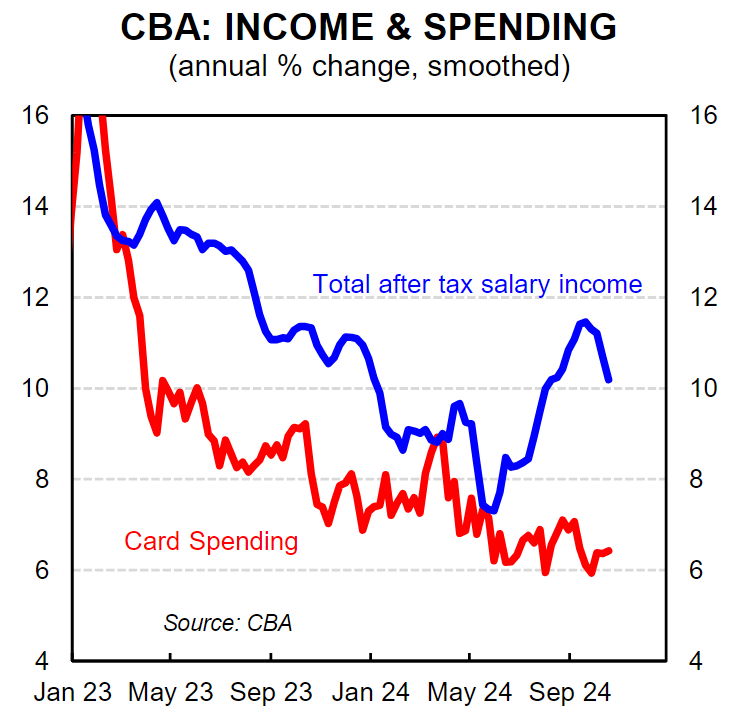

The RBA has been aware of the possibility that consumer spending could be stronger than projected, especially given the significant boost to household income from the Stage 3 tax cuts. This would complicate their goal of sustainably returning inflation to target.

The below video from Westpac provides an overview of the latest Westpac-DataX Consumer Panel. It provides some good news for the RBA, indicating that the income boost from the Stage 3 tax cuts has yet to convert into increased expenditure.

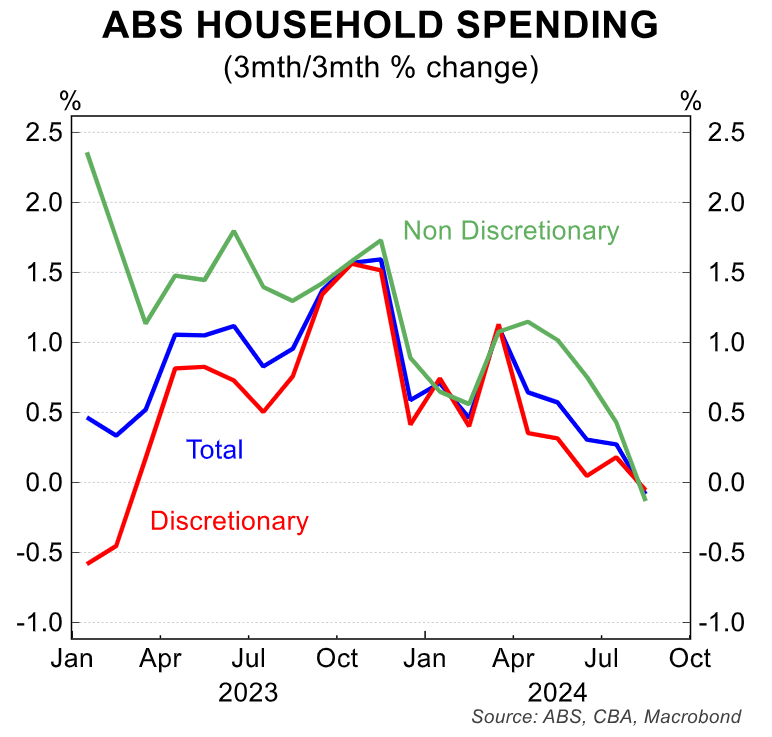

Other data sets corroborate:

Going nowhere:

Advertisement

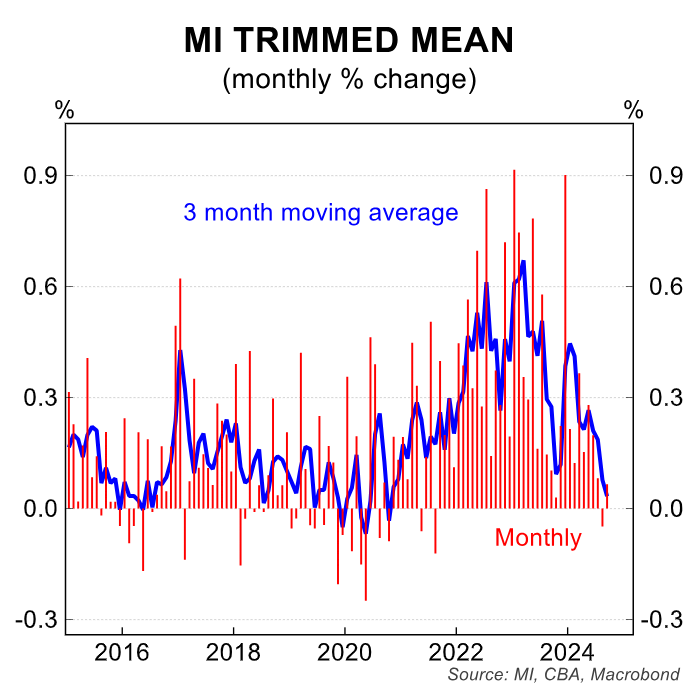

Inflation smashed:

Expectations fine:

Add more immigration to cap wages and cost-of-living relief to crush 2025 administered prices and the RBA should cut in December.

Advertisement