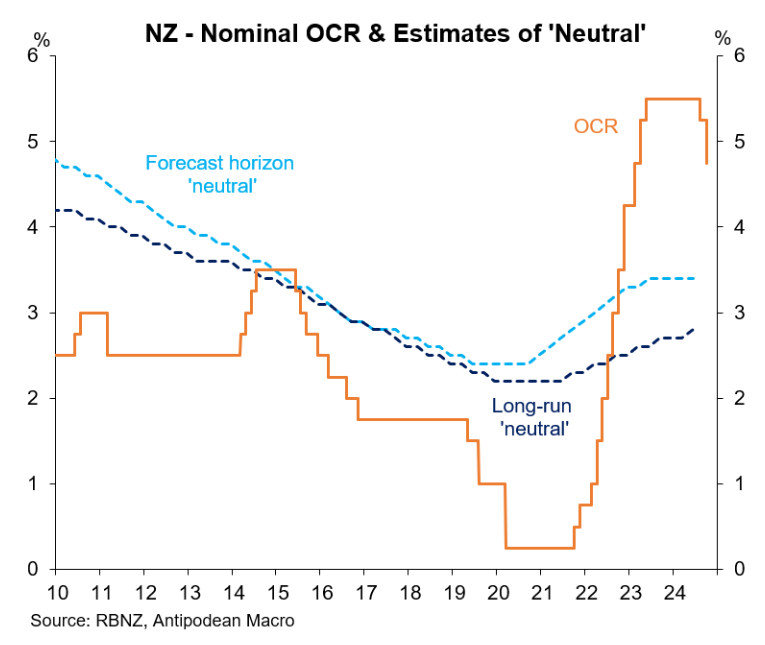

The Reserve Bank of New Zealand was one of the most aggressive central banks in the world, lifting the official cash rate to a peak of 5.50%.

As illustrated in the chart below from Justin Fabo at Antipodean Macro, New Zealand’s official cash rate remains overly restrictive, despite 0.75% of cuts delivered over the past two monetary policy meetings.

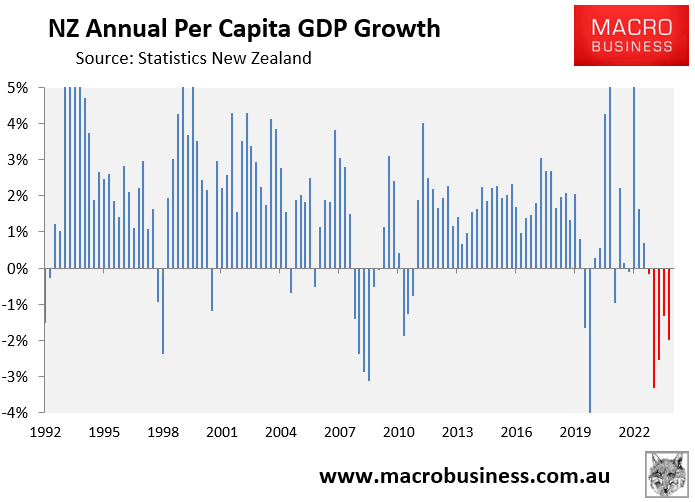

New Zealand’s economy has fallen into a deep recession.

Real per capita GDP has declined by around 4% from its peak, as illustrated below. This represents one of the country’s largest declines in per capita GDP in modern history.

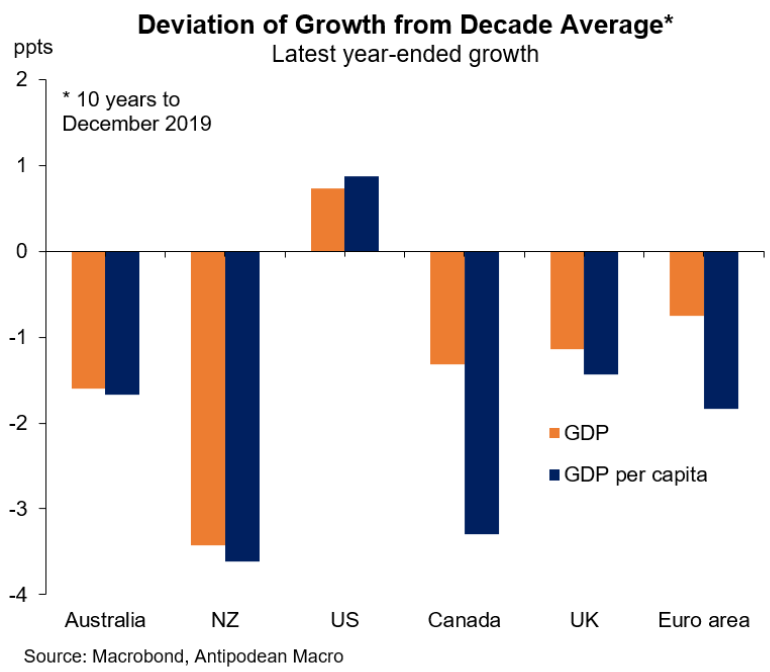

New Zealand’s recession has also been one of the most severe in the developed world in both aggregate and per capita terms.

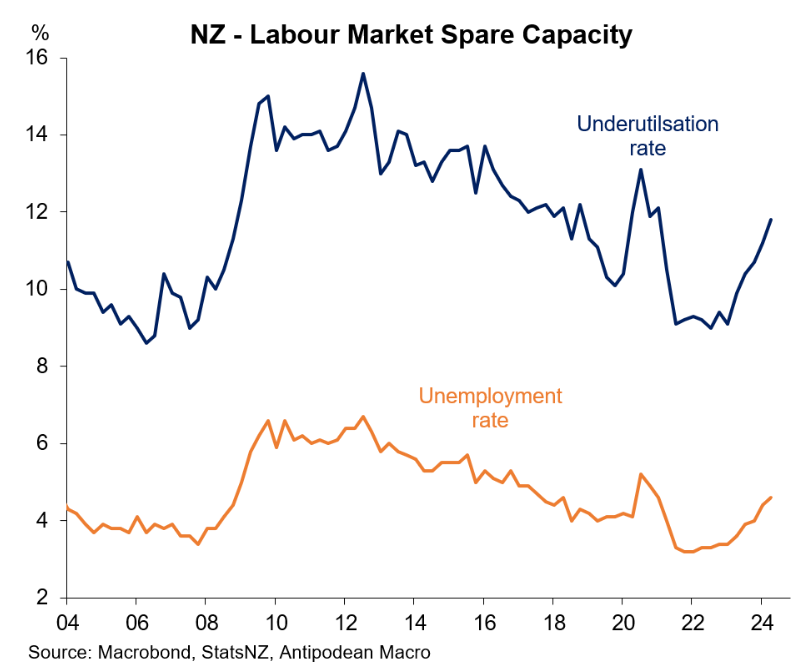

The labour market, where job growth has slowed to a crawl and unemployment has risen sharply, has coincided with the contraction in the economy’s output.

New Zealand’s official unemployment rate is only released on a quarterly basis and is current to June 2024.

As shown below, the unemployment rate rose to 4.6% in June, with the underutilisation rate rising even more sharply.

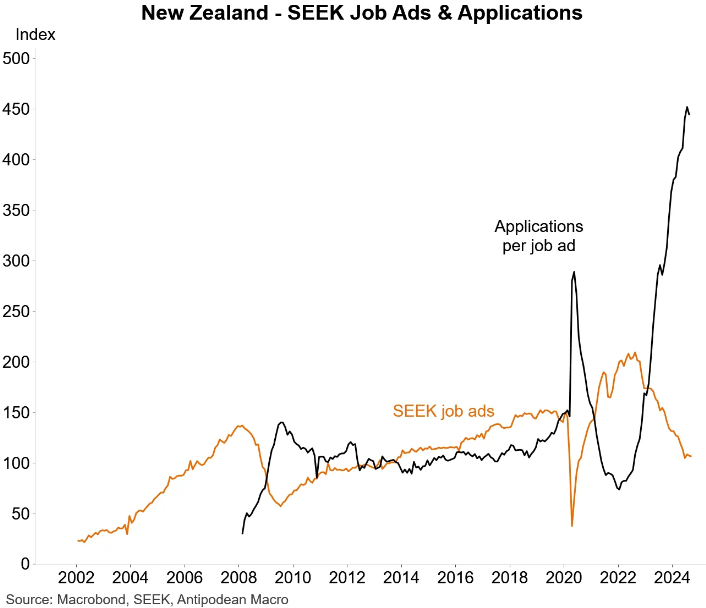

More timely indicators paint a grim picture for workers.

SEEK data shows that new job ads have tanked and applicants per job ad soared, pointing to higher unemployment in the period ahead.

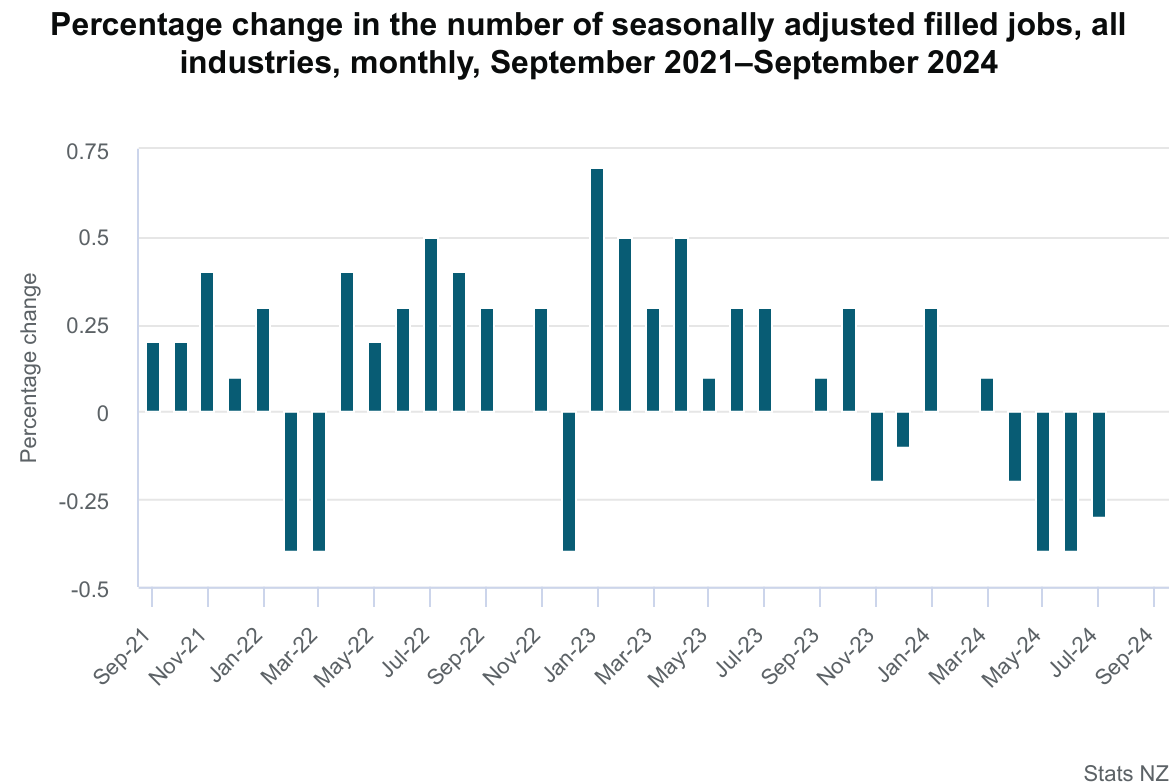

Statistics New Zealand data, released on Tuesday, shows that the number of filled jobs has fallen by more than 20,000 (0.9%) in the past year. There has also been no monthly job growth in any of the past six months.

Youth have bore the brunt of the decline in filled jobs, with the number of 15-29-year-olds in filled occupations falling by almost 29,000 compared to a year ago.

ASB senior economist Mark Smith said the latest employment indicators suggest “that the unemployment rate could approach 5%”.

“The soft economy and gloomy headlines point to further labour market softening”.

“A front-loaded pace of OCR [Official Cash Rate] cuts is still needed to avoid labour market scarring”, he said.

They say that hindsight is 20-20. It is clear from the data above that the Reserve Bank was too aggressive in its monetary tightening, causing a severe recession and excessive job losses.

It will need to reverse course quickly with a series of deep cuts to the official cash rate.