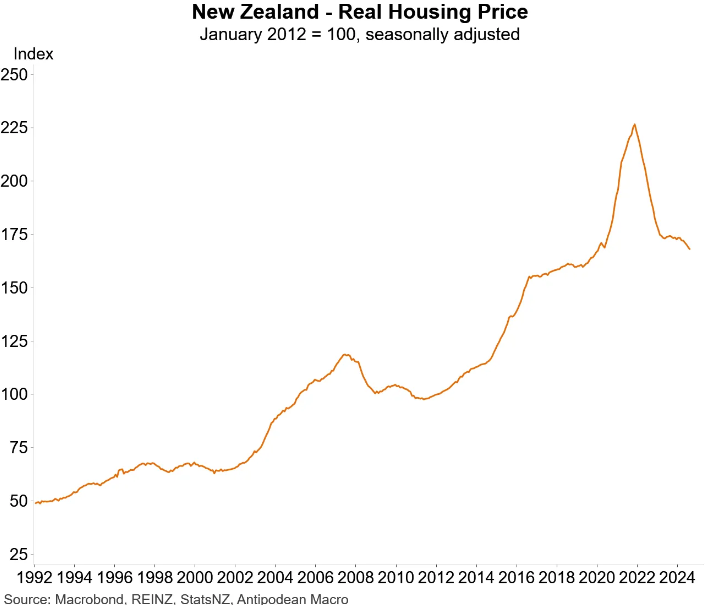

The Reserve Bank of New Zealand is already battling deflation in the housing market, where prices nationally have declined 16.7% from their 2021 peak.

This decline has lowered real inflation-adjusted house prices to pre-pandemic levels:

Recent data suggests that the Reserve Bank could soon contend with falling prices elsewhere in the economy.

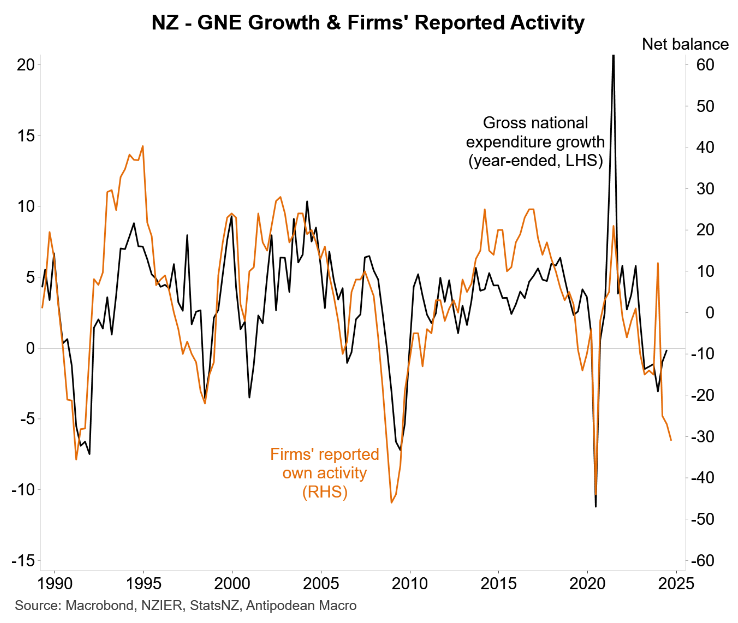

The latest data from the QSBO survey, compiled by Justin Fabo at Antipodean Macro, shows that demand has collapsed across the New Zealand economy, pointing to severe cost disinflation and maybe even future deflation.

Reported activity by New Zealand firms has plummeted, pointing to softer gross national expenditure and GDP:

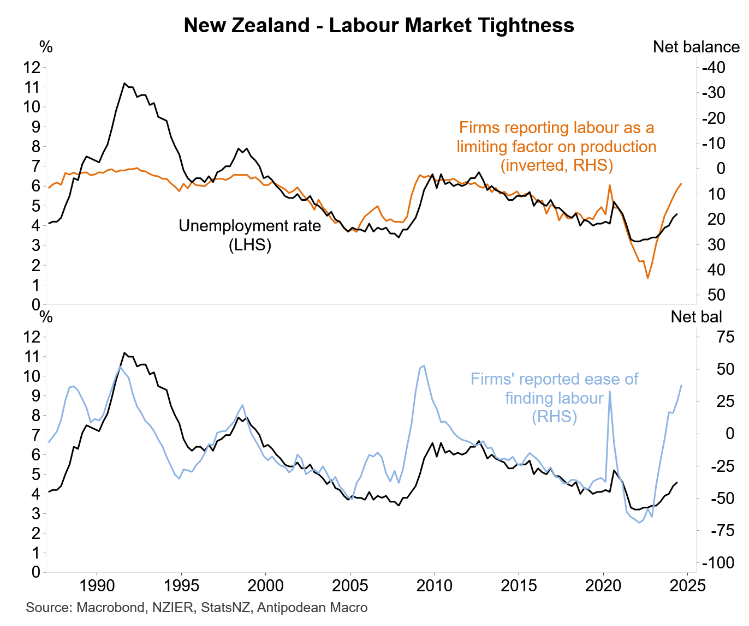

New Zealand firms are oversupplied with workers:

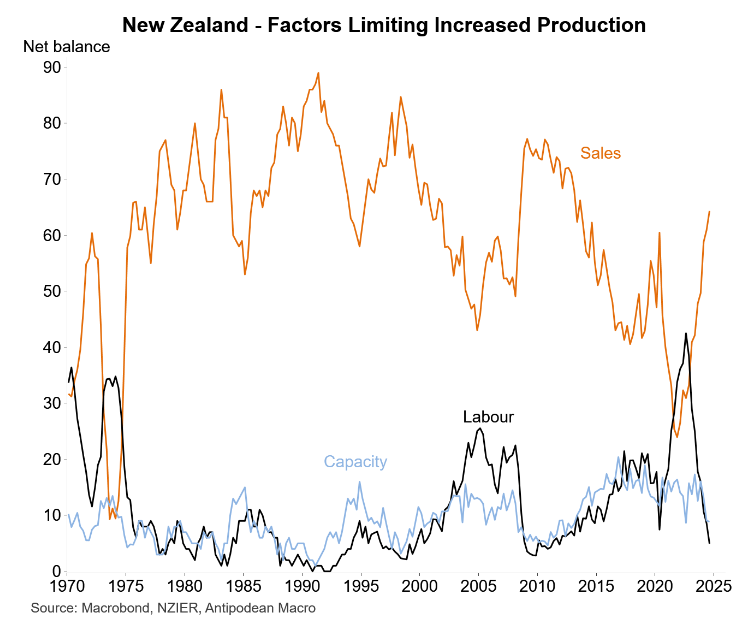

They now cite a lack of sales as the biggest factor limiting production:

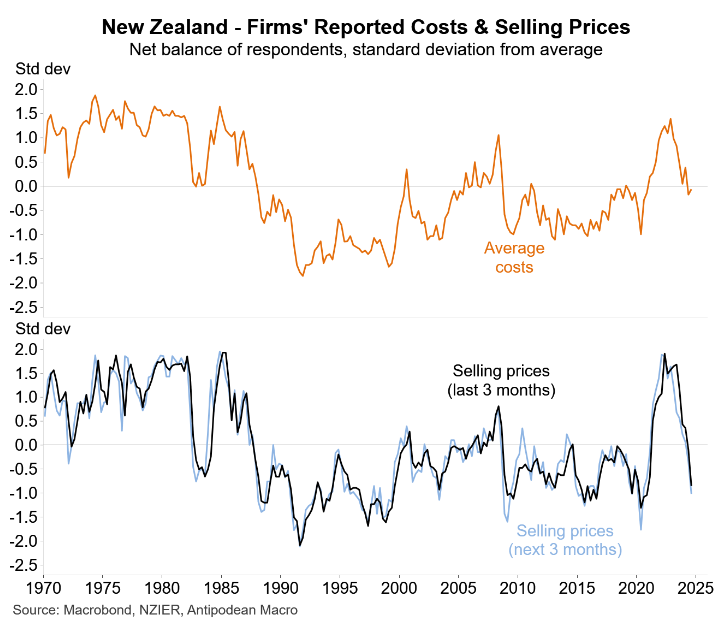

Given the lack of demand, New Zealand firms have reported a sharp slowing in average costs and selling prices:

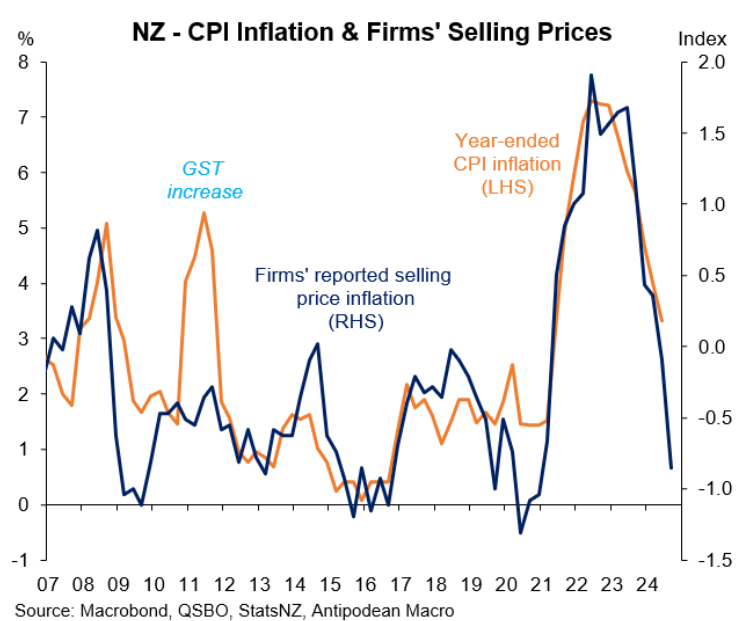

Finally, reported selling price inflation is swiftly moving into deflation territory:

Clearly, New Zealand’s economy is incredibly weak and inflationary pressures are rapidly easing.

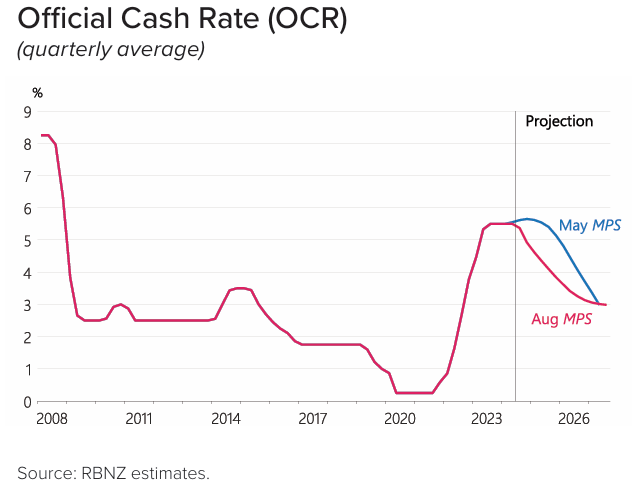

The Reserve Bank has forecast around 2.5% of rate cuts over a 2.5 year period:

Based on the recent flow of data, it will need to front-load the cuts to stave off a deepening recession and outright deflation.