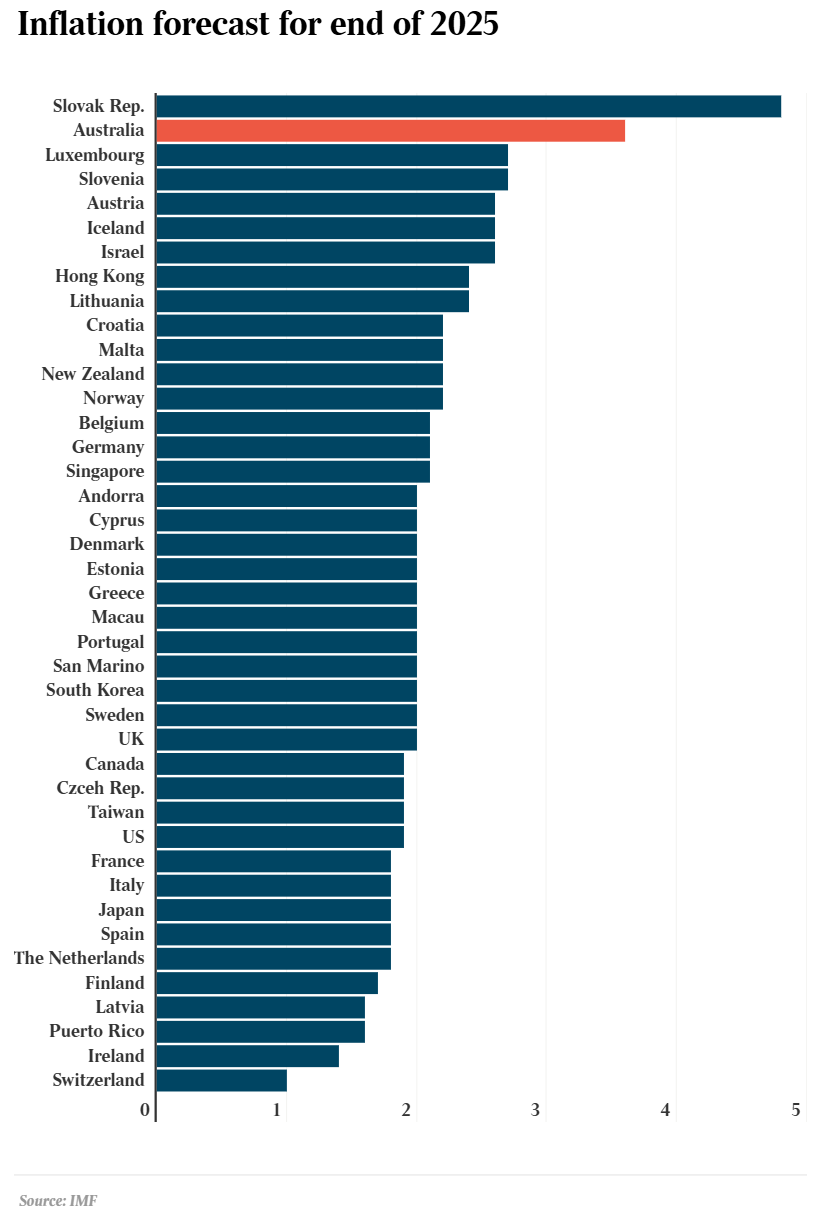

The International Monetary Fund’s (IMF) latest World Economic Outlook report forecasts that Australia and Slovakia will be the only two advanced economies with headline inflation above 3% by the end of 2025.

The IMF expects Australia’s inflation rate to rise to 3.6% by December 2025 as federal and state government cost-of-living relief is wound back. The IMF had previously forecast in April that Australia’s inflation rate would fall to 2.8% in 2025.

While some economists do not expect the Reserve Bank of Australia (RBA) to begin reducing the cash rate until the second half of 2025, the IMF forecasts that other central banks will aggressively ease monetary policy.

The IMF World Economic Outlook said that disinflation had continued “broadly as expected but did show signs of slowing in the first half of the year, suggesting potential bumps on the road to price stability”.

“Further disruptions to the disinflation process, potentially triggered by new spikes in commodity prices amid persistent geopolitical tensions, could prevent central banks from easing monetary policy, which would pose significant challenges to fiscal policy and financial stability”, the report said.

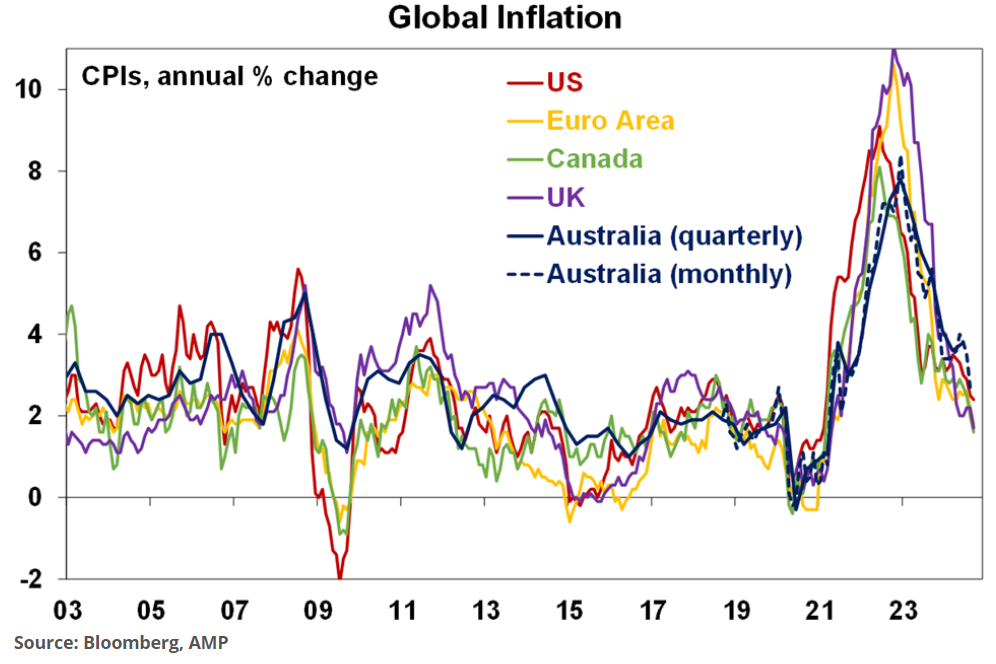

The IMF’s inflation forecast for Australia are odd given that Australia has followed a similar, albeit lagged inflation path to other nations:

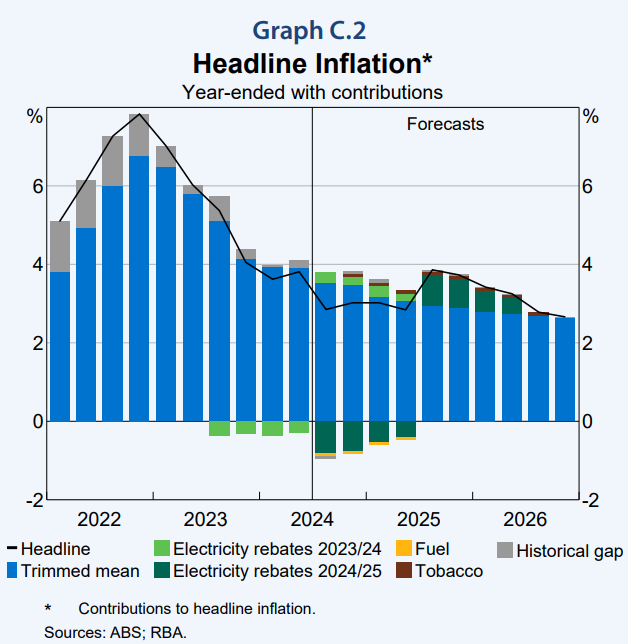

The IMF has also assumed that the energy rebates will not be extended, which seems highly unlikely given that we are headed into an election year.

NSW’s toll road rebates were also supposed to be temporary but have been extended again and again. The same will likely happen with the federal government’s energy rebates.

Moreover, the rebate’s lowering of headline CPI will also spill over into underlying inflation via lower growth in administered (indexed) prices, such as alcohol and tobacco excise, aged pension and JobSeeker payments, minimum wage decisions, etc.

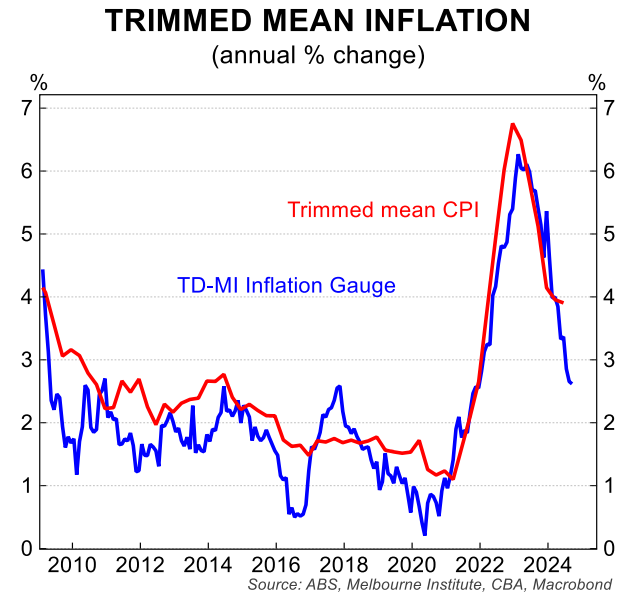

The reality of the situation is that Australia’s inflation pressures are easing.

The Melbourne Institute Inflation Gauge serves as an example of this:

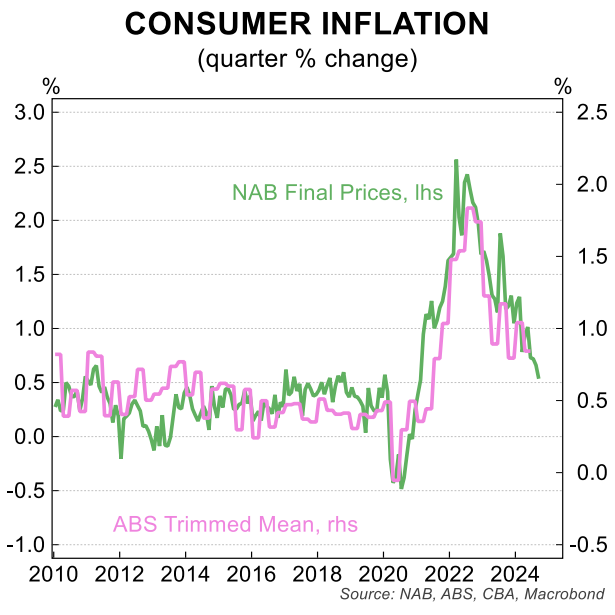

So does the NAB business survey’s final prices measure:

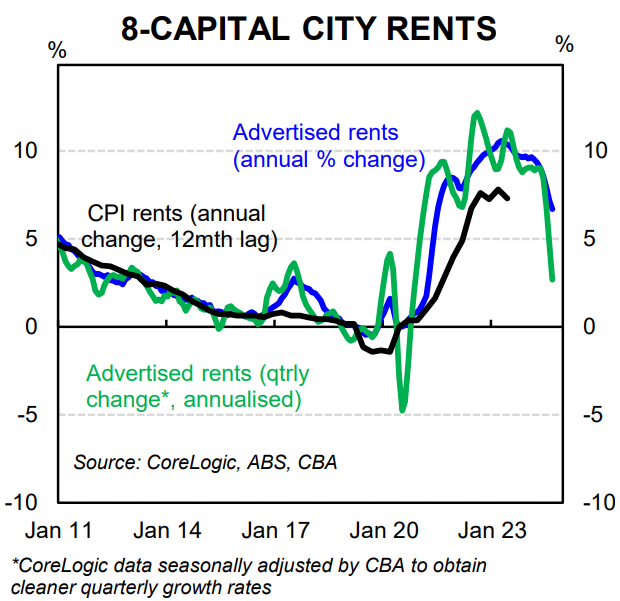

As well as the slowing in advertised rents:

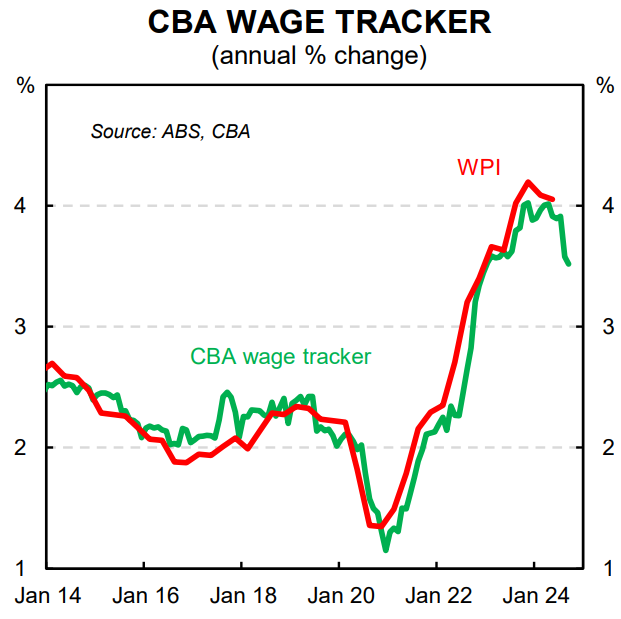

CBA’s wage tracker also suggests that wage inflation is falling:

The ABS will release the Q3 CPI inflation data next week. A soft result seems likely, which should see the discussion pivot back to rate cuts.