The Reserve Bank of Australia (RBA) has published a research paper examining the claim that high interest rates are partly to blame for the rental crisis.

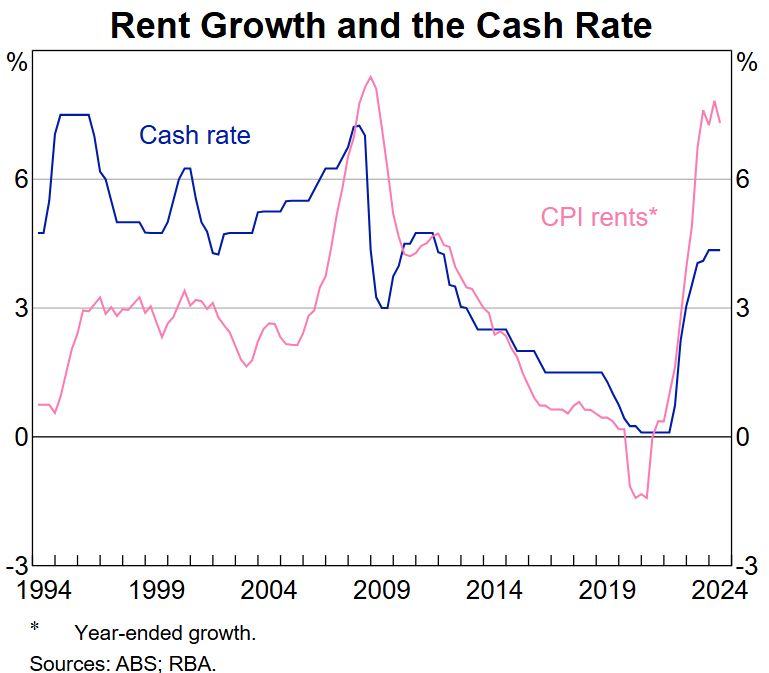

This claim has come about because interest rates and rents often move together, suggesting that leveraged housing investors are passing through increases in their interest costs to their tenants:

The RBA’s modelling shows that correlation does not equal causation, with only a “small pass-through on average, even when interest rates are rising”.

“The largest estimate suggests that direct pass-through results in rents increasing by $25 per month when interest payments increase by $850 per month (the median monthly increase in interest payments for leveraged investors between April 2022 and January 2024)”, the RBA paper found.

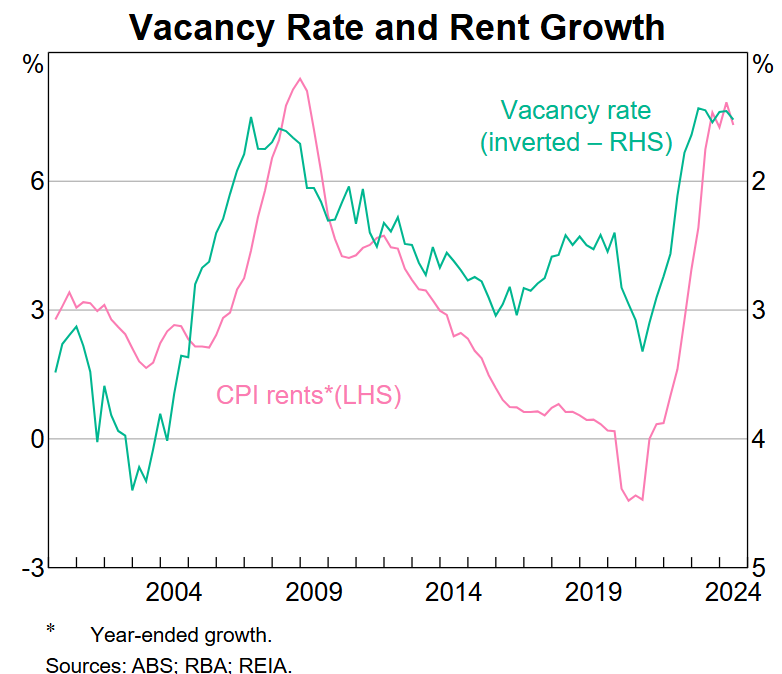

Instead, the RBA believes that “the level of housing demand relative to the housing stock is the key driver of rents”, which is reflected by the vacancy rate:

“Housing demand has been strong, supported by high population growth and increased preference for more space, while supply has been hampered by ongoing capacity constraints and increases in construction costs”, the RBA concluded.

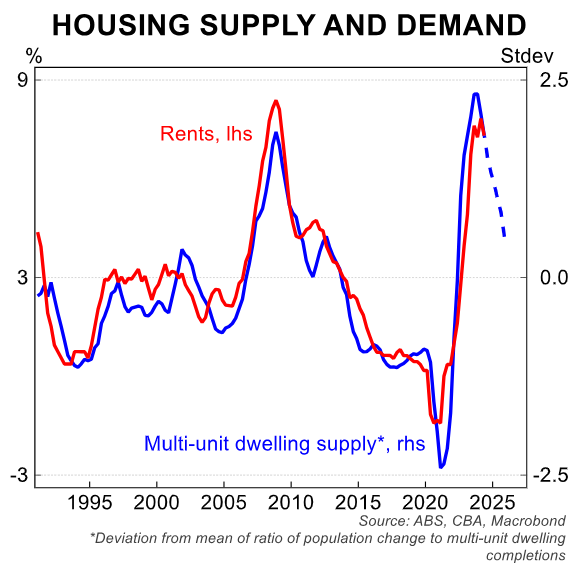

CBA has come to the same conclusion, producing the following chart illustrating how rental growth is highly correlated to the ratio of population growth to new apartment construction:

Australia has imported around one million net migrants over the past two years who all needed somewhere to live. As a result, the vacancy rate collapsed and rents soared.

Similar happened during the 2008-09 immigration surge, which broke records at the time.

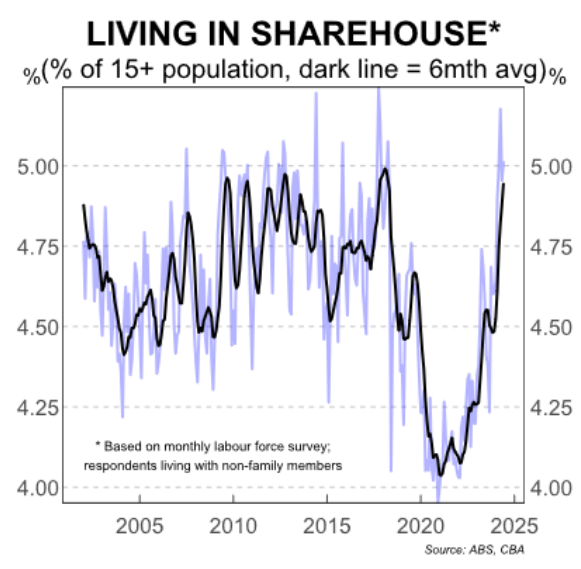

The good news is that pressures on the rental market are easing.

Households are economising on housing costs by moving into shared housing, which is reducing rental demand:

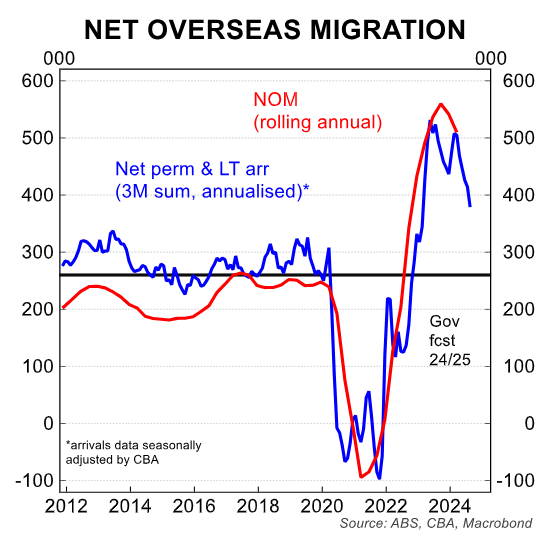

More importantly, net overseas migration has eased from last year’s peak, which is further alleviating rental demand:

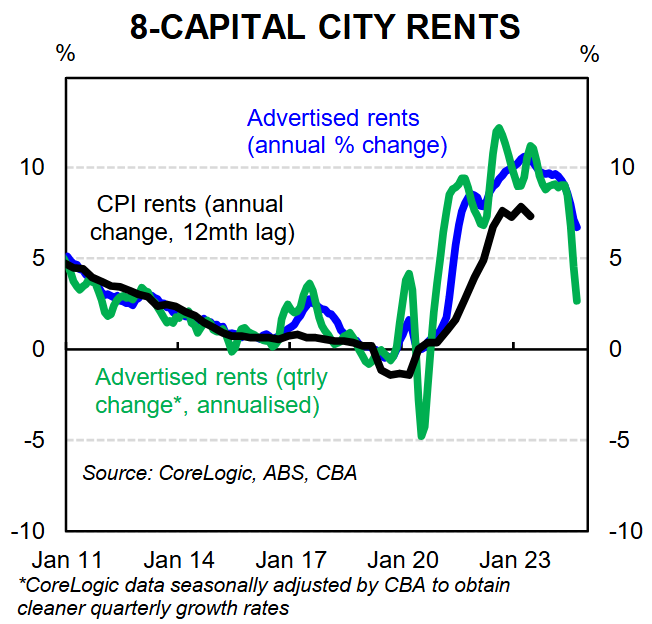

The upshot is that the growth in asking rents has moderated significantly from last year’s highs but remains structurally higher in actual dollar terms:

Thanks to an easing of demand, Australia’s rental crisis is no longer worsening.