Yesterday we had more evidence that the RBA is reading the big pivot to a December rate cut when economics governor, Sarah Hunter, explained why its inflation expectations modelling is not worth the processing power wasted on it:

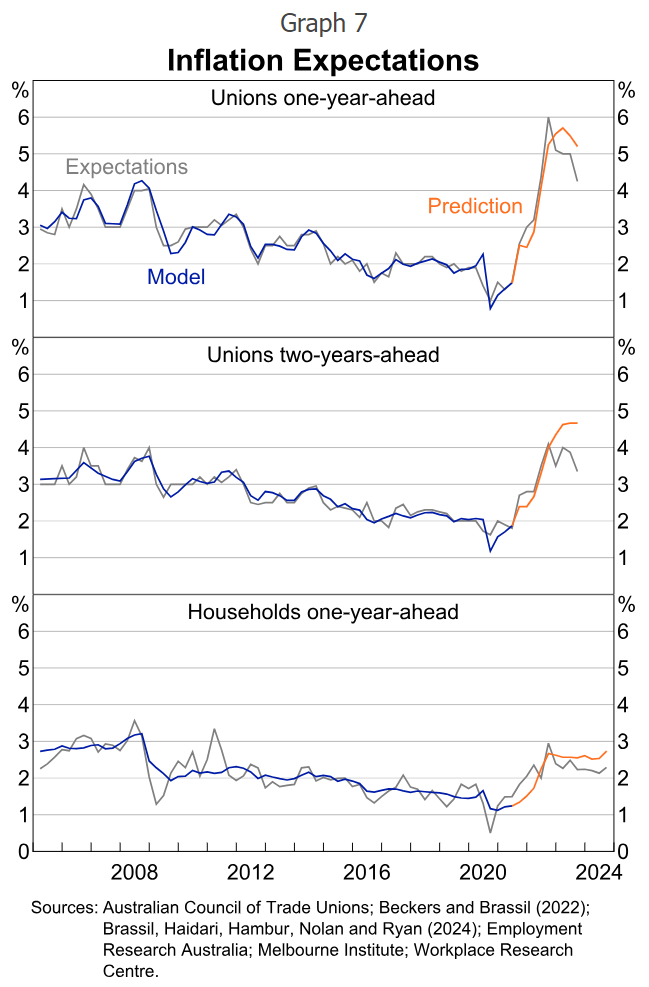

The orange line is the model’s prediction for how inflation expectations would evolve during the recent high-inflation period (Graph 7).

While inflation was rising, expectations were evolving in-line with the model’s output.

But the model suggested that the turning point in expectations would come later. So expectations are currently lower than our models thought would be the case.

As best we can tell, the models missed the turning point because unions and households have been extrapolating less from the recent high inflation outcomes. The model attributes part of this to an increase in the share of people who take on board forward-looking information, from around one-quarter to over two-thirds for unions.

…To conclude, recent research has improved our understanding of how people form inflation expectations. As a result, we have been able to better analyse how expectations have evolved during the recent high-inflation period. And it’s a good news story with respect to expectations:

- Short-term expectations appear to be converging towards long-term expectations, and these have remained anchored through the recent past.

- There’s no evidence of expectations being more persistent than normal.

- And there’s even some evidence of households and unions extrapolating less from recent inflation, at least during the period of higher inflation.

- We need to be mindful of certain prices that may be particularly ‘salient’ for households. But such prices work in both directions, and recently have been working to bring expectations down faster.

Just because Sara Haunter is better looking than the average central banker, with perhaps the exception of Andrew Hauser and his Wall Street hair, it does not excuse her perpetuating the RBA’s wage growth dumbarsery:

Aussies know that their economy does not do pay rises.

They know as well that their pollies will sell them out to the cheapest emerging market labour that they can lay their hands on.

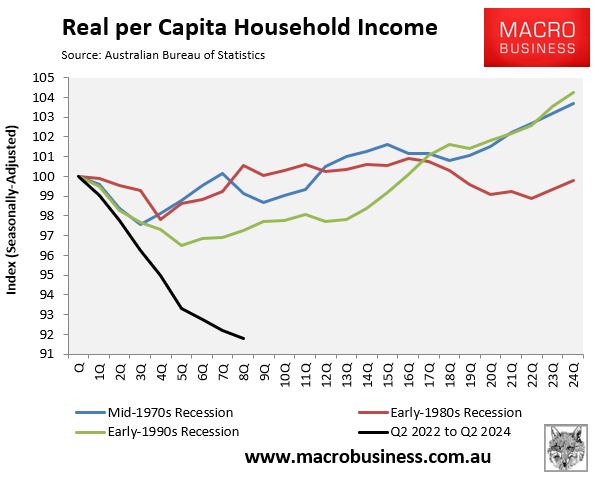

Indeed, punters have just lived through the worst smash to their real incomes since the Great Depression for this very reason, as mass immigration crushed wages while dramatically inflating the cost of the nation’s capital stock, including dwellings.

Why would their inflation expectations pick up in those circumstances?

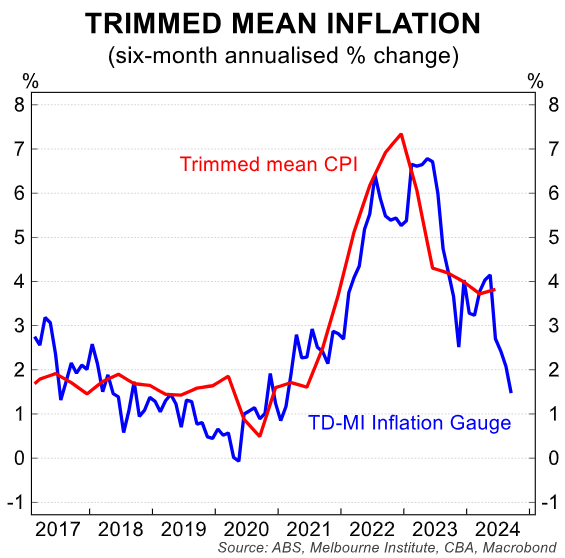

The RBA is only going to wait until a December cut to save face:

After 2.5 years of per capita recession, the RBA should cut 50bps to stop inflation expectations from cratering.