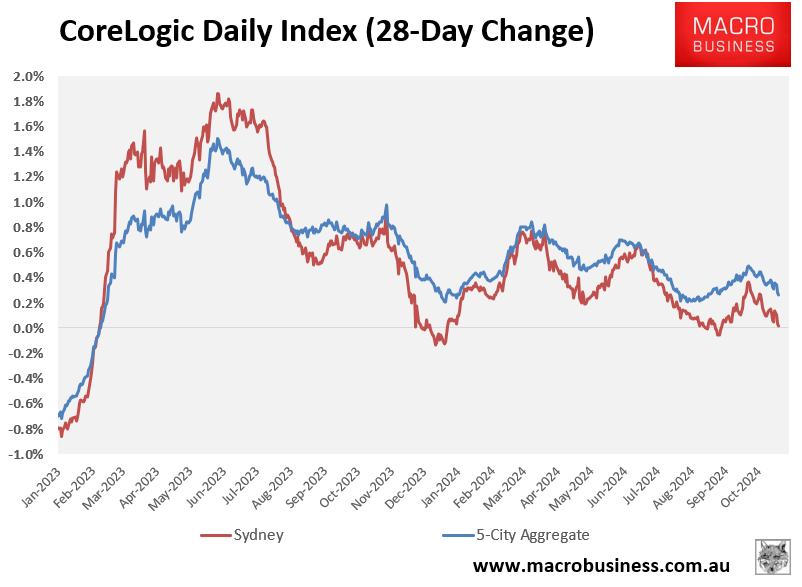

CoreLogic’s daily dwelling values index shows that Sydney home values have recorded zero growth over the past 28 days, as illustrated below:

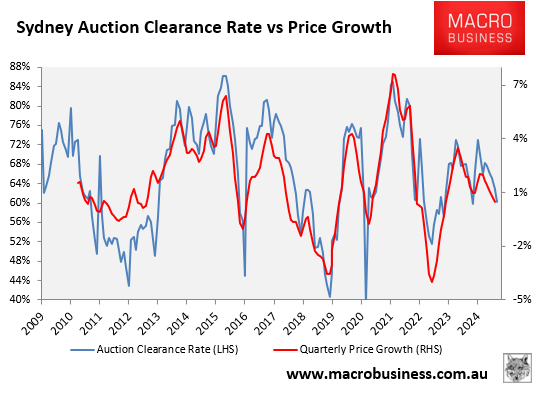

Final auction clearance rates have fallen sharply across Sydney, pulling down prices.

SQM Research managing director and founder, Louis Christopher, believes that last weekend’s auction results were the weakest since 2022, despite CoreLogic reporting a preliminary rate for Sydney of 70.5%.

“We’re very confident that the final Sydney clearance rate will be about 40%”, Christopher told The AFR after analysing data from 1005 auctions.

“The total sold reported in [the data] was quite weak compared to what was listed – and will be the weakest since 2022″.

“Normally when you see that, it means agents are reluctant to report bad results hence my caution for this weekend”, he said.

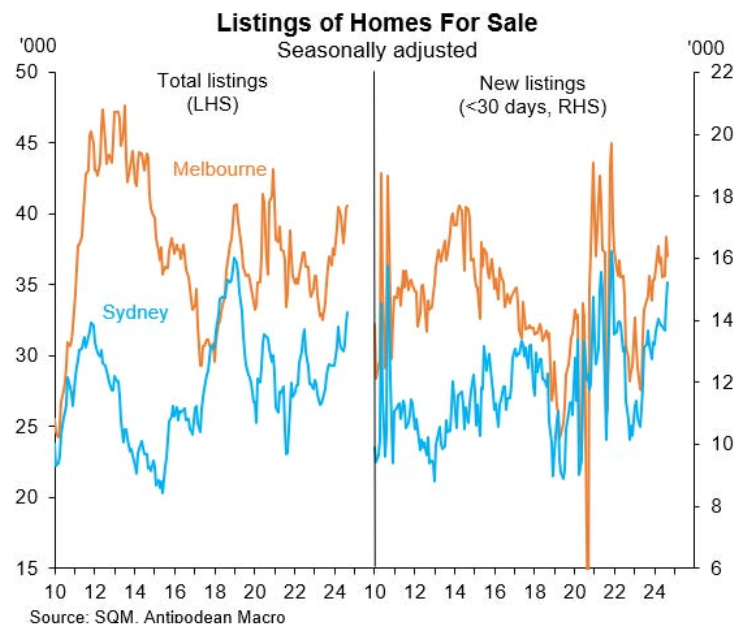

Over recent week’s, leading Sydney auctioneer Tom Panos has stated that Sydney is now a buyers’ market with an abundance of supply.

“The supply of listings right now is outstripping the increase in buyers”, Panos said.

“Buyers are having a much better time than I’ve seen for a very long time. It will only get better [for buyers] as these volumes go up”.

“Buyers are simply saying that if you don’t take my offer, I now have choices. And they will continue to have choices with all the listings that are on the market”, he said.

For sale listings in Sydney have risen significantly in recent months:

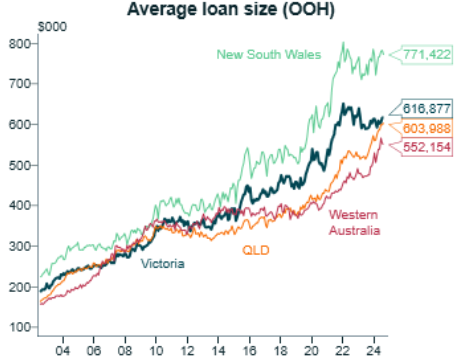

Affordability in Sydney is also stretched, with the average owner-occupier mortgage size hitting $771,422 in August, according to the ABS:

Source: Alex Joiner (IFM Investors)

Sydney housing is simply too expensive at prevailing interest rates and prices are about to fall.