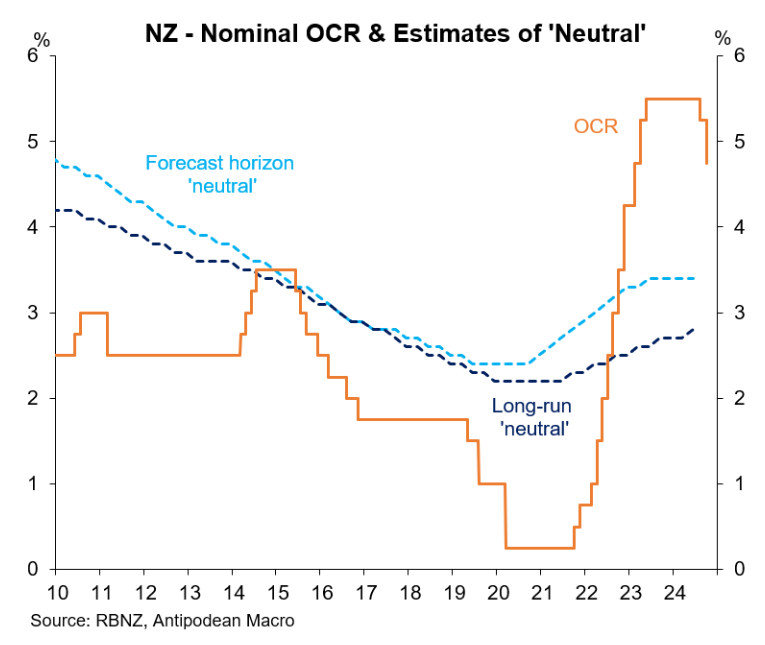

The Reserve Bank of New Zealand has cut the official cash rate by 0.75% over the past two monetary policy meetings.

Despite the cuts, monetary policy remains highly restrictive, as illustrated below by Justin Fabo at Antipodean Macro:

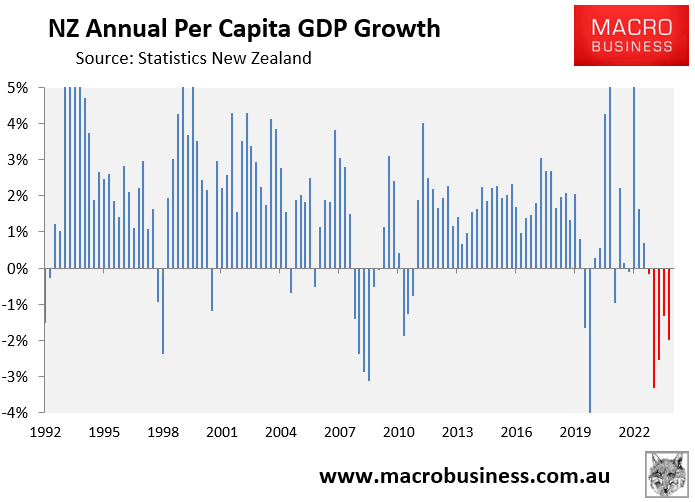

New Zealand’s economy is experiencing a deep per capita recession, with GDP declining by around 4% from its peak in per capita terms – one of the largest falls in modern history:

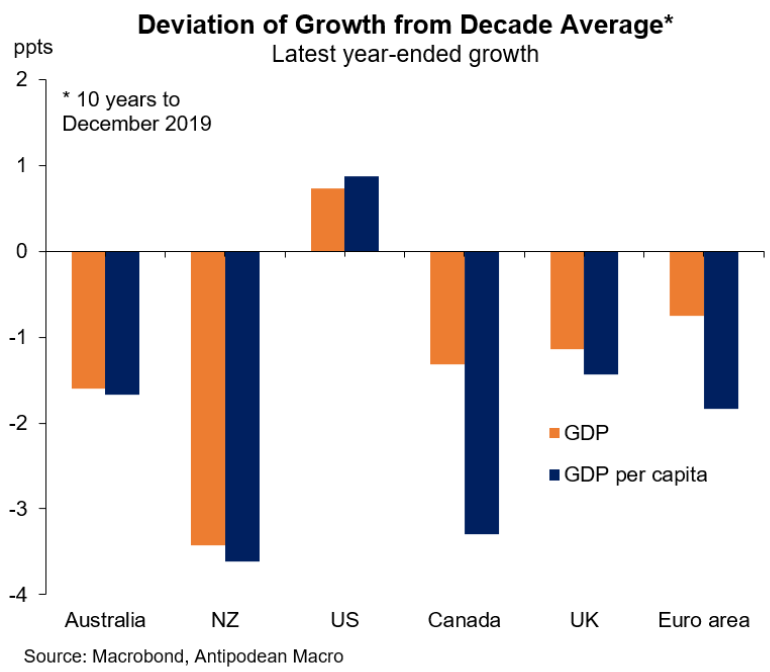

In fact, New Zealand has recorded one of the largest declines in aggregate and per capita GDP relative to the decade average among advanced nations:

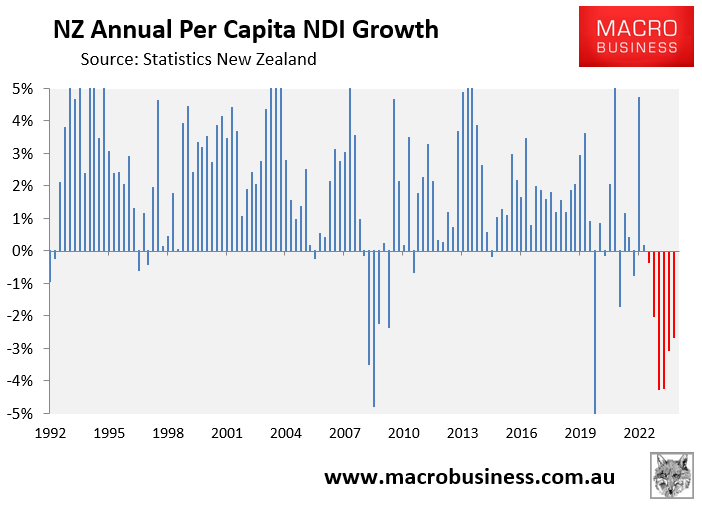

New Zealand’s real per capita national disposable income has also collapsed by nearly 6% from its peak:

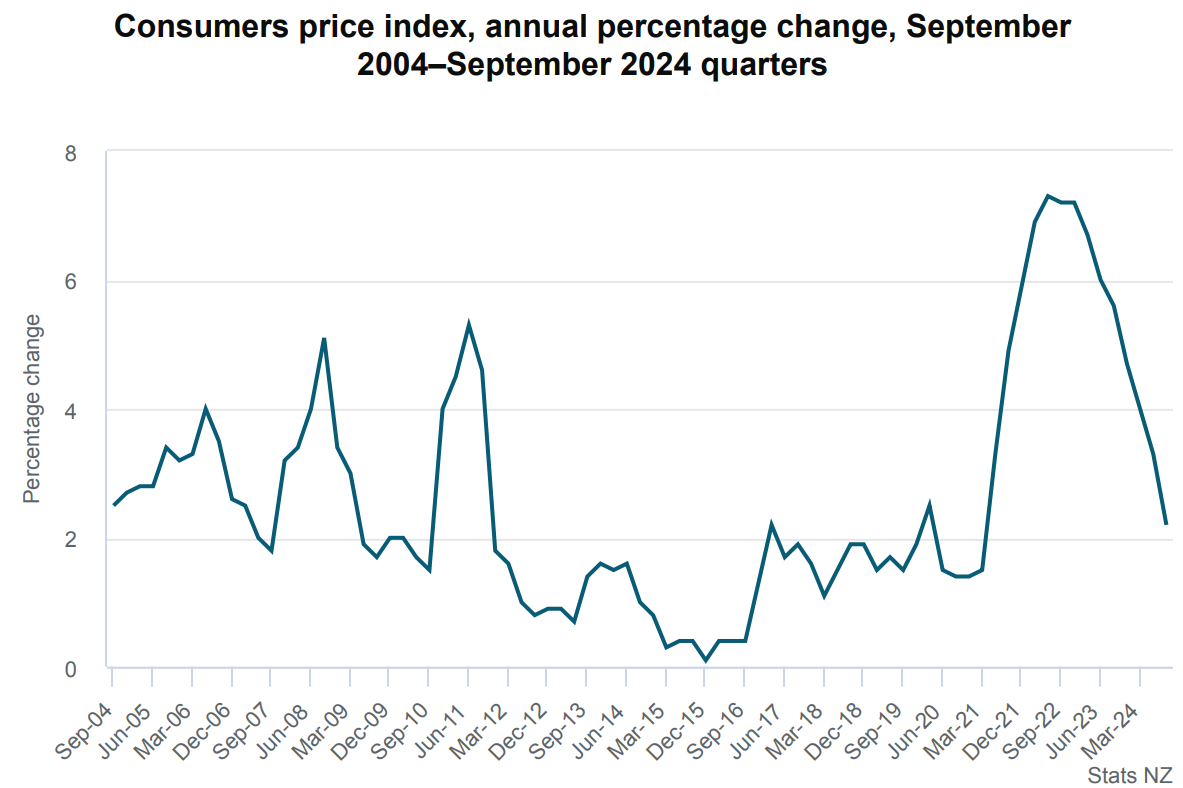

On Wednesday, Statistics New Zealand released CPI inflation data for Q3, which has fallen comfortably within the Reserve Bank’s target band of 1% to 3%.

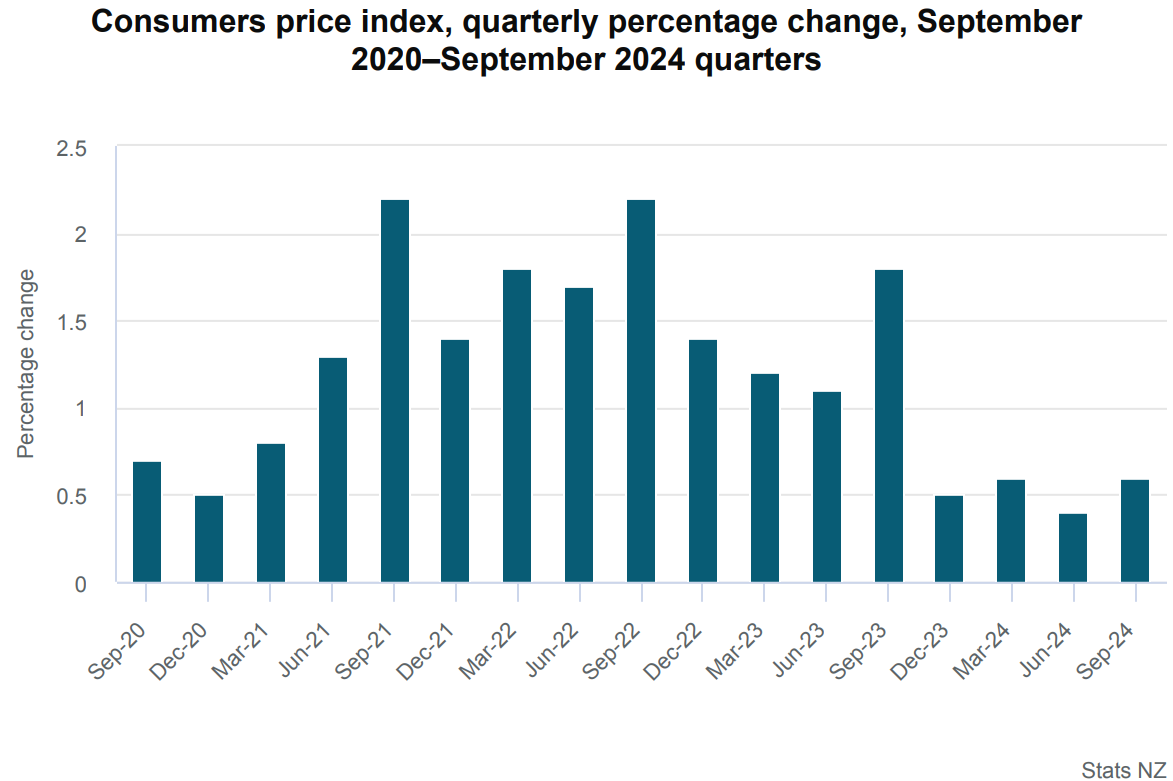

New Zealand’s CPI inflation was 0.6% in the September quarter (below expectations of 0.7%) and 2.2% year-on-year (expected 2.2%).

“Prices are still rising, but not as much as previously recorded”, Statistics New Zealand consumer prices manager Nicola Growden said.

Falling import goods prices were primarily to blame for the weaker headline inflation. These ‘tradable’ prices fell by 1.6% over the last year, including -0.2% in the September quarter.

Prices for goods and services that do not face international competition have continued to rise at a solid pace. These ‘non-tradable’ prices rose by 4.9% annually and by 1.3% in the September quarter.

Higher rent prices were the most significant individual contributor to the annual inflation rate, rising by 4.5%. Almost one fifth of the 2.2% annual increase in the CPI was due to rent prices.

Prices for local authority rates and payments also increased by 12.2% in the 12 months to September, contributing 16% of the 2.2% increase in CPI.

“This is the largest rates increase since 1990”, Growden said.

The following chart shows that New Zealand’s CPI inflation was within the Reserve Bank’s target for each of the past four quarters:

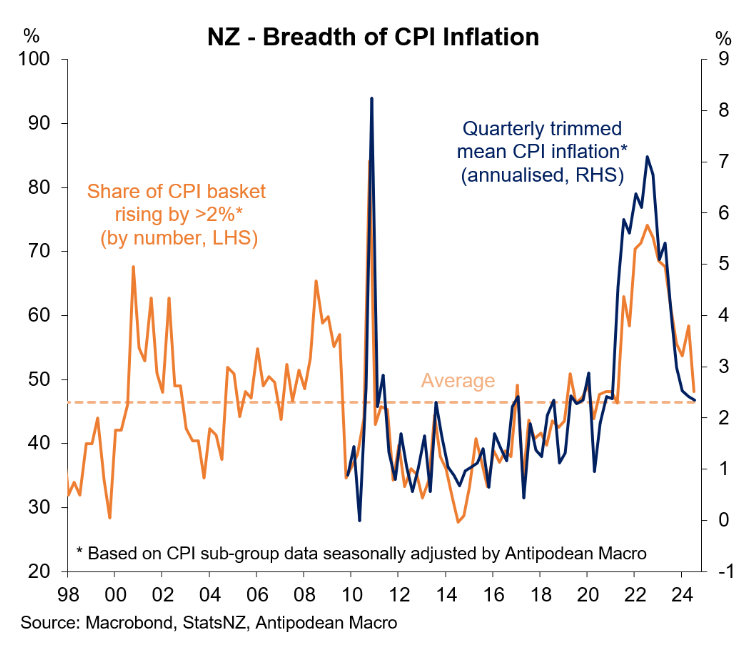

Trimmed mean inflation has also tanked, as has the breadth of inflation:

Clearly, the Reserve Bank has slayed the inflation dragon.

Now it must cut rates hard and return monetary policy to a neutral setting before it breaks the economy’s.