This week, reports emerged claiming that the Coalition is considering stripping the Australian Prudential Regulatory Authority (APRA) of some of its powers to regulate mortgage borrowing and overhauling credit laws to make it easier for first home buyers to borrow for housing.

The move comes as the Coalition’s Andrew Bragg is chairing a Senate inquiry into mortgage regulations.

The Senate inquiry will focus on the regulatory framework and concerns that rules aimed at reducing the riskiest forms of borrowing have gone too far, making banks too cautious about lending to first home buyers.

“We cannot allow access to home ownership and financial services to become a privilege only the rich can afford”, Shadow Treasurer Angus Taylor said.

Some MPs also reportedly want to scrap responsible lending laws, which put the onus on the banks to verify borrowers’ ability to make mortgage repayments.

Not surprisingly, some of the major banks, including ANZ, support looser credit, arguing that current rules preclude lower-income borrowers like first home buyers.

Indeed, ANZ recently canvassed 50-year mortgage terms to reduce monthly loan repayments in a bid to entice more buyers into the market:

Bendigo & Adelaide Bank’s CEO Richard Fennell told the Senate inquiry into mortgage regulations that regulatory and legislative constraints are making it harder for some people to secure a home loan.

“These legislative barriers not only limit potential homebuyers but also constrain competition”, Fennell said in the Bank’s submission to the Senate inquiry.

Refreshingly, Westpac boss Peter King challenged the above concerns, telling a parliamentary inquiry last month that he did not believe there was a problem with access to housing finance in Australia.

“We can debate about lending standards and responsible lending, but broadly the issue is not the ability to get finance; the issue is getting the stock into the market”, King said.

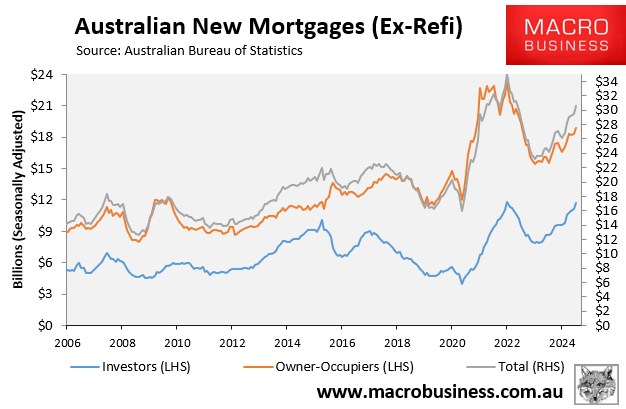

To King’s point, it is hard to argue that lending is restrictive when mortgage commitments are tracking at historically high levels despite the surge in mortgage rates:

Average loan sizes have also risen inexorably alongside house prices:

It is also worth pointing out that the number one recommendation of the Hayne Banking Royal Commission was for responsible lending rules to remain untouched:

The Hayne Banking Royal Commission’s central recommendation was to keep responsible lending laws.

Twenty years of empirical evidence show that demand-side “affordability” measures, such as looser credit provision, have helped increase the cost of Australian housing.

Increasing lending to marginal buyers will exacerbate the housing affordability problem by inflating prices, increasing consumer debt, and compromising financial stability.

The truth is that our political leaders do not genuinely want more affordable homes since it would require lower prices.

They will never reduce immigration to reasonable, sustainable levels below 120,000 a year so that housing supply can keep up with demand.

Nor will our politicians undertake broad-based tax reforms to shift economic activity away from housing speculation to productive pursuits.

Instead, politicians pretend to care by providing false solutions and hope to would-be first home buyers while systematically driving the cost of housing higher through demand-side stimulatory policies.