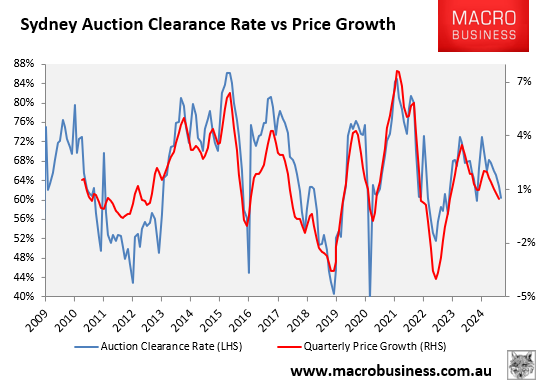

This month’s final auction results for Sydney are the worst for the year with only 60% of homes selling under the hammer.

Following the weekend’s soft results, SQM Research managing director, Louis Christopher, declared that Sydney faces a mild correction whereby prices could fall by 5%.

“It was another soft weekend, possibly even softer than the previous weekend, which we regard as the softest we’ve had since 2022”, Christopher told The AFR.

“Melbourne is a patchy market, but Sydney seems to be turning weaker very quickly”.

“We still have a fundamental underlying shortness of supply”, he said. “But we do think the market is now falling”.

“We’ve been recording falls from August. Sydney property prices will be slightly down for the full year, and could decline by 5 per cent before a rate cut hits”.

“It’s a good window for buyers, they’re a bit spoilt for choice”, he said.

CoreLogic research director, Tim Lawless, agreed that Sydney’s housing market is experiencing a fadeoutwith buyers gaining the upper hand.

“A fade is the best description”, Lawless said. “It’s not like clearance rates are tumbling”.

“In the major auction markets of Sydney, Melbourne and Canberra, I would say it’s now absolutely in favour of buyers”, he said.

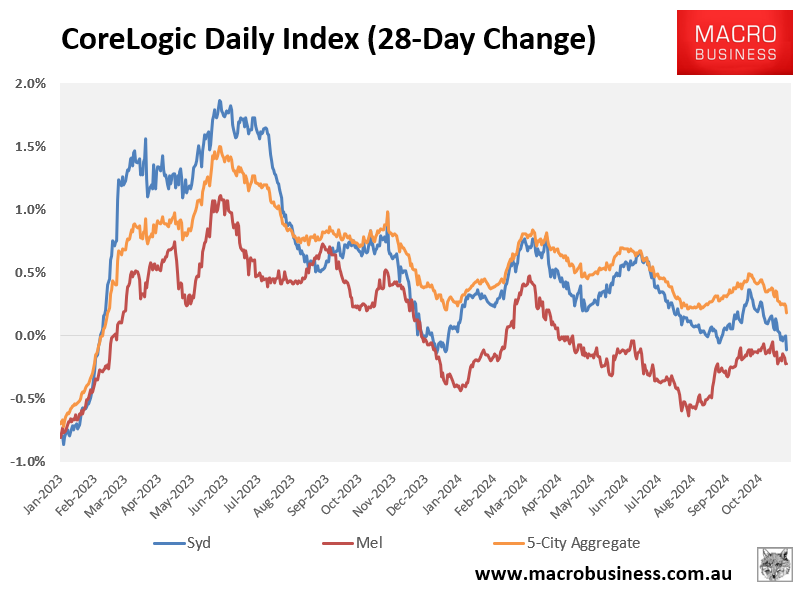

Certainly, CoreLogic’s daily dwelling values index backs up their claims.

As illustrated in the following chart, Sydney values are now falling on a 28-day moving average basis, joining Melbourne in the red.

The last time Sydney’s price growth was this weak was in December 2023.