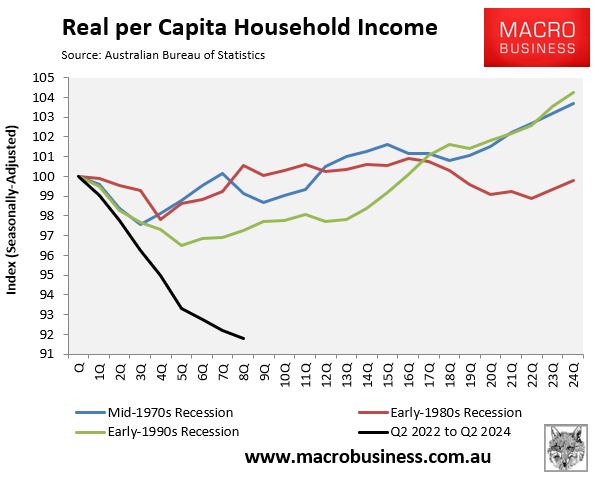

Australian households have had a torrid time in recent years, experiencing the largest decline in disposable incomes in history:

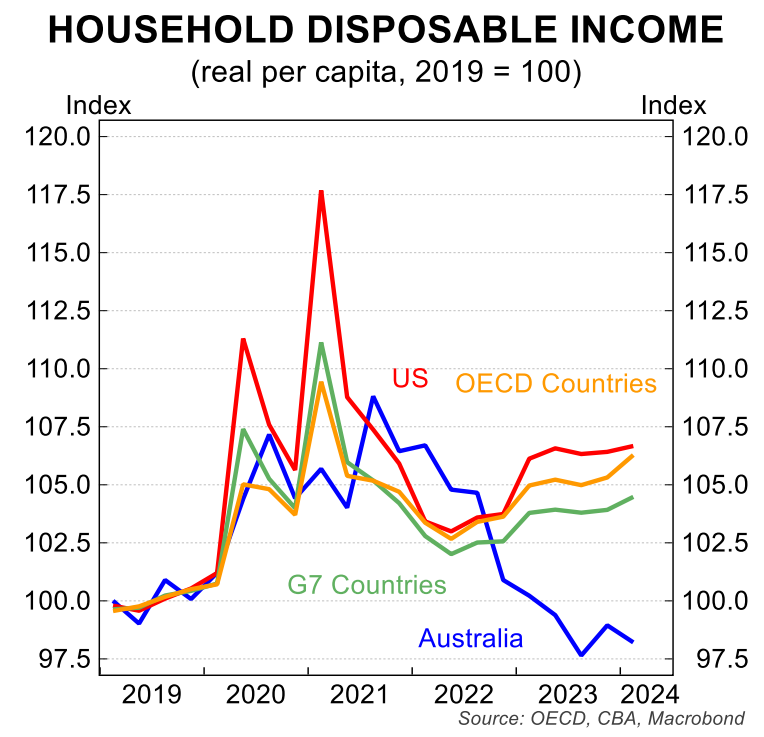

This decline in household income has also been among the largest in the world:

On July 1, the Stage 3 tax cuts came into effect, which reduced personal income taxes by around $1,200 annually for somebody on the median income and $3,729 for high-income earners.

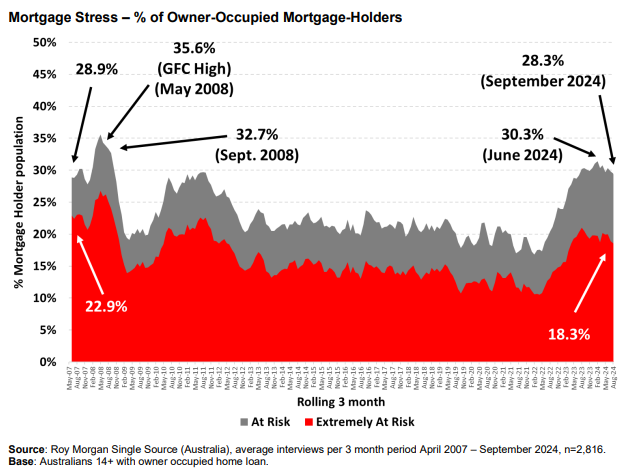

The tax cuts have increased household disposable income, resulting in a meaningful reduction in mortgage stress.

According to new research from Roy Morgan, 28.3% of mortgage holders were ‘At Risk’ of ‘mortgage stress’ in the three months to September, down 2% from the June figures prior to the Stage 3 tax cuts:

Roy Morgan estimates that there are still 917,000 more Australians ‘At Risk’ of mortgage stress than in May 2022, when the RBA began a cycle of interest rate increases.

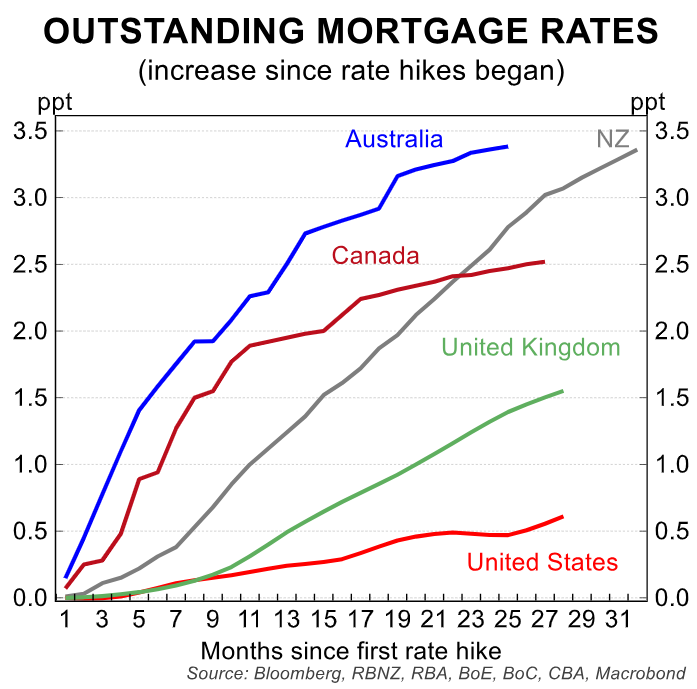

Official interest rates are now at 4.35%, the highest interest rates have been since December 2011, over a decade ago. Australia has experienced one of the world’s largest rises in mortgage repayments, owing to the predominance of variable-rate mortgages.

Moreover, 1,082,000 (18.3% of mortgage holders) are now considered ‘Extremely At Risk’ of default, which is significantly above the long-term average over the last 10 years of 14.6%.

Australia’s low unemployment rate is another factor favouring mortgage holders.

Roy Morgan notes that “unemployment is the key factor which has the largest impact on income and mortgage stress” because if someone loses their job, they cannot repay their debts.

“Although all eyes will be on the Reserve Bank’s interest rate decision in early November, the fact remains that the greatest impact on an individual, or household’s, ability to pay their mortgage is not interest rates, it’s if they lose their job or main source of income”, Roy Morgan noted.

Even so, the Q3 CPI inflation results will be released next week, which will determine whether the Reserve Bank of Australia (RBA) will cut interest rates this year.

My pick is that the RBA remains on hold.

If you wish to save thousands of dollars in mortgage payments, try the MB Compare n Save mortgage comparison tool. It takes a few minutes. And if you choose to refinance, Compare n Save will handle the process.