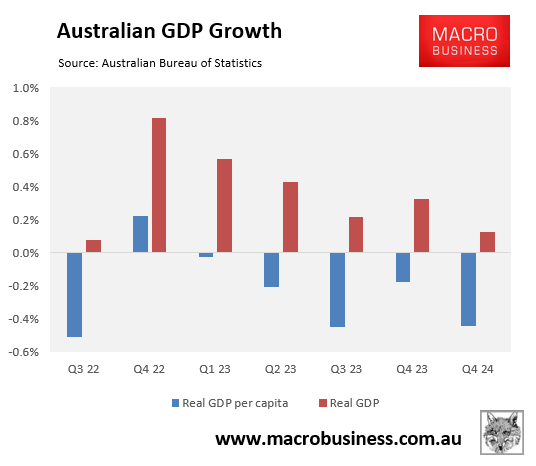

Australians are experiencing the longest per capita recession on record, with six straight quarterly contractions and seven declines in the preceding eight quarters to Q2 2024.

The OECD’s latest economic outlook downgraded Australia’s GDP growth forecast for the 2024 calendar year to only 1.1%, down from 1.5% in the previous edition published in May. The OECD also forecast that Australia’s GDP will grow by only 1.8% in 2025.

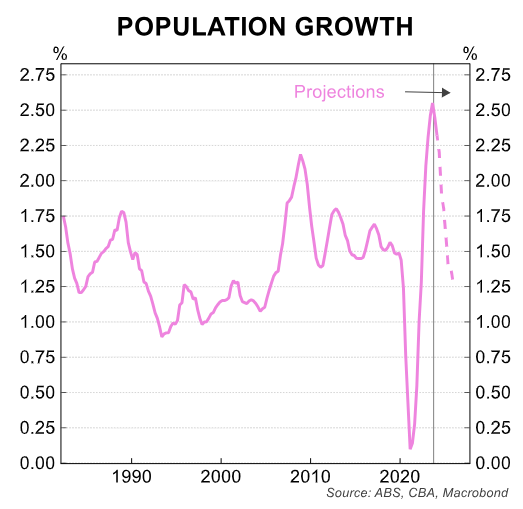

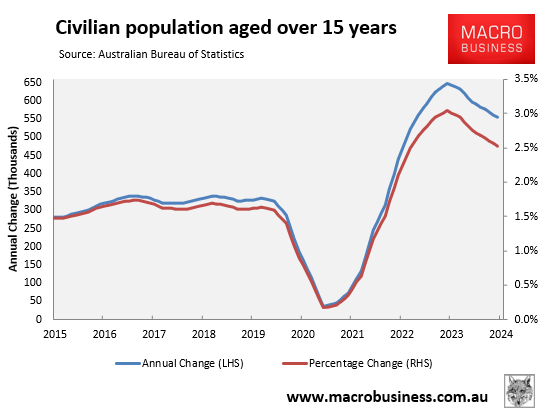

CBA expects Australia’s population growth to slow to just under 2% by year-end 2024 and to around 1.5% in mid-2025.

The OECD’s forecast, therefore, suggests that Australia’s per capita recession will last well into next year, an unprecedented decline.

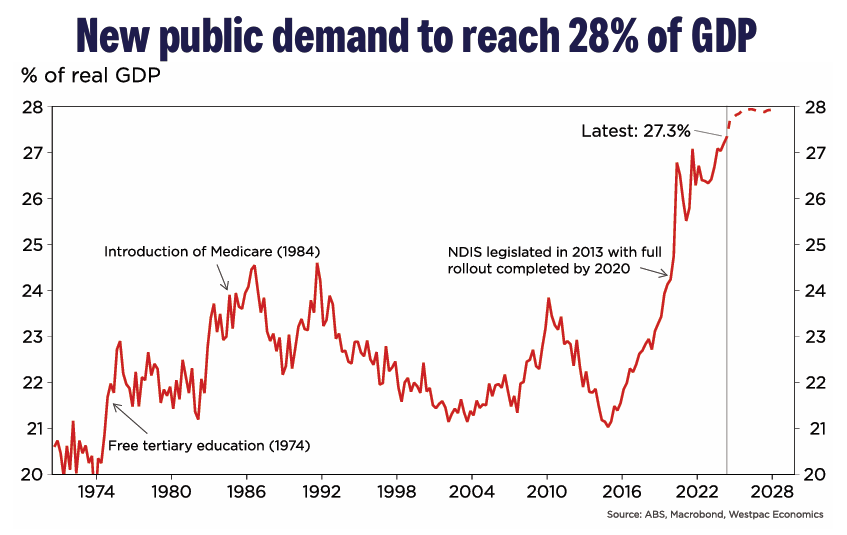

The per capita recession has occurred despite unprecedented government spending.

In Q2 2024, public demand reached a record high of 27.3% of GDP, up 1.5% from the previous quarter. Westpac also predicted that government spending will continue to increase as a share of the economy:

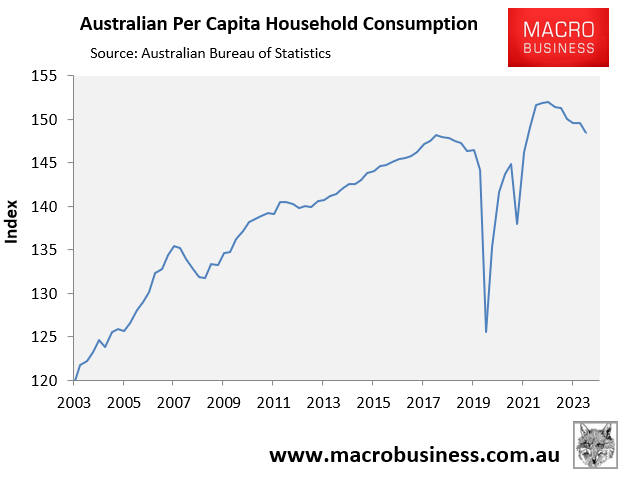

The recession and the RBA’s aggressive rate hikes have hit Australian households the hardest.

In real per capita terms, household consumption had declined 2.4% from its high in Q2 2024:

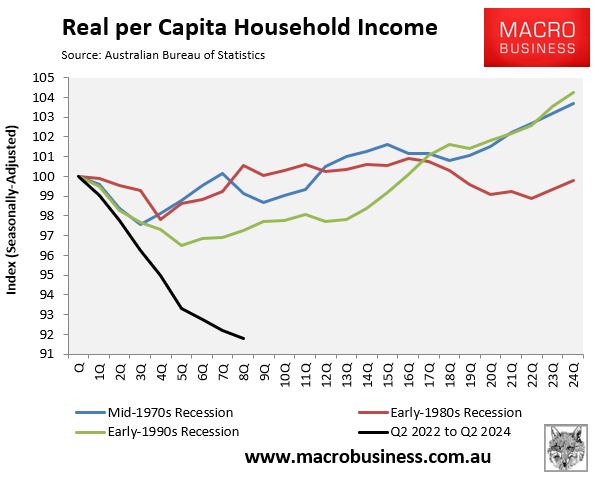

Worse, real per capita household disposable income fell by 8.2% over the two years to Q2 2024, marking the largest fall on record:

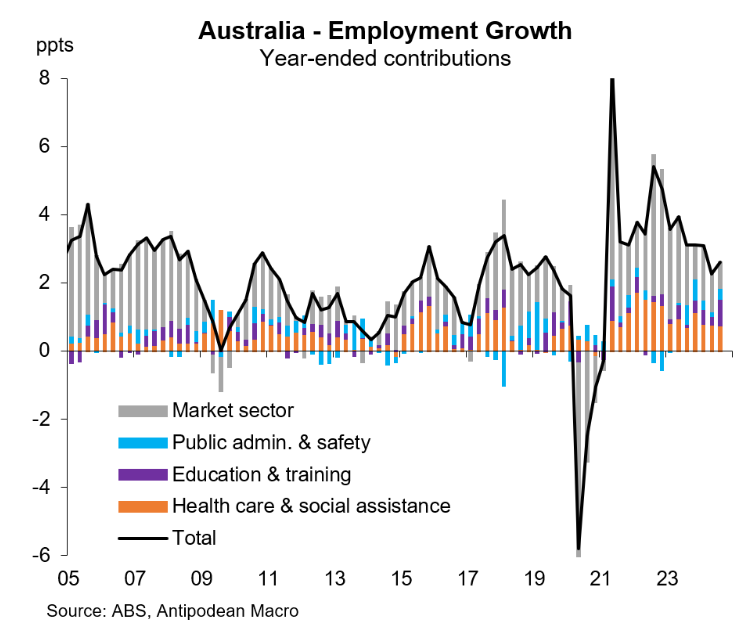

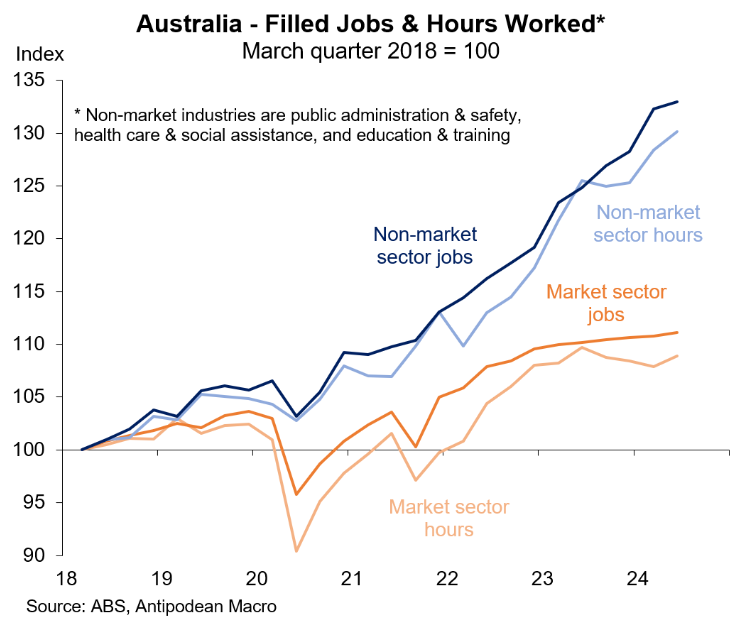

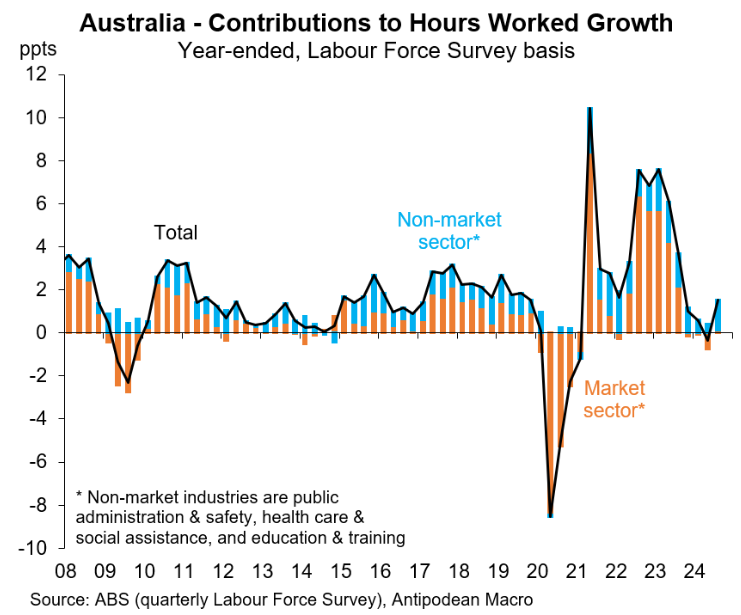

Justin Fabo at Antipodean Macro published a stunning set of charts showing the astonishing weakness in market sector jobs growth, which is lagging well behind the non-market (government-aligned) job growth, which are those most directly impacted by changes in government funding.

Fabo explains these non-market sector jobs as follows:

“While non-market industries include large numbers of private-sector workers, ultimately their employment may be (largely) determined by government funding”.

“A good current example is employment in aged and disability care which has grown very strongly due to surging government spending, including on the NDIS. Many of these workers, however, are NOT public-sector workers but work for private employers whose funding is largely determined by government”.

Fabo shows that the market sector contributed only around 30% of Australia’s job growth in the year to August 2024:

The quarterly ABS Labour Account also showed that annual market sector job growth was only 0.8% in the year to Q2 2024, compared with 6.5% in the non-market sector:

To add further insult to injury, the latest monthly labour force survey from the ABS shows that all of Australia’s 1.5% annual job growth in the year to September came from the non-market (government-aligned) sector:

The above must be considered in the context of annual civilian population growth of around 2.6%:

Clearly, the market sector is experiencing a protracted per capita recession.