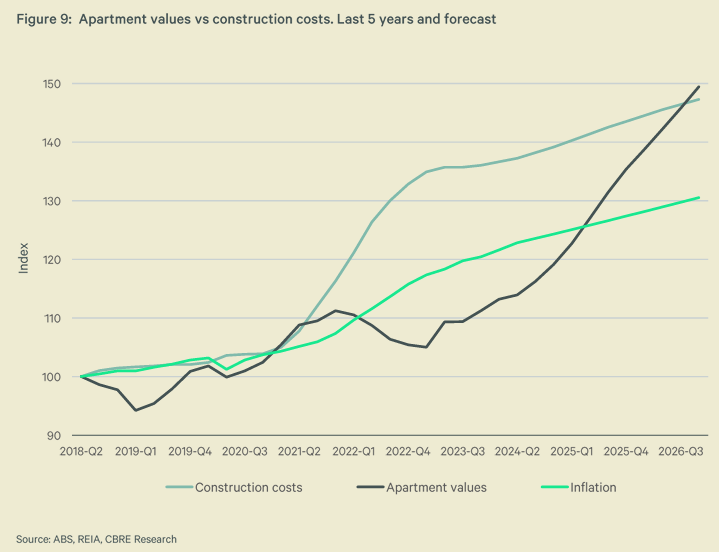

Sameer Chopra from CBRE says apartment prices in Australia have not kept pace with construction costs over the last five years.

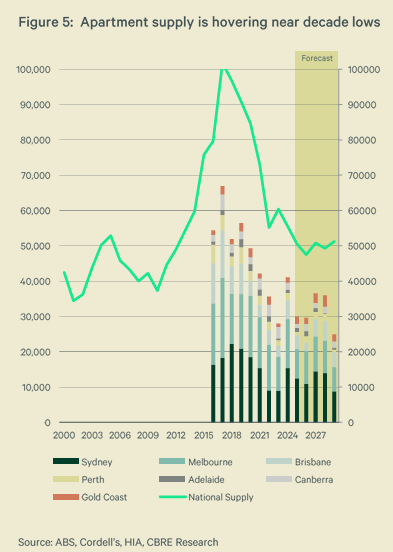

CBRE forecasts that Australian apartment supply will only average around 50,000 units annually between 2025 and 2029. This is around half the 2017 peak and well below the rate required, given population growth.

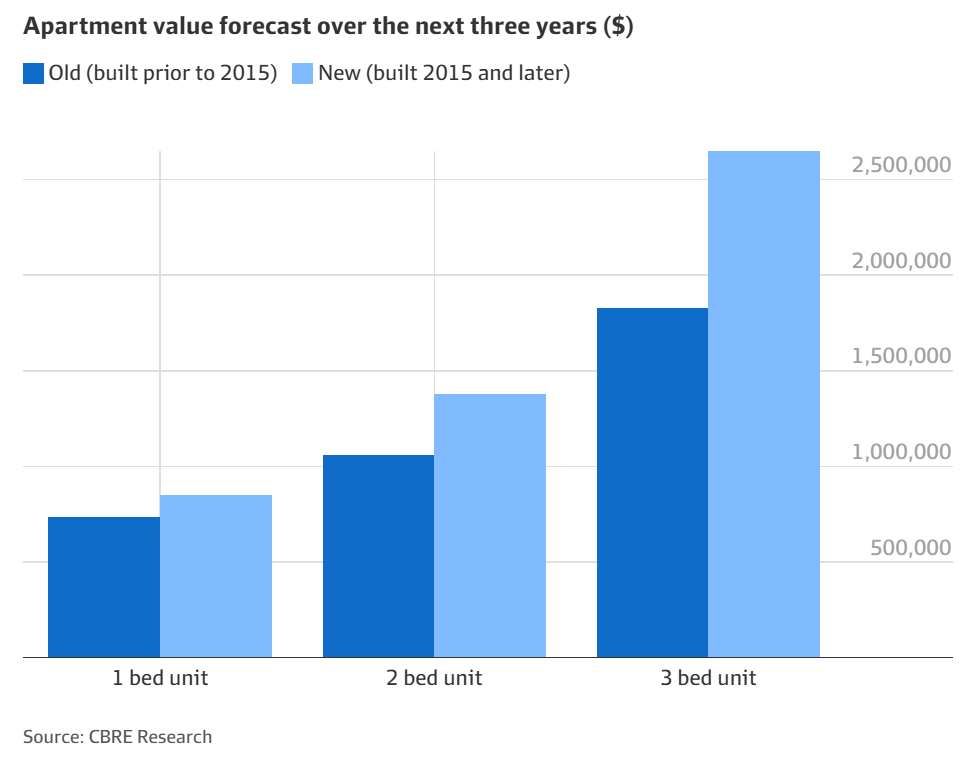

Chopra added that factors such as falling interest rates and a limited supply of new apartments coming onto the market could see their price premium over established apartments widen over the next several years.

“Apartment values have not kept pace with construction costs in the past five years”, he said.

“That disparity is currently at 23%. We expect this gap to close out and revert to a premium”.

“Construction costs for residential have increased by 32% over June 2020 to June 2024, well in excess of the growth in inflation”.

“Tight labour markets… may keep upward pressure on the cost to build new supply”.

“In our view, apartment values will need to accelerate significantly higher to entice developers. This will only occur once interest rates drop”, Chopra said.

Chopra added that newly built one-bedroom apartments generally trade at a 16% premium over older stock, whereas two-bedroom apartments command a 30% premium and three-bedroom apartments a 45% premium compared to older stock.

CBRE also forecast that median apartment rents would rise another 25% over the coming five years, easily beating CPI inflation.

The further decline in Australia’s capital city’s vacancy rate to 1.2% by 2029 from 1.9% in 2024 will be the primary factor driving this increase in rent.

Property developer Tim Gurner agreed with Chopra’s analysis, forecasting a “perfect storm” for the apartment sector that will drive prices higher.

He added that in retrospect, people will regard the present time as the best opportunity to buy into the market in the last 10 to 20 years.

“It is coming, whether it’s in the next 12, 18 or 24 months, I’m certain that it’s coming and that it’s going to be even bigger than people are expecting”, Gurner said.

“We’ve never seen such a critical undersupply of housing in this country, and when you combine that with record demand fuelled by population growth then you’ve got a perfect storm”.

“People will look back at this time right now as the best moment to buy in 10 to 20 years. The market is depressed due to negativity, but that will turn, and it will turn fast”, he said.

Clearly, those hoping that apartment construction will alleviate Australia’s rental crisis will be disappointed, with both prices and rents set to climb further.

There is only one genuine solution to Australia’s rental crisis: significantly cutting net overseas migration to a level below the nation’s capacity to build housing and infrastructure.

However, as shown above, the federal government has targeted permanently high levels of net overseas migration, which means the housing crisis will worsen.