CBA’s non-consensus call predicting that the Reserve Bank of Australia (RBA) will cut rates before Christmas is looking prescient following the latest inflation data from the Melbourne Institute.

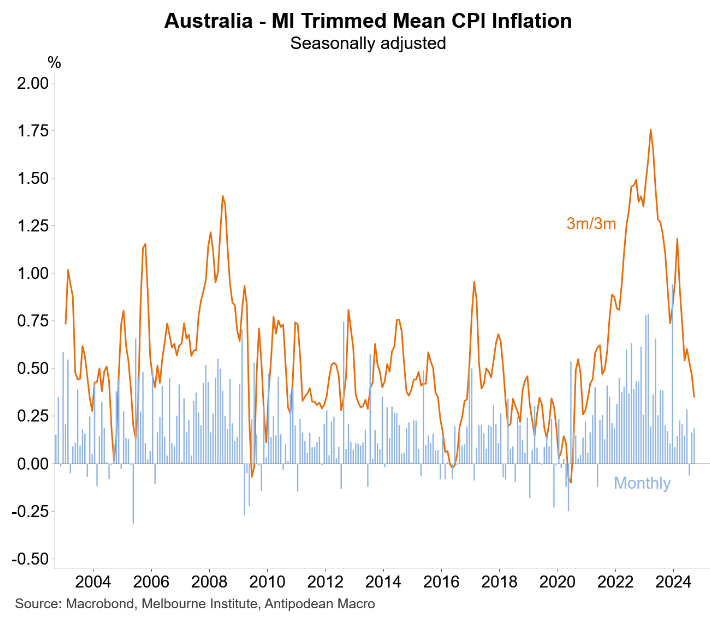

As illustrated by the following chart from Justin Fabo at Antipodean Macro, the Melbourne Institute’s monthly trimmed mean inflation gauge for Australia slowed sharply in the September quarter:

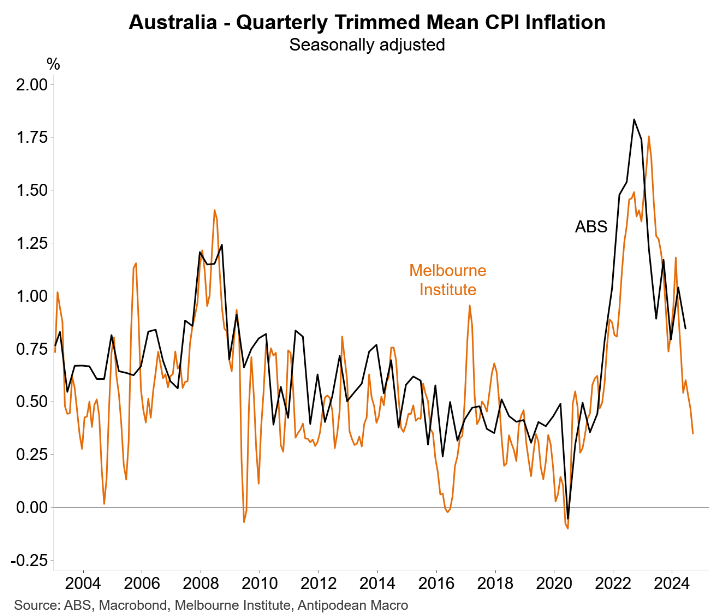

According to Fabo, “the MI measure has diverged significantly from official trimmed mean inflation in the past, but the RBA will welcome the recent trend”:

Fabo also notes that the “MI measure of trimmed mean inflation has, on average, been lower than the official ABS measure”.

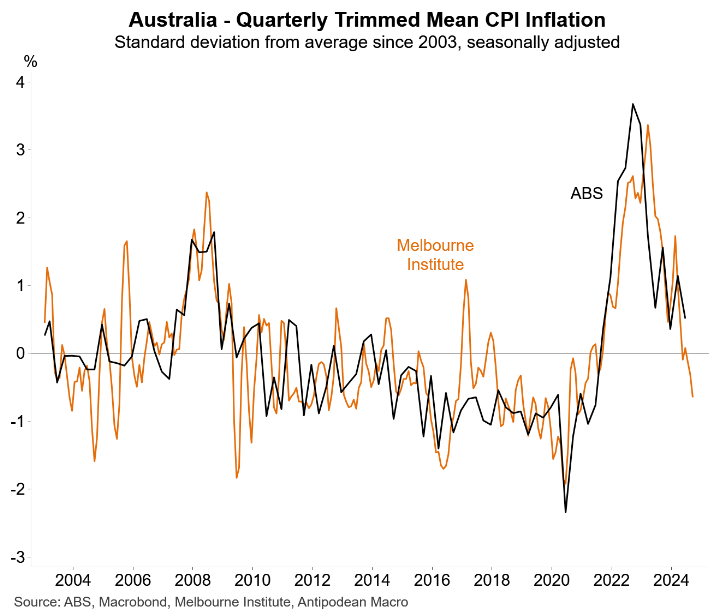

Therefore, Fabo has standardised the two series below for a better comparison, which reveals the same conclusion—that inflation has fallen sharply:

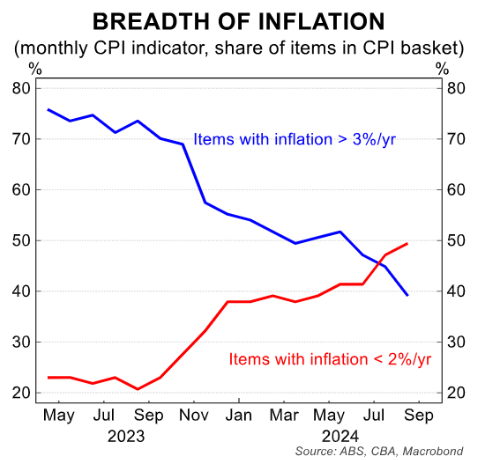

The August monthly CPI indicator from the ABS showed that the number of items with annual price rises above 3% continued to fall while the number of items with annual price changes below 2% continued to rise:

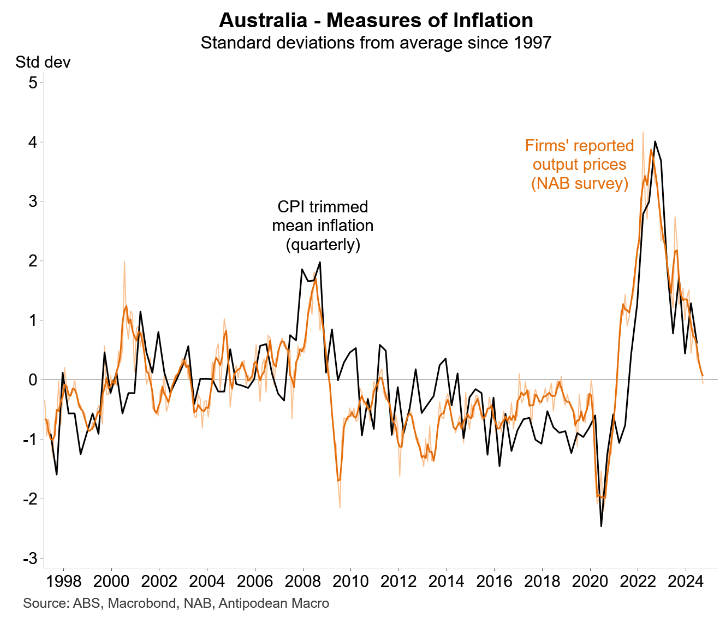

Surveyed price measures have also moderated. The PMIs’ measure of output price growth eased to its slowest level since December 2020, whereas the NAB Business Survey’s measurement of output prices has fallen to early 2021 levels, pointing to a further decline in underlying inflation:

CBA forecasts that trimmed mean inflation will moderate to 0.7% in the September quarter, representing an undershoot relative to the RBA’s forecast.

If this forecast comes to fruition, then inflation would be within the RBA’s target range.

This would place the RBA in an awkward position, given that it was overly hawkish at its September meeting and strongly suggested that rates won’t be cut this year.

The Albanese government desperately needs the RBA to cut rates before the federal election, which is due by May 2025.

Therefore, if underlying inflation falls within the 2% to 3% target in Q3, expect the government to dial up pressure on the RBA to cut rates.