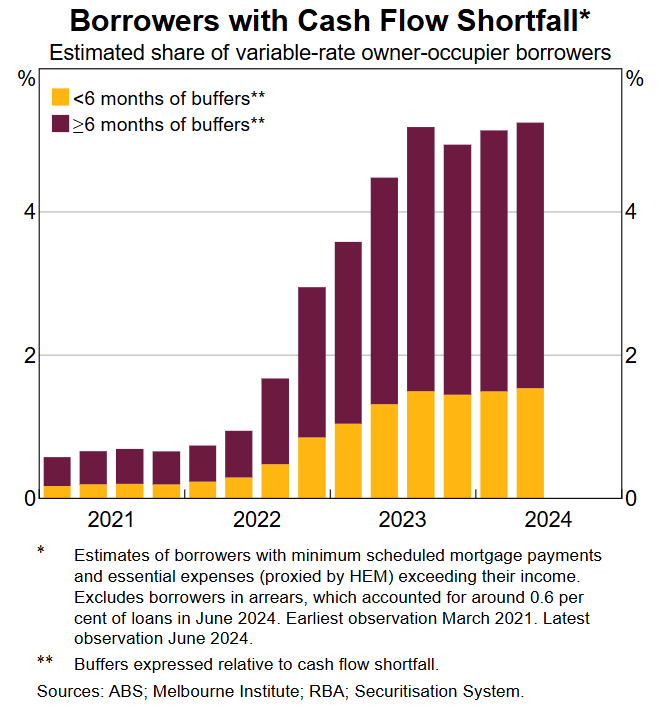

The Reserve Bank of Australia (RBA) released its half-yearly Financial Stability Review (FSR), which noted that around one-in-20 Australian borrowers have a cashflow shortfall:

“In addition to cutting back their spending to mostly essential items and trading down in quality for some goods and services, these households have had to make other difficult adjustments to continue servicing their mortgages”, the FSR notes.

“These include drawing down on liquid savings, selling assets and working additional hours. Lower income borrowers are more likely to be in this group”.

The RBA also notes that around one-in-50 borrowers are at serious risk of default because they have both a cash flow shortfall and low buffers.

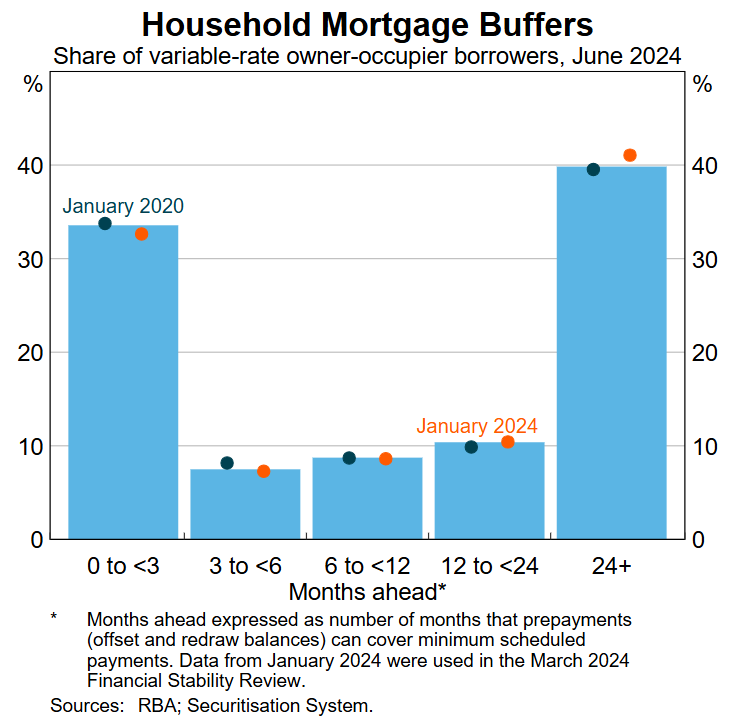

The FSR shows that after surging during the pandemic period of low interest rates, savings buffers have returned to pre-pandemic levels for most borrowers:

“The share of variable-rate owner-occupier borrowers persistently drawing down on their offset and redraw balances is higher than before the pandemic”, the FSR notes.

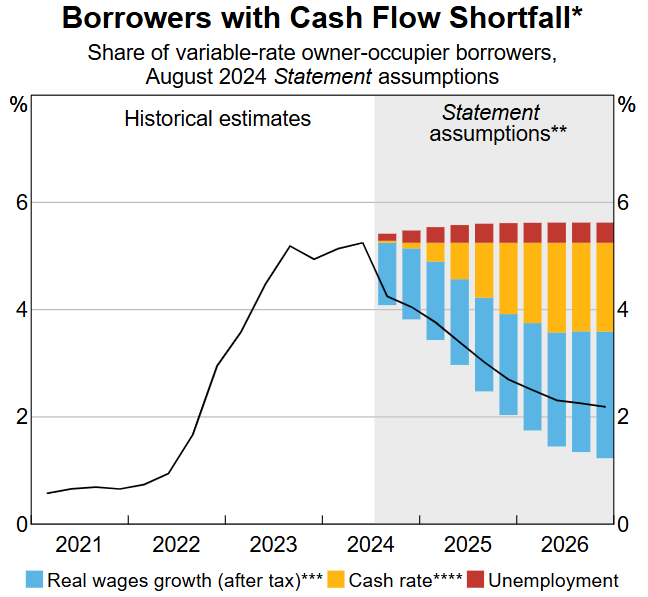

The good news is that the RBA believes that “budget pressures on households should start to ease in the second half of 2024” as the cashflow boost from the Stage 3 tax cuts takes effect. This will be augmented by lower interest costs in response to future reductions in the official cash rate.

“If overall budget pressures do in fact ease in line with these forecasts and assumptions, the share of borrowers with an estimated cash flow shortfall is projected to decline by a couple of percentage points by 2026”, the FSR notes:

The biggest risk to these assumptions is a much larger than expected rise in unemployment, which would increase financial stress among borrowers carrying large debts.

“Borrowers who experience job loss or reduced hours typically see substantial declines in their income, and as such are at risk of falling behind on their loans”, the FSR notes.

However, the RBA notes that “few borrowers would be at risk of default” even if the unemployment rate rose by 2%.