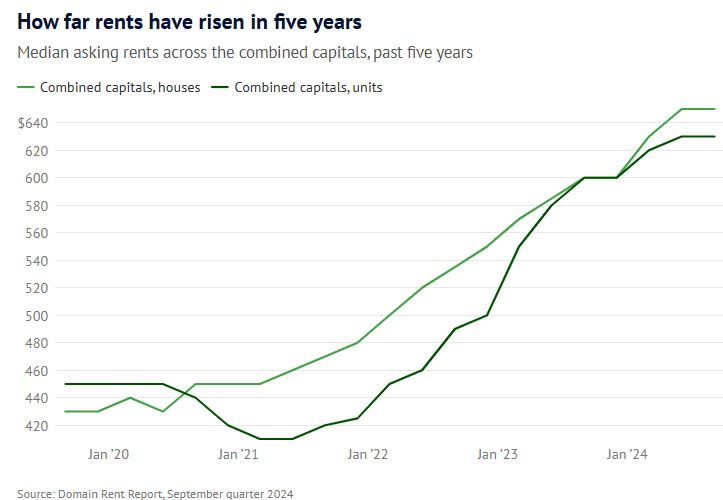

Domain has released its September quarter rent report, which contains the below chart showing the dramatic growth in median asking rents across the combined capital cities:

According to Domain, median house rents soared by $220, or 51%, from $430 to $650 between December 2019 and September 2024.

Median unit rents rose by $180 or 40%, over the same period, from $450 to $630.

Despite rents remaining steady over the most recent quarter, BIS Oxford Economics head of macroeconomic forecasting Sean Langcake, warned that the rental crisis would be ongoing because population demand would continue to exceed supply.

“It’s more likely that the odd market comes off, but generally demand remains high with steady population growth, while government housing targets feel very aspirational”, he said.

“It’s hard to see rents falling back in a very big way. I think it’s more a question of how quickly are they going to go up, rather than when are they going to go down”.

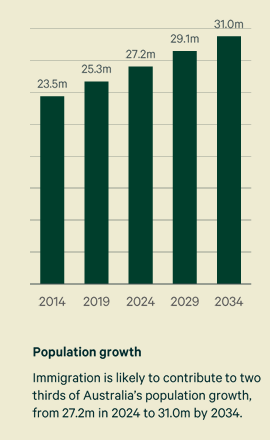

Presumably, the “steady population growth” Langcake is referring to is the 2023 Intergenerational Report’s projection that net overseas migration would remain at the permanently high level of 235,000 a year for the next four decades?

This “steady” immigration is projected to increase Australia’s population by more than 13 million, or roughly 50%, in only 39 years, effectively adding another Sydney, Melbourne and Brisbane to the nation’s current population.

This “steady” immigration will ensure that the rental vacancy rates remain forever low, putting upward pressure on rents.

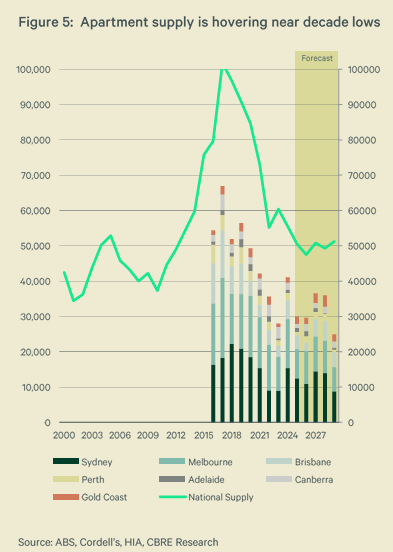

Indeed, the world’s largest commercial real estate group, CBRE, projects that Australia’s rental crisis will continue as population demand overruns supply.

CBRE projects Australia’s population will grow by 3.6m to 31m by 2034 (from 27.4m currently).

CBRE projects that apartment supply to hover around decade lows (50,000 per year between 2024 and 2029).

Accordingly, CBRE projects that Australia’s capital city vacancy rate will fall further to 1.2% by 2029, from 1.9% in 2024.

As a result, median Australian rents will grow by 25% between 2024 and 2029, well above projected CPI inflation.

In short, there is no end in sight to Australia’s rental crisis unless the federal government eases demand by slashing net overseas migration.