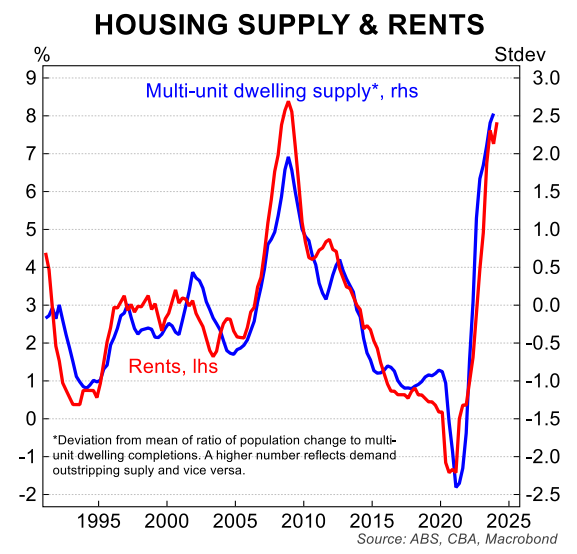

Earlier this year, CBA published the following chart showing the extraordinary correlation between the ratio of population change to unit completions and asking rents:

In a nutshell, when population growth exceeds apartment construction, rental inflation rises, and visa versa.

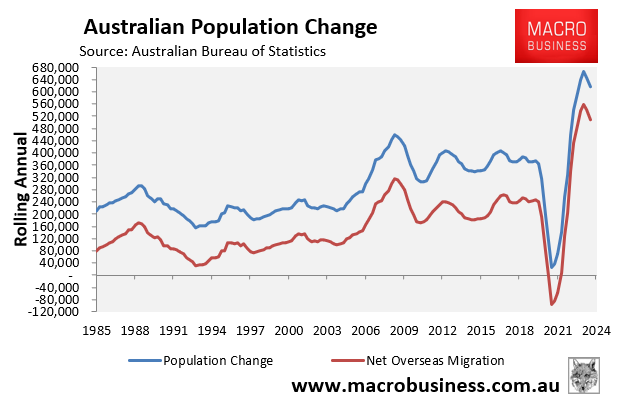

As we know, Australia’s population growth whiplashed over the past four years.

Population growth crashed over the pandemic when net overseas migration turned negative before rocketing upwards once borders reopened in late 2021:

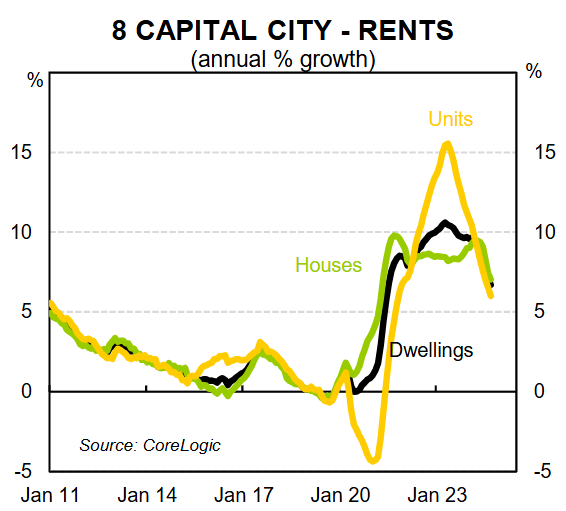

The asking rents for apartments have matched this whiplash. Apartment rents fell sharply over the pandemic when net overseas migration turned negative before recording explosive 15% annual growth when net overseas migration rocketed back:

As shown above, house asking rents have displayed far less volatility, experiencing smaller booms and busts.

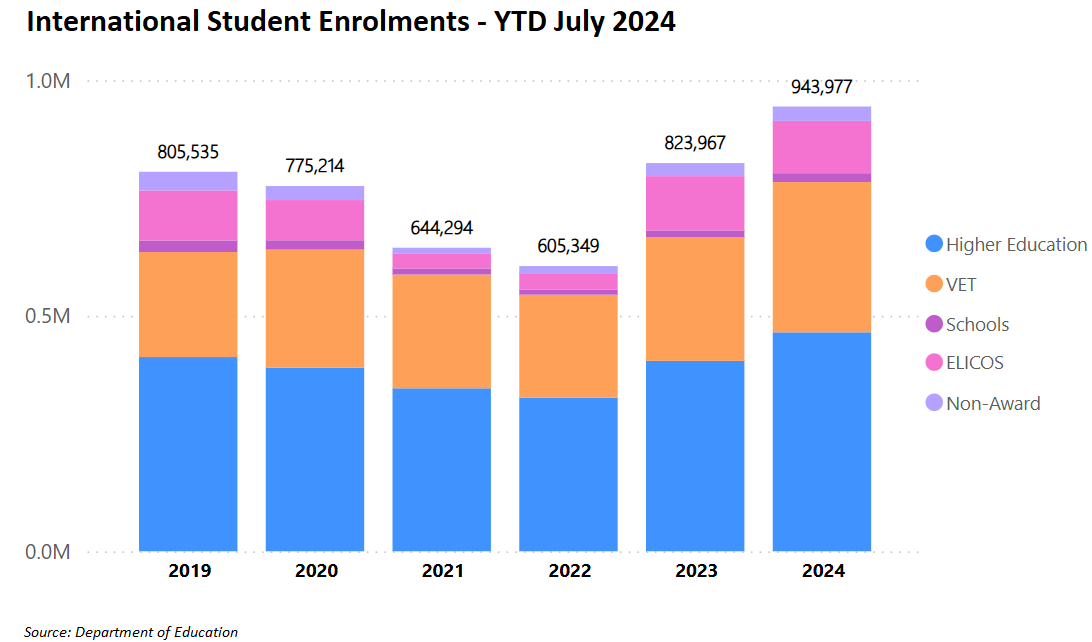

It makes sense that apartment rents more closely track immigration flows given that most temporary migrants (e.g., students) rent apartments when they arrive in Australia.

International student enrolments fell sharply during the pandemic before recovering to record levels.

By contrast, detached houses are more likely to be rented by local families and therefore are less sensitive to changes in migration flows.

Increased work from home over the pandemic also saw a rush for space, which boosted house rents in spite of the negative immigration.