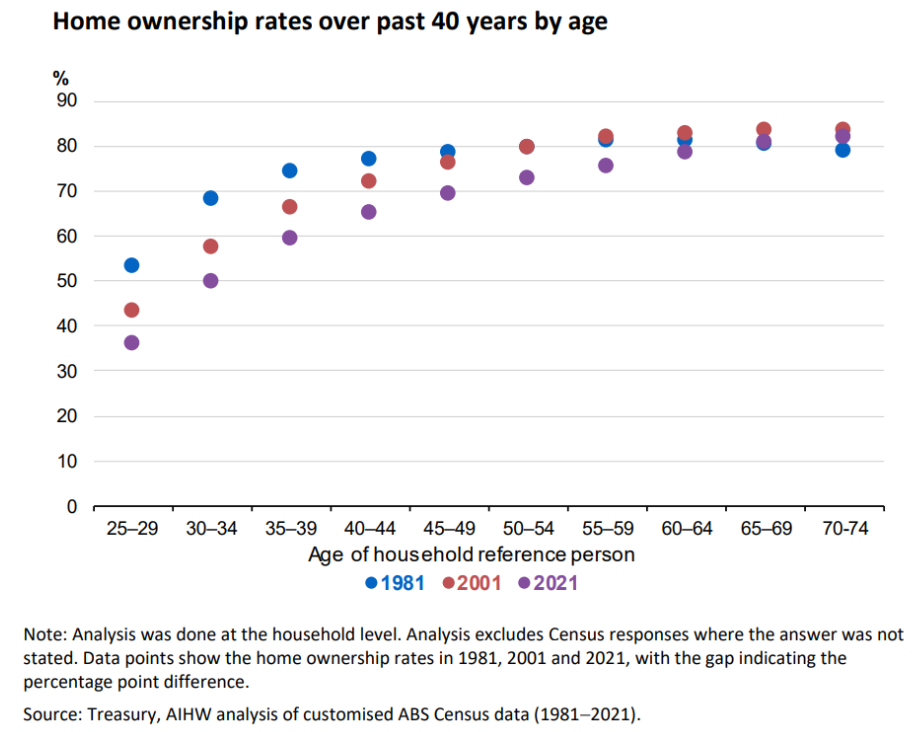

The 2023 Intergenerational Report included the following chart showing the collapse in home ownership amongst younger Australians:

As explained by Ian Verrender at The ABC, in 1981, about 55% of Australians aged 25 to 29 owned a home.

Four decades later, there has been a significant decline to a little over 35%.

The discrepancy narrows as you move up the age group.

The proportion of Australians over the age of 70 who own a home now is essentially the same as in 1981.

However, this is because most people over the age of 70 purchased their homes in the 1980s and 1990s, prior to the massive real estate boom.

The disparity will remain constant as the present cohort of under-30s progresses up the band.

The disparity will also widen as the next generation of under-30s enters the data.

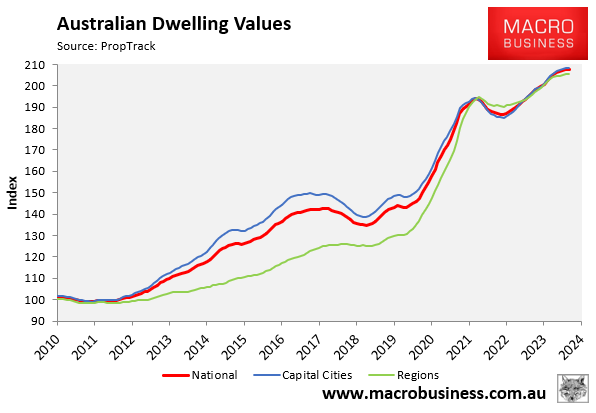

The above chart was based upon 2021 Census data. And the housing picture has worsened since then.

Australian dwelling values have pushed even higher, alongside mortgage rates:

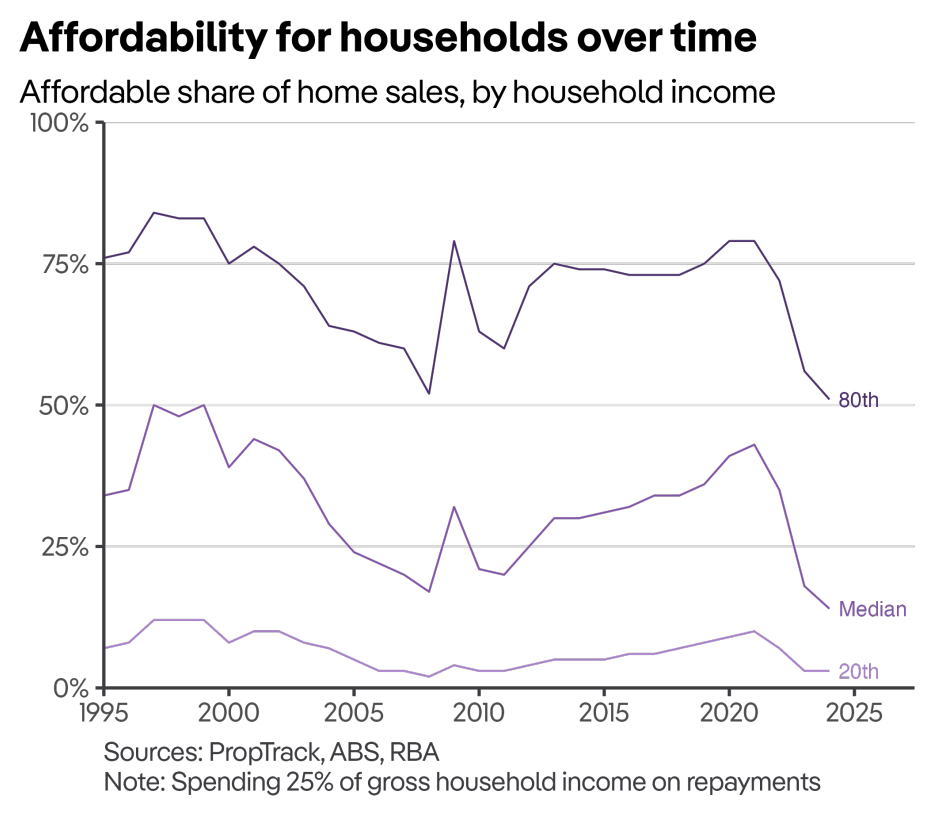

As a result, housing affordability has collapsed to its lowest ever level, with median-income households earning just over $112,000 a year able to afford only 14% of homes sold across the nation over the past year:

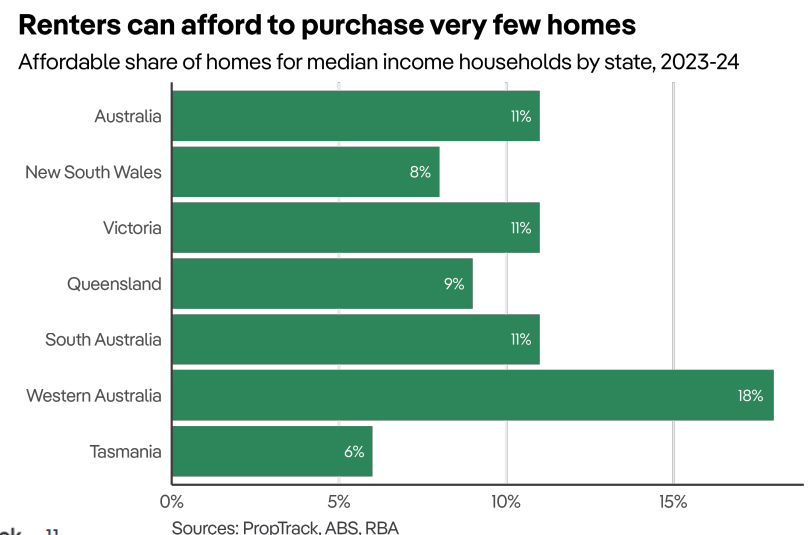

A median-income renting household could afford just 11% of homes sold over the past year (and just 9% of houses).

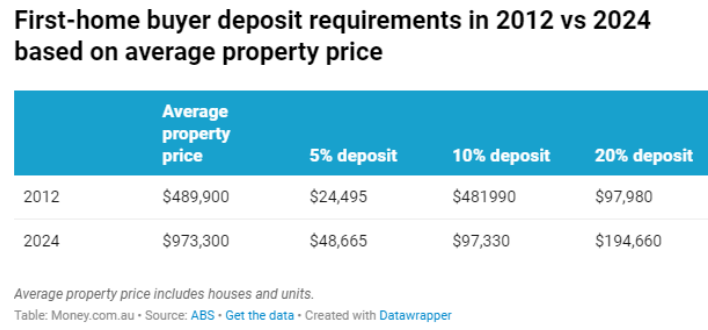

And first-home buyers need to save an unprecedented deposit just to have the privilege of taking out a mega mortgage to purchase an ordinary home.

The sad reality is that it has become nearly impossible for a first-home buyer to purchase a home without substantial support from parents and grandparents.

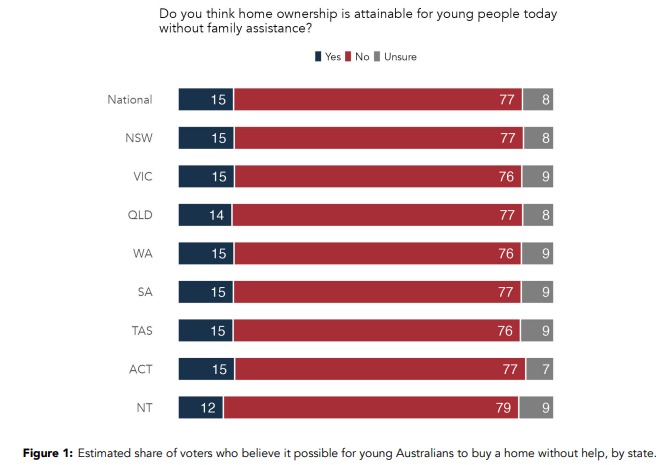

Unsurprisingly, a new Accent Research survey shows that just 15% of respondents believe it is possible for young Australians to buy a home without help:

Fewer than 8% say that on average the standard of living will be better for the next generation of Australians and only 27% are very confident that their retirement will be financially secure.

Australia is no longer the nation of the ‘fair go’ and has transformed into a class-based society.

Intergenerational wealth transfer has replaced the Australian Dream of home ownership.