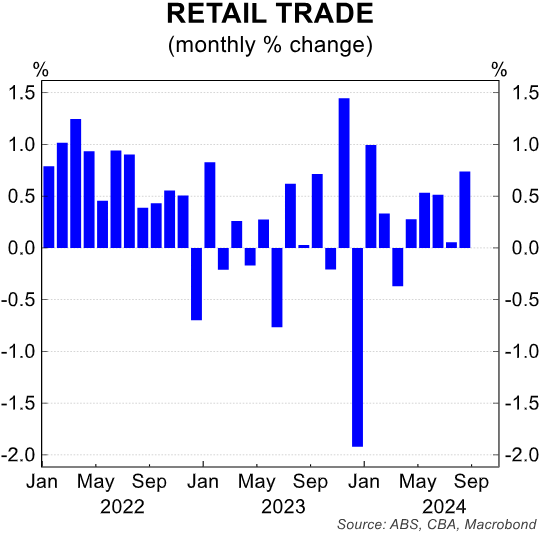

On Tuesday, the Australian Bureau of Statistics (ABS) released retail trade data, which posted a solid 0.7% gain in August following an upwardly revised 0.1% lift in July (previously reported as flat):

Unseasonably warm weather and increased Father’s Day spending both contributed to the result, which easily exceeded economists’ expectations of a 0.4% rise.

The annual rate of retail sales lifted to 3.1%.

On the face of it, the stronger-than-expected result suggests that consumer spending is holding up and augers against the RBA cutting interest rates this year.

However, most economists expect soft retail sales in September, which will be released before the next RBA board meeting on 31 October.

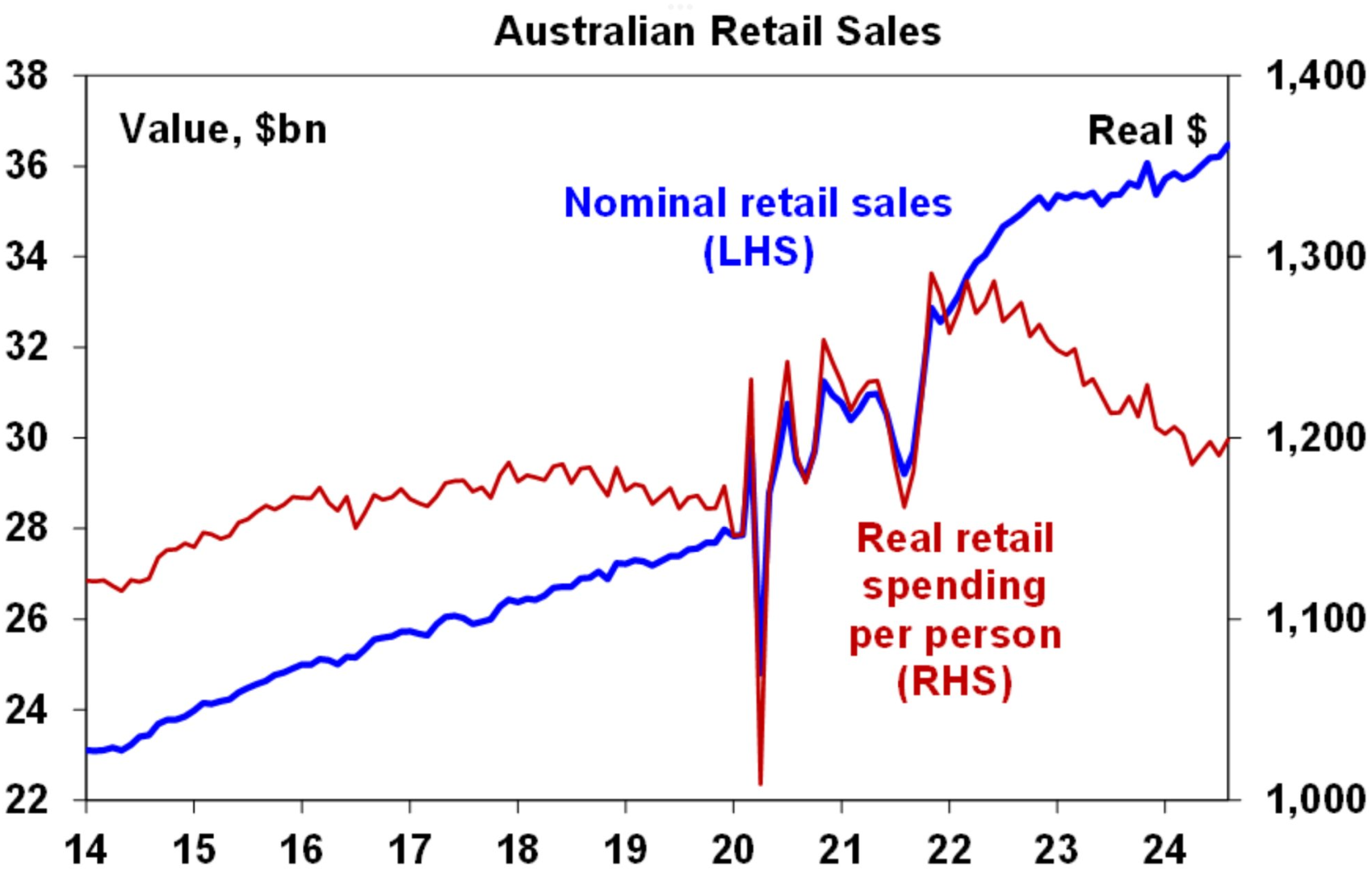

It is also worth pointing out that retail sales in real per capita terms have fallen sharply, as illustrated below by AMP chief economist Shane Oliver:

Source: Shane Oliver (AMP)

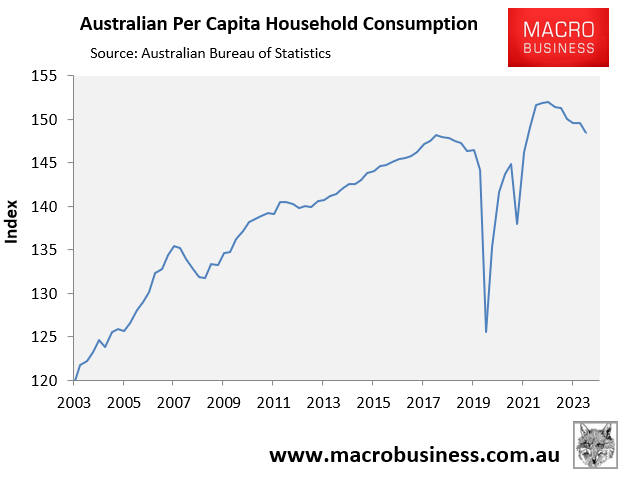

This decline is replicated at the overall consumer level, with real per capita household consumption also falling:

Commenting on Tuesday’s sales data from the ABS, Australian Retailers Association CEO Paul Zahra said that interest rates and cost-of-living pressures continue to impact Australians, which is resulting in slowed consumer spending in most categories.

Zahra has urged the RBA to provide relief for consumers by reducing the cash rate in November, ahead of the peak sales season for retailers.

“This remains one of retail’s most difficult years – with a continued slowdown in discretionary spend”, Zahra said.

“Interest rates and cost-of-living pressures continue to impact Australians which is resulting in slowed consumer spending in most categories”.

“Retailers employ thousands of people during the all-important Christmas trading period, providing jobs and boosting the Australian economy”.

“Whilst there is great resilience within retail, we know there are many businesses in the sector that are doing it tough, especially small businesses”.

“The RBA needs to offer relief for consumers through a reduction in the cash rate when it next meets in November”, Zahra said.

The unfortunate reality is that traditional brick-and-mortar discretionary retailers are facing a perfect storm of challenges that threaten their survival.

In addition to the obvious macroeconomic causes such as increasing interest rates, general cost-of-living concerns, and declining real household disposable incomes, merchants face fierce competition from global online platforms.

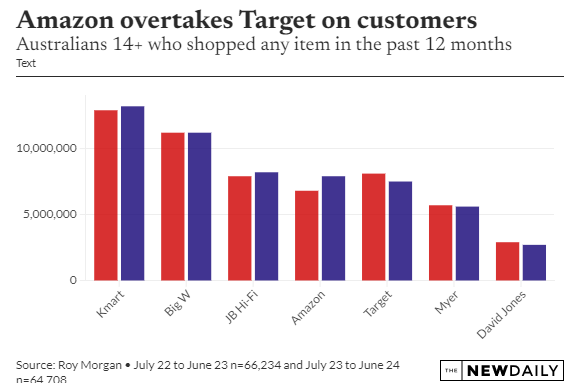

Leading the pack is global behemoth Amazon, which entered the Australian market in December 2017 and has since expanded its presence.

Amazon Prime offers competitive pricing and unsurpassed convenience, with most purchases delivered free to your door within 48 hours.

Roy Morgan estimates that Amazon’s customer base grew by 16% last financial year, with 1.1 million more users using the platform than in 2022-23.

Amazon has previously indicated that it will expand its operations and delivery network in Australia, increasing competition for traditional Australian merchants.

Temu and Shein, Chinese behemoths, are also expanding their market share in Australia, with a focus on the low-end of the retail sector.

Roy Morgan estimated that 5.8 million Australians utilised either platform last financial year, with almost 80% of them being repeat buyers.

Online competition will only increase. We are still far from saturation.

As a result, traditional brick-and-mortar retailers will continue to lose market share.

The impact is most severe for smaller speciality retailers. However, it is just a matter of time before major players, such as department stores, are forced to rationalise their operations to adapt to the changing economic situation.