At its September monetary policy meeting, the RBA suggested that the official cash rate would remain on hold for the foreseeable future.

The RBA statement noted that the underlying inflation rate of 3.9% over the year to the June quarter “is still some way above the midpoint of the 2%–3% target range”.

It also noted that its “current forecasts do not see inflation returning sustainably to target until 2026. In year-ended terms, underlying inflation has been above the midpoint of the target for 11 consecutive quarters and has fallen very little over the past year”.

“Underlying inflation is more indicative of inflation momentum, and it remains too high”, the RBA said.

As a result, “policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range”.

In her media conference following the decision, governor Michele Bullock also suggested that the cash rate would remain on hold for the foreseeable future.

“The recent data, I think you’d agree, have been a little mixed, but overall, they reinforce the need to maintain a restrictive monetary policy stance and remain vigilant to the upside risks to inflation”, Bullock said.

“The board needs to be confident that inflation is moving sustainably towards the target before any decisions are made about a reduction in interest rates”.

Bullock also stated that while the worst of the inflation problem is over, there is still a long way to go [my emphasis].

“Inflation has come down a long way since it peaked in 2022—both in Australia and overseas”, she said.

“But inflation is still above our target, and it’s proving to be sticky. Progress in getting underlying inflation down has slowed, and it’s likely to have remained slow in the September quarter“.

A literal reading of the above comments from the RBA suggests that interest rates remain on hold until next year.

However, as CBA’s Gareth Aird reports below, the RBA Minutes released on Tuesday seem to indicate that the RBA has made a dovish pivot, opening the door for potential rate cuts this year.

Key Points:

- The September Board Minutes officially removed the RBA’s forward guidance from the August Minutes that, ‘it was unlikely that the cash rate target would be reduced in the short term’.

- The September Minutes outline scenarios that could see monetary policy either tightened or loosened.

- We expect Q3 24 underlying inflation to come in below the RBA’s expectations. And we forecast household consumption growth to be weaker than the RBA anticipates over the same period.

- As such, we continue to expect the RBA will commence normalising the cash rate in December 2024 with a 25bp interest rate cut.

- We look for 125bp of RBA easing by end 2025 that would take the cash rate to 3.10%.

September RBA Board Minutes omit the RBA’s recent forward guidance:

The September Board Minutes are a lot less hawkish than the August Minutes. Expressed another way, the Minutes today have made a dovish tilt to the RBA’s communication strategy on the outlook for monetary policy.

The final paragraph in the August Board Minutes stated that, “based on the information available at the time of the meeting, it was unlikely that the cash rate target would be reduced in the short term, and that it was not possible to either rule in or rule out future changes in the cash rate target.’”

The final paragraph in Tuesday’s Minutes only noted that, “it was not possible to either rule in or rule out future changes in the cash rate target at this time.”

Put simply, the September Board Minutes have removed the line that, “it was unlikely that the cash rate target would be reduced in the short term.”

We view this change as significant. The Board has now back-pedalled from its forward guidance. We consider this prudent given the RBA is data dependent and it appears increasingly likely than not that the Q3 24 trimmed mean CPI will come in below the RBA’s forecast.

In addition, it also looks to us like household consumption growth will not rebound in Q3 24 as strongly as implied in the RBA’s central scenario.

Overall, the Minutes read like a script from the archetypal two-handed economist.

On the one hand, “members observed that monetary policy could need to be tightened, even if the Board’s judgements about consumption, the labour market and supply potential prove correct, should present financial conditions turn out to be insufficiently restrictive to return inflation to targe”.

But on the other hand, “members observed that there were scenarios in which future financial conditions might need to be less restrictive than they were at present”.

The Minutes considered two scenarios that would justify financial conditions needing to be less restrictive than currently:

(i) if the economy proved to be significantly weaker than expected and this placed more downward pressure on underlying inflation than expected (due to higher household savings and/or if the labour market weakened more sharply than forecast); or

(ii) if inflation proved less persistent than assumed, even without weaker-than-expected activity.

We believe the introduction of these two scenarios that would justify less restrictive financial conditions provide an insight into the Board’s reaction function that could see the RBA commence an easing cycle this calendar year (in line with our base case).

It is important to note that if either of these scenarios came to fruition it could be sufficient for the RBA to begin the process of normalising the cash rate. But clearly if both of these scenarios played out that would bolster the case for the Board to start cutting rates.

Importantly, the implicit message from these scenarios is that a further loosening in the labour market is not a necessary pre-condition for the RBA to cut rates, provided inflation continues to fall and/or the economy proved significantly weaker than expected (thus putting more downward pressure on inflation).

On that score, our base case sees inflation less persistent than the RBA assumes. And we also expect GDP growth in Q3 24 to be below the RBA’s expectations (primarily due to a smaller lift in household consumption than the RBA has forecast).

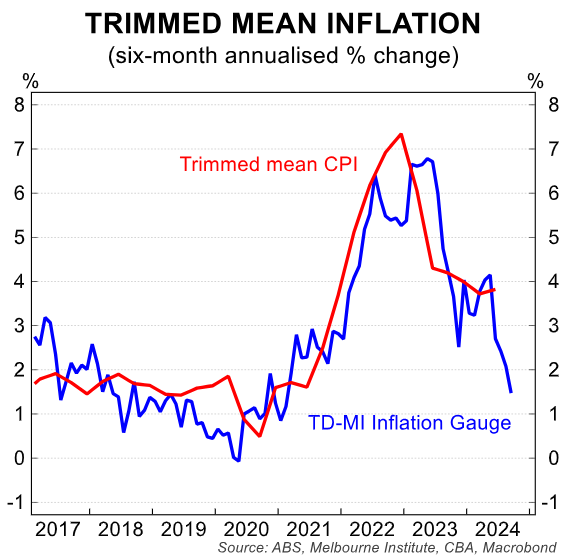

On inflation specifically, we feel increasingly confident that the Q3 24 trimmed mean CPI will print below the RBA’s forecast (CBA forecast Q3 24 trimmed mean CPI 0.7%/qtr vs the RBA at 0.8%/qtr).

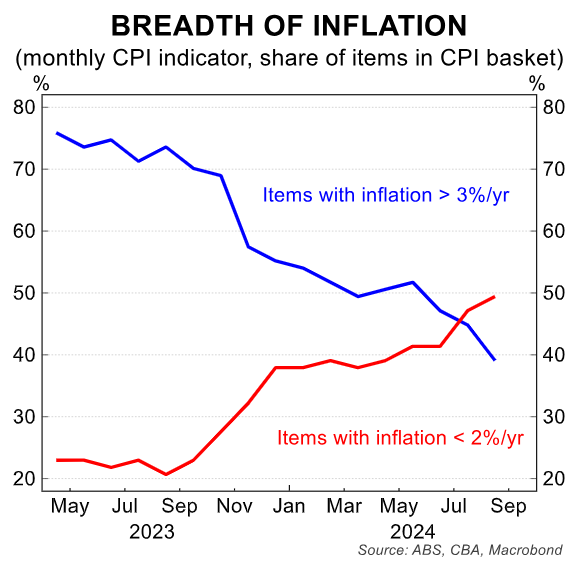

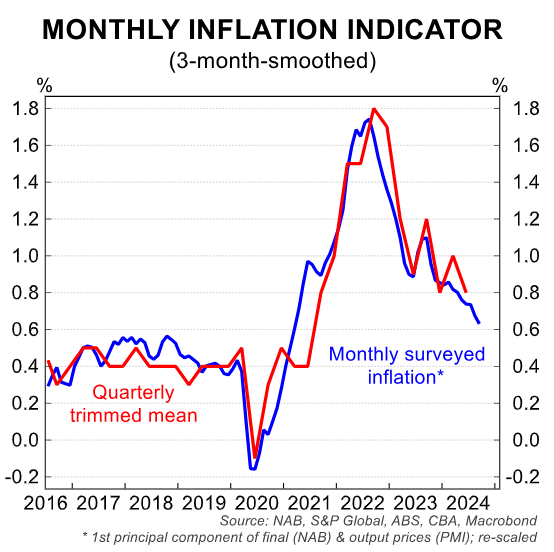

The August monthly CPI indicator coupled with some key private surveys over the September quarter have all been particularly encouraging for the pulse of core inflation in Q3 24.

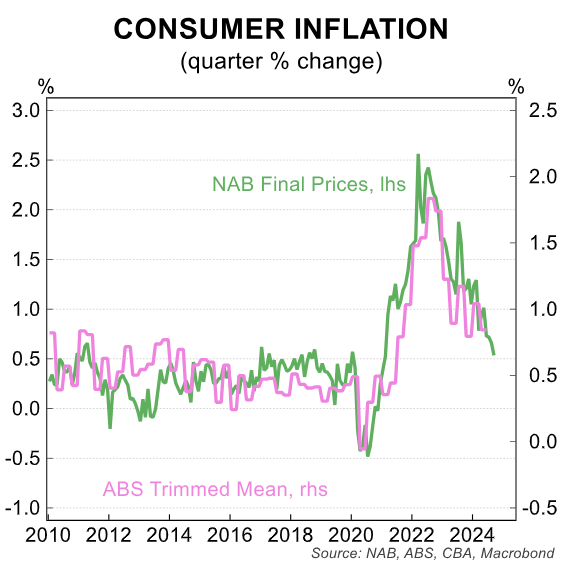

Indeed final prices in the September NAB Business Survey, released on Tuesday, grew at their slowest pace since February 2021.

The key releases ahead of the RBA November Board meeting are the September labour force survey (17/10), retail trade (31/10) and the all-important Q3 24 CPI (30/10).

An undershoot on the Q3 24 trimmed mean CPI compared to the RBA’s forecasts will allow the Board to further evolve its communication strategy (it could move to an explicit easing bias in November or a particularly dovish ‘on-hold’ decision).

We expect the combination of a weaker set of national accounts than the RBA expects coupled with a trimmed mean CPI undershoot will see the RBA cut the cash rate by 25bp at the December Board meeting.

And we continue to look for 125bp of RBA easing by end 2025 that would take the cash rate to 3.10%.